Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

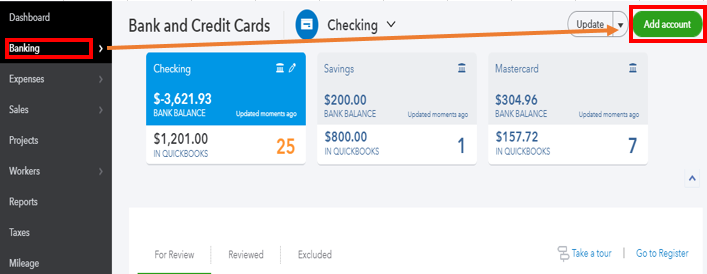

After following the help article instructions to set up the principal and interest accounts, I went to the banking screen to begin importing my LOC transactions. I've attached a screenshot that shows my options.

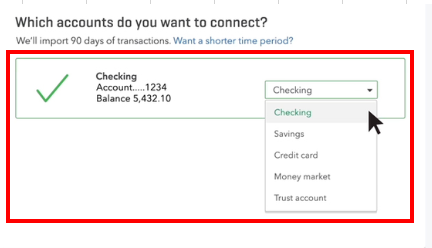

The only account types available are BANK or CREDIT CARD. If I selected CREDIT CARD, the only option under Detail Type is CREDIT CARD. If I select BANK, you can see the options available in the attached screenshot, CASH ON HAND, CHECKING, MONEY MARKET, RENTS HELD IN TRUST, SAVINGS, and TRUST ACCOUNT.

None of these seem correct for a LOC. Does this mean that I should be manually adding LOC principal and interest payments?

Hello there, @vcventures1.

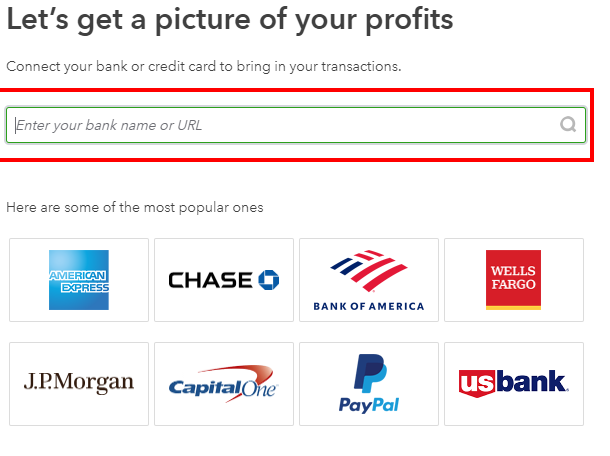

I'd be glad to guide you on how to connect to online banking so you can add your line of credit. Here's how:

After that, you can now do the import process for these transactions in QBO.

You may also check this article to learn more about online banking: QBO Online Banking.

Moreover, you may also read this awesome help article to aid you if you've got other QuickBooks concerns, such as setting up payments, third-party apps integration, track income, and expenses, etc to keep your business running smoothly.

Please know that I'm here if you need any help. Have a great day!

It looks as if my second post with elaboration did not post as I thought it did. What I failed to include in the original post was the attached screenshot. What Account and Detail Type should be selected? None of them explicitly state LOC.

Account Type option CREDIT CARD further offers CREDIT CARD as a Detail Type. Account Type option BANK further offers CASH ON HAND, CHECKING, MONEY MARKET, RENTS HELD IN TRUST, SAVINGS, and TRUST ACCOUNT as Detail Type.

Thanks for getting back to us, vcventures1.

I can explain this further to help you with setting up and tracking your Line of Credit in Quickbooks Online. In Quickbooks, Line of Credit is a liability account. so we'll need to create a new Line of Credit account in the Chart of Accounts. I'll show you how:

Setting up your Line of Credit account as a Credit Card allows you to make purchases using it. It also allows you to add your transactions is QuickBooks to match them.

I've attached some articles you can visit on about how to record a payment manually and match bank transactions:

Please tag me directly if you have any other concerns.

we use a revolving charge account (LOC) with Home Depot. When an invoice goes past 60 days, that particular invoice incurrs interest. But the interest is not on the whole balance of the account like a credit card would be. If I categorize the account like you suggested as a credit card not a Line of Credit, how would I then reflect that the interest was incurred on a specific invoice?

Hello there, @Kmartinez985. Welcome to the Community.

I'm here to ensure you're able to reflect an incurred interest in QuickBooks Online (QBO). This way, you can keep your financial data accurate.

Interest is considered a different entry or line item when posting one on your transactions. When you earned interest, you can record it using the Bank Deposit feature. But before doing so, you'll first have to create a new interest account. Here's how:

Once done, you're now set to record a Bank Deposit transaction. Here's how:

You'll also notice that the deposit has been recorded under Bank Accounts on the Dashboard.

After that, I'd recommend pulling up the Deposit Detail report. This way you can effectively monitor that the interest is recorded accordingly. Just go to the Sales and customers section from the Reports menu's Standard tab.

Also, here's an article that provides further details about LOC in QBO: Track a line of credit. It includes topics about transferring credit funds, interest charges, and making payment to your LOC, to name a few.

Let me know in the comments below if you have other concerns about managing interest on invoices in QBO. I'm just around to help. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here