Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowHello,

I have encountered a bug while importing bank transactions from a Line of Credit and wanted to see if anyone else had the same issue. Ideally I would like to have this escalated to the engineering team to see if they can fix this on the backend.

The bug I encountered is that when importing transactions from a Line of Credit through the Bank Boeing Employee Credit Union, interest charged is being imported as interest received, as if it were a checking account.

Please see attached PDF showing the BECU bank statement.

On the statement, there are two $75.00 fees, one $75.00 repayment from the Bank for the excess fee. one $75.00 payment, one $0.06 payment, and two interest charges of $0.01 and $0.05.

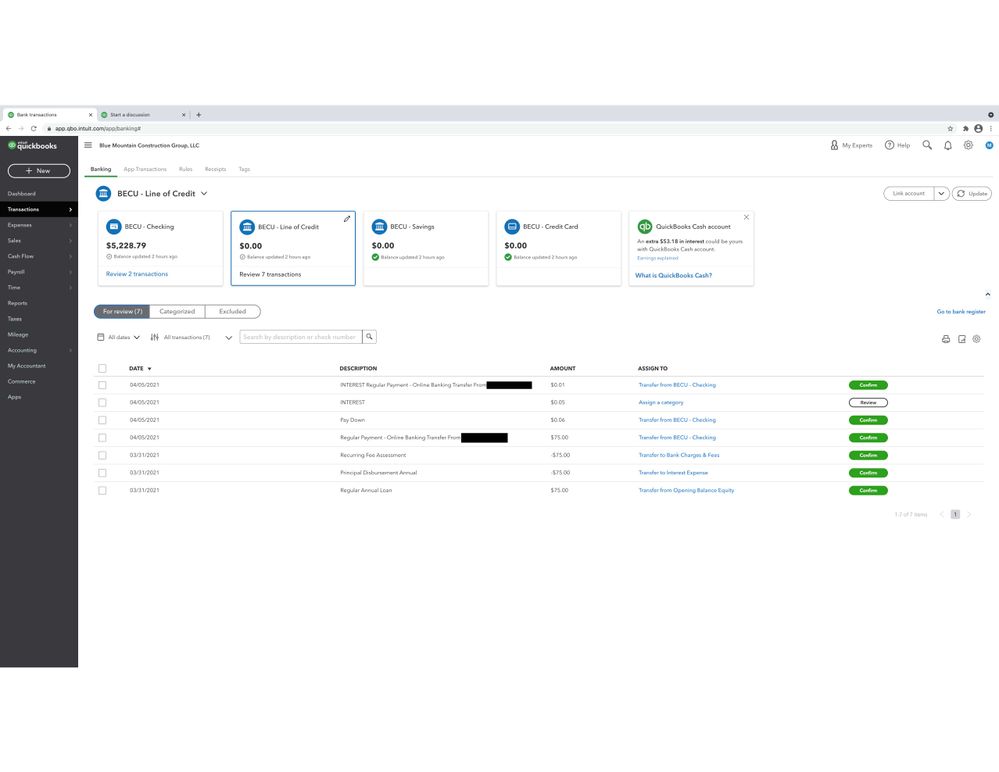

Please see attached screenshot from QBO:

The problem arrises when trying to categorize these transactions. QBO locks positive amounts out of the expense categories as they are seen as decreases to the Line of Credit balance, and QBO locks negative amounts out of transfers as it sees those as increases to the line of credit balance. It appears to me that this is an issue on the backend that thinks interest on a Line of Credit is the same as interest from a checking account. The problem is that there is no way for me to categorize the interest charges to an expense category since it comes in as a positive number instead of a negative. The only workaround is to exclude these charges and manually enter them in the registry.

Has anyone else run into this issue and is anyone from the engineering team able to look into this bug? It appears that something on the backend is not switching the interest charges from + to - for charges that appear in that column.

Thanks for the details, @NJDevilx11.

I have some information about how credit card transactions display in QBO. CSV files for credit card accounts will display in reverse in the bank feed center (Example: deposits may appear as negative amounts.) This will also apply to the line of credit transactions.

That said, you'll want to make sure your transactions were imported and mapped correctly. Select the corresponding line of credit account (not the bank account) when you upload the file into QBO.

Learn more about the file format in this guide: Format CSV files in Excel to get bank transactions into QuickBooks.

