Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy problem is two sales receipts went into undeposited funds and then were deposited. One of those sales receipts shouldn't have been listed as a sales receipt but as a regular deposit. The account has been reconciled as this was several months ago.

How do I remove the one sales receipt from that deposit? And once I do, can I put the removed sales receipt amount back in as a deposit? Will that mess up the reconciliation?

Solved! Go to Solution.

Thanks for checking in with us, LLConroy.

To avoid messing up your reconciliation, as an initial step, you'll need to undo the reconciled transactions, delete the sales receipt, and enter the amount as a deposit.

The QuickBooks Online Accountant (QBOA) gives you the ability to Undo reconciliations without manually editing individual transactions from within the register.

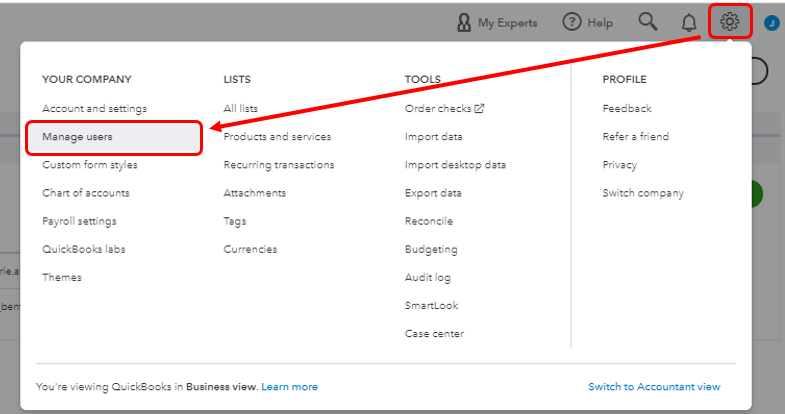

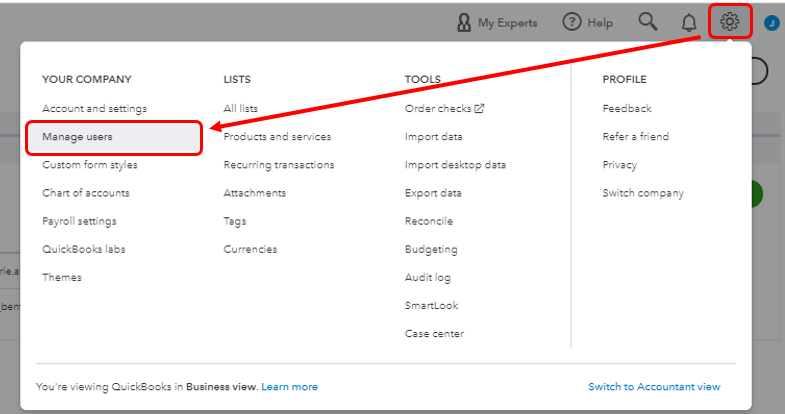

However, if you don't have an account version of QuickBooks, I'd recommend inviting your accountant to your company and let them do the process. Here's how:

Otherwise, you'll need to undo the reconciled transactions one at a time. You can use this article for reference: Undo and remove transactions from reconciliations in QuickBooks Online. On the same link, you'll find a write-up that provides steps on how to adjust as well as fixing beginning balances.

Once done, you can delete the sales receipt and enter a deposit.

Additionally, you can visit the following write-up: Sales and customers. This will provide you articles on how to manage your company income in QuickBooks Online.

Let me know if you have additional questions. I'll be available in the comments to assist you further. Have a nice day!

Thanks for checking in with us, LLConroy.

To avoid messing up your reconciliation, as an initial step, you'll need to undo the reconciled transactions, delete the sales receipt, and enter the amount as a deposit.

The QuickBooks Online Accountant (QBOA) gives you the ability to Undo reconciliations without manually editing individual transactions from within the register.

However, if you don't have an account version of QuickBooks, I'd recommend inviting your accountant to your company and let them do the process. Here's how:

Otherwise, you'll need to undo the reconciled transactions one at a time. You can use this article for reference: Undo and remove transactions from reconciliations in QuickBooks Online. On the same link, you'll find a write-up that provides steps on how to adjust as well as fixing beginning balances.

Once done, you can delete the sales receipt and enter a deposit.

Additionally, you can visit the following write-up: Sales and customers. This will provide you articles on how to manage your company income in QuickBooks Online.

Let me know if you have additional questions. I'll be available in the comments to assist you further. Have a nice day!

Hi, LLConroy.

Hope you're doing great. I wanted to see how everything is going about deleting the sales receipt. Was it resolved? Do you need any additional help or clarification? If you do, just let me know. I'd be happy to help you at anytime.

Looking forward to your reply. Have a pleasant day ahead!

The instructions you presented were clear and easy to follow. I was able to make the changes without any issue! Thank you so much for your quick reply and much-needed advice!

Ok, I am fairly new to Quickbooks and coming in behind another Office Manager. I do not want my sales receipts being automatically deposited into undeposited funds, I prefer to input them myself when I reconcile. I just and to do a sales receipt and it be saved in the computer for my end of year sales tax report, etc. I have unchecked the auto deposit button but on the screen where you create sales receipt up at the top only gives you the options of : depositing into a undeposited account, into our bank account, accounts receivable and inventory asset. We just want to make a sales receipt, have it saved in the system.

Signed,

Extremely frustrated

Allow me to share with you a few information about Undeposited Funds, Cakemaster123.

I know how you want everything just to be simple. The Undeposited Funds (UF) account is a special temporary account that serves a special function wherein QuickBooks uses to hold payments received from invoices before you deposit them into the bank. You will see this as the default "Deposit to" account when you receive payments from invoices, use a payment item on an invoice, or enter a sales receipt. To know more about Undeposited Funds, I've added this article for more information: Using Undeposited Funds In QuickBooks Online.

You'll want to select an account on the Deposit to option field if you'll want to choose a specific account. If you just want to create a sales receipt in the system, you can use UF instead. I've attached a screenshot for your visual reference:

Furthermore, QuickBooks downloads the latest transactions automatically and tries to match them with what you've entered in QuickBooks. To know more about categorizing bank transactions, learn from this article for your guide: Categorize And Match Online Bank Transactions In QuickBooks Online.

Feel free to let us know if you have any concerns about Undeposited Funds. Remember, we're here to help you all the time.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here