Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy customer forgot to apply a discount code, so I owe them $25. I set up that refund in Stripe, and it will hit my bank on Thursday as a separate transaction from his original purchase.

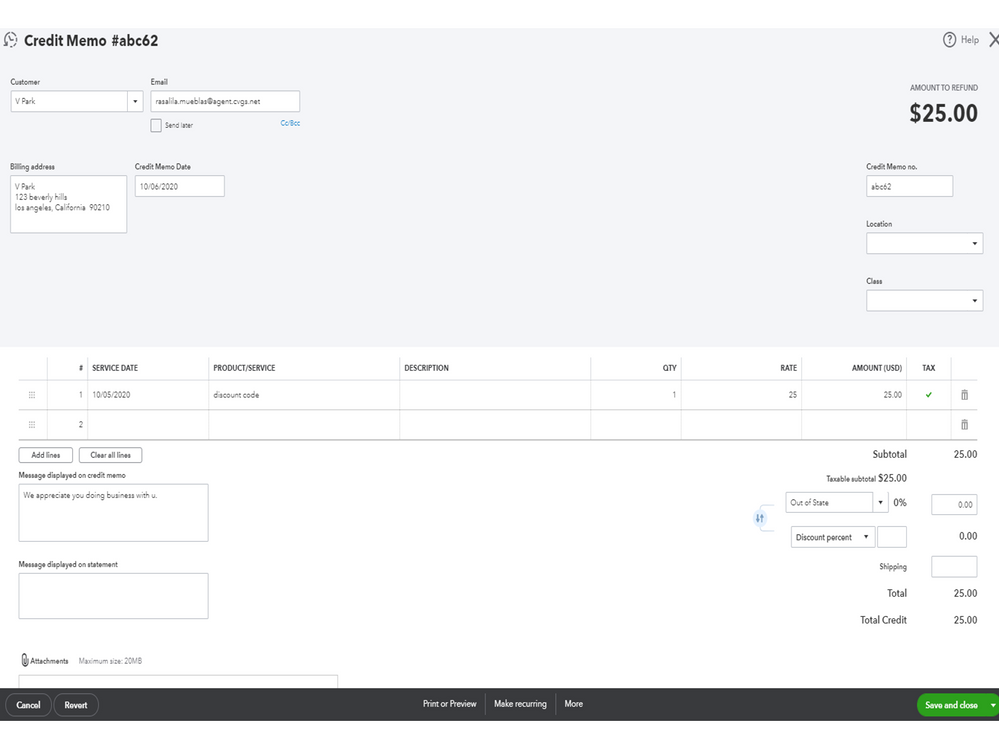

I set up a $25 credit memo for him. From what I remember, desktop used to ask at that point if I wanted to use the credit as store credit, apply it in future, or refund in my bank account.

How do I get this credit memo to show up in my checking account as the $25 withdrawal transaction that it will show up as when the transaction occurs on Thursday? I can't find any way to do that by doing sales receipt, etc.

I can't apply it to the original transaction, because that happened in full before the refund could be applied. It's essentially a separate transaction.

Glad to see you in the Community, userbil.