Additionally, here's a link that covers all the tasks you can do when using the banking feature. Feel free to browse for topics that suit your concern.

Please let me know if the charges still appear different on your end, so I can assist you further. Don't hesitate to comment anytime. Take care and have a great day ahead.

Hello and thanks for the reply!

Would these steps apply for when you have the accounts linked online? I’m not importing a CSV file. The transactions are being pulled by QBO service.

Thanks!

Hello and thank you for the reply!

I am actually not importing a file. I am using the QBO linked accounts. So QBO is pulling the transactions for me. Would these steps still apply to that?

thanks!

Thanks for adding more details about your concern, NJDevilx11.

When you download (bank feeds) or import transactions, you have the option to customize them. Before bringing the entries to QBO, make sure to map them correctly (positive or negative amounts). This is because the data we receive is dependent upon what your Financial Institution sends over to us.

We have collated resources that contain tips on how to keep your bank feeds organized and show the latest transactions to review.

Don’t hesitate to visit the Community again for any QuickBooks concerns. I’ll be around to help and make sure you’re taken care of. Have a great rest of the day.

Hi Rasa,

When you link a bank account to QBO it auto imports the transactions for you, correct? I don't download a file for upload I believe.

Thanks!

Hi there, NJDevilx11.

I appreciate you for coming back to ask for further clarification about how transactions imported to QuickBooks Online.

Yes! When you connect or link an account in QuickBooks, it automatically downloads and categorizes bank and credit card transactions for you. It enters the details so you don't have to enter transactions manually. All you have to do is review them. Then, the downloaded data in QuickBooks depends on what your bank shares with us and how they're posted online.

For additional information on how connecting bank account works in the QBO system, you can refer to this article: Connect bank and credit card accounts to QuickBooks Online.

Please refer to this article to see detailed steps on how to review downloaded bank and credit card transactions by matching or adding them to avoid duplicate entries: Categorize and match online bank transactions in QuickBooks Online.

Please know that I'm only a post away if you have any other questions or concerns. I'll be more than willing to help. Have a good one!

Thank you for the reply!

I believe this goes back to the original post then. The transactions are being pulled incorrectly by QBO and the interest charged is being presented as a decrease on the LoC instead of an increase. This is locking the transactions out of being able to be categorized as an expense. Let me

know if this is incorrect.

thanks!

Hi there, NJDevilx11.

I appreciate you for coming back to QuickBooks Community to ask for more clarification about the interest charged being pulled in QuickBooks Online.

A credit card account is a liability type by nature. Therefore, the CREDIT side will increase its balance and the DEBIT side will reduce its balance. The posting transactions depend on what type of account you've created and connected to online. That said, if you connected a credit card to QuickBooks Online banking, an account would display in reverse in the bank feed center. This is how banking entries work in the QuickBooks system. As mentioned above, you'll have to make sure your transactions were imported and mapped correctly. This way, you'll see that your account is up to date and accurate.

You can check this article to view steps on how you can track your line of credit: Set up and track a line of credit.

Please refer to this article to see detailed instructions on how to reconcile your accounts so they'll always match your bank and credit card statements to avoid discrepancies: Reconcile an account in QuickBooks Online.

Keep me posted in the comment section down below if you have any other questions about banking. I'll be always around ready to lend a helping hand. Have a great day!

The account is setup as an Other Current Liability - Line of Credit. So this is not setup as a credit card. Everything is being pulled in correctly except for interest charges. Everything is setup according to the "Setup and Track a Line of Credit" link you provided. Quick Books seems to handle all transactions from the LoC correctly except for interest charges. These charges are being brought in by Quick Books as decreases in the LoC balance when they should increase the LoC balance. Since they are incorrectly being brought in as a positive instead of a negative.

Hello NJDevilx11!

I understand that you set up the account in QuickBooks Online as an Other Current Liability. I'd like to reiterate what my colleagues mentioned.

These transactions are from a credit card account and the credit card is a liability. That's why some transactions may display in reverse.

Also, this depends on how the financial institution sends the data to QuickBooks Online.

Now, if you want to change how these transactions appear, you can follow these steps:

If you need a reference on how to categorize transactions and reconcile the account, check these links:

Leave a comment again if you have more clarifications. We'll respond as soon as we can.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.