Announcements

Get your business taxes done right with unlimited expert help. Check out QuickBooks Live Expert Tax

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Banking

- :

- Credit card downloads

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Credit card downloads

I downloaded credit card transactions and imported a csv file. The amounts were in one column - expenses as debits and payments as credits. After importing into QBO I realized that the transactions signs had flipped: expenses as credits and payments as debits. As I had set up rules, many of the transactions have been categorized so now I have expenses in the GL showing credit amounts and the credit card account showing a debit balance. There are also several hundred transactions awaiting review. How can I fix this?

Solved! Go to Solution.

Labels:

Best answer January 06, 2021

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Credit card downloads

It's my pleasure to help you today, Alnoor55.

To correct the downloaded transactions signs that had flipped, you can batch delete your imported transactions listed under the For Review tab.

Here's how to exclude:

- Go to the Banking menu and choose the For Review tab.

- Select the transactions you want to exclude.

- Click the Batch Actions drop-down arrow and select Exclude Selected.

This will move the transactions to the Excluded tab from the For Review tab.

You may find this article handy to learn more about the process of excluding downloaded transactions in QBO.

Once done, you can re-import your transactions anytime you desire. You can read through this article for step-by-step instructions: Manually upload transactions into QuickBooks Online.

Check out this article about categorizing and matching downloaded transactions from your bank: Categorize and match online bank transactions in QuickBooks Online.

In addition to that, you visit these links about reconciliation in QBO:

The Community is always open if you have other questions. I'll be around to help. Wishing you a great day ahead!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Credit card downloads

Let me jump in to help you with your banking concern, @Alnoor55.

Yes, you'll need to flip the signs (debits and credits) of your transactions before importing the new CSV file. You'll have to tag expenses as debits and payments as credits.

For more insights, please review this article: Format CSV file to get bank transactions into QuickBooks.

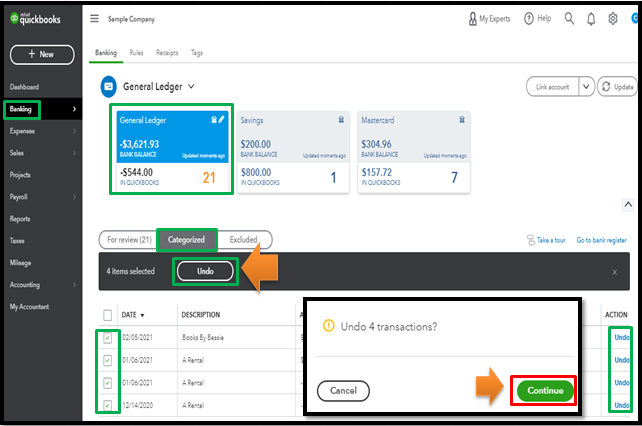

Also, you can undo those entries posted to the general ledger. I've got the steps needed to get this done right away.

Here's how to do it:

- Go to the Banking menu, and then choose the Categorize tab.

- Tick the checkbox for the transactions you want to batch undo. You can also manually click the Undo link under the Action column as another option.

- Click Undo, and then Continue to confirm.

When you're ready, you can begin importing the file again.

After that, you can categorize and match your entries to put them in the correct accounts and prevent duplicates.

To ensure they match your credit card and bank statements, you can perform your usual reconciliation.

I'm just a post away if you have more banking questions. I'd be glad to lend a helping hand.

5 Comments 5

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Credit card downloads

It's my pleasure to help you today, Alnoor55.

To correct the downloaded transactions signs that had flipped, you can batch delete your imported transactions listed under the For Review tab.

Here's how to exclude:

- Go to the Banking menu and choose the For Review tab.

- Select the transactions you want to exclude.

- Click the Batch Actions drop-down arrow and select Exclude Selected.

This will move the transactions to the Excluded tab from the For Review tab.

You may find this article handy to learn more about the process of excluding downloaded transactions in QBO.

Once done, you can re-import your transactions anytime you desire. You can read through this article for step-by-step instructions: Manually upload transactions into QuickBooks Online.

Check out this article about categorizing and matching downloaded transactions from your bank: Categorize and match online bank transactions in QuickBooks Online.

In addition to that, you visit these links about reconciliation in QBO:

The Community is always open if you have other questions. I'll be around to help. Wishing you a great day ahead!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Credit card downloads

Thank you Charies. I will delete the pending transactions and re-import them.

Should I flip the signs on the (new) csv file before I import the transactions?

How can I fix the transactions that have already been posted to the general ledger?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Credit card downloads

Let me jump in to help you with your banking concern, @Alnoor55.

Yes, you'll need to flip the signs (debits and credits) of your transactions before importing the new CSV file. You'll have to tag expenses as debits and payments as credits.

For more insights, please review this article: Format CSV file to get bank transactions into QuickBooks.

Also, you can undo those entries posted to the general ledger. I've got the steps needed to get this done right away.

Here's how to do it:

- Go to the Banking menu, and then choose the Categorize tab.

- Tick the checkbox for the transactions you want to batch undo. You can also manually click the Undo link under the Action column as another option.

- Click Undo, and then Continue to confirm.

When you're ready, you can begin importing the file again.

After that, you can categorize and match your entries to put them in the correct accounts and prevent duplicates.

To ensure they match your credit card and bank statements, you can perform your usual reconciliation.

I'm just a post away if you have more banking questions. I'd be glad to lend a helping hand.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Credit card downloads

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Credit card downloads

You're most welcome, @Alnoor55.

Feel free to get back here in the Community if you need more QuickBooks tips and insights. I'm always around to help you.

Take care and have a great day!

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Featured

Welcome to our Top 5 Questions series dedicated to Reports & Accounting.

Wh...

When starting your own business, it can be difficult to know where to

begin...

Stay ahead of the curve by catching all of the latest QuickBooks Online

upd...