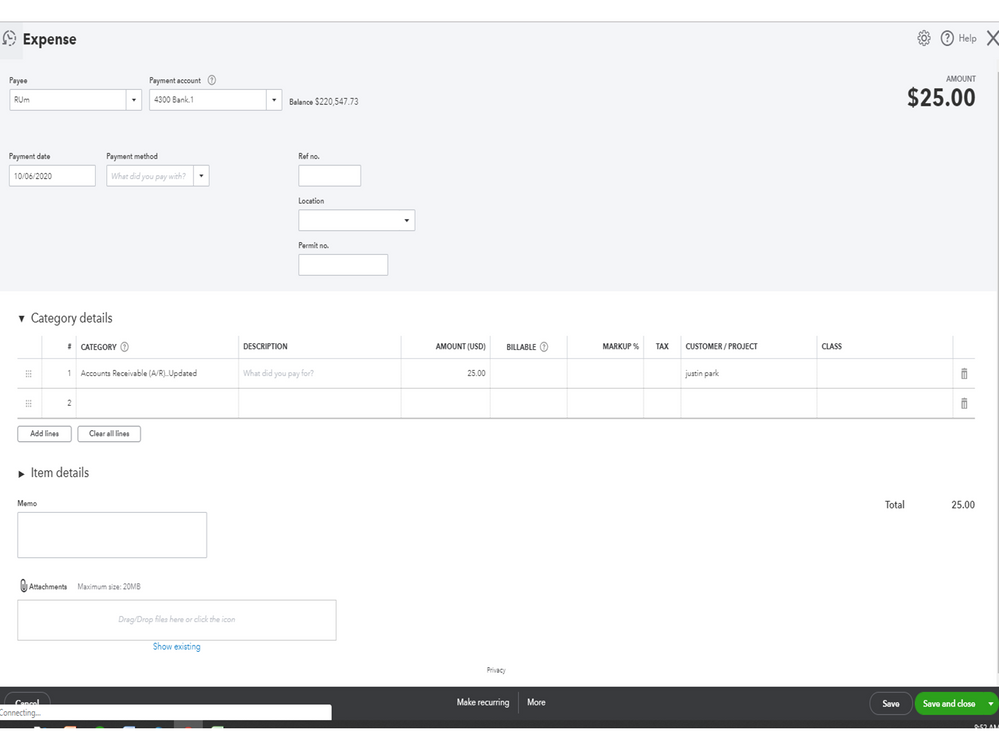

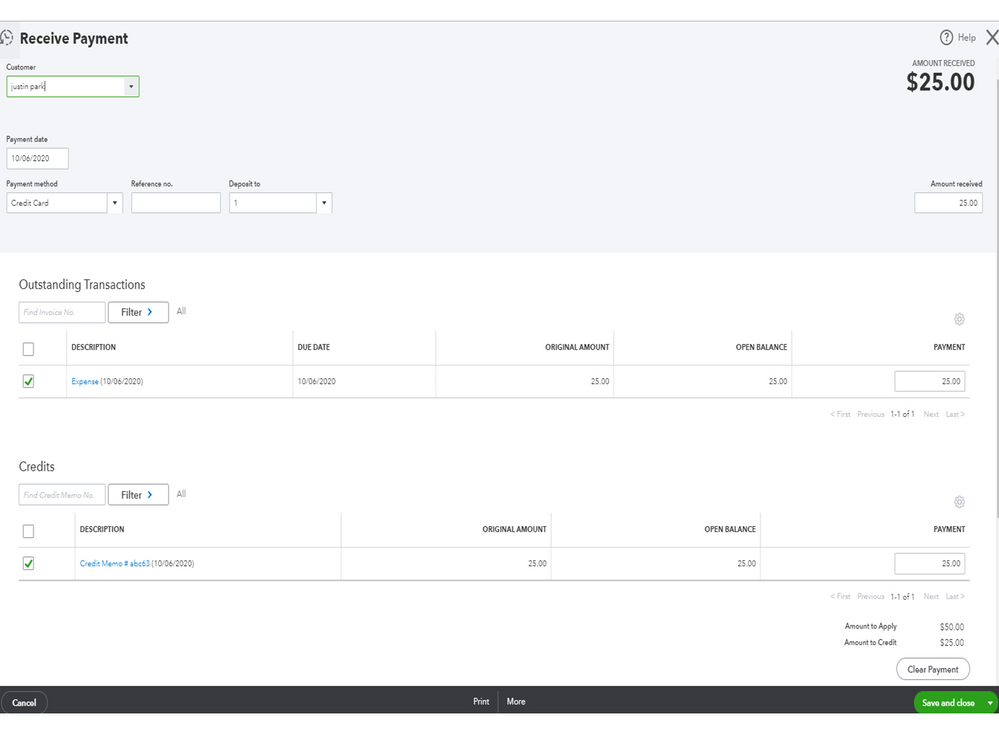

Based on the scenario, we’ll have to enter a credit memo and create an expense transaction. Then, use the A/R account to associate it to the entry.

To add an expense:

To link both transactions:

For additional information about tracking customer credits, refunds, credit memos, or overpayments, see the following guides.

Stay in touch if you need further assistance performing any of these steps. I’ll be more than happy to help. Enjoy the rest of the day.

Are you sure this is the right solution?

Again, the customer paid the $150 charge and forgot to use his $25 discount code. So there's no outstanding accounts receivable balance, it's zeroed out. I just need to account for the *additional* transaction where I refunded him $25 through Stripe (separate transaction completely).

This is for Quickbooks Online. Some of the fields you reference don't appear (No expense/expense under the menu, only vendor/expense, and no Customer/Project on that page). Also, when I try it, I get an error message "When you use Accounts Receivable, you need to choose a customer. If you are refunding the customer's A/R balance, choose the customer in the Purchased From or Pay to the Order Of field at the top of the screen. Otherwise, choose the customer in the Customer field in the Split table at the bottom of the screen. If you don't see a Customer field, Expense tracking by customer is turned off. To turn it on, you can go to Preferences and find it under Vendors & Purchases."

I don't see the fields referenced in that error message either!

So I'm not sure this is the right way to go. Can someone else comment please? I want to get it right and not screw up my accountging.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here