Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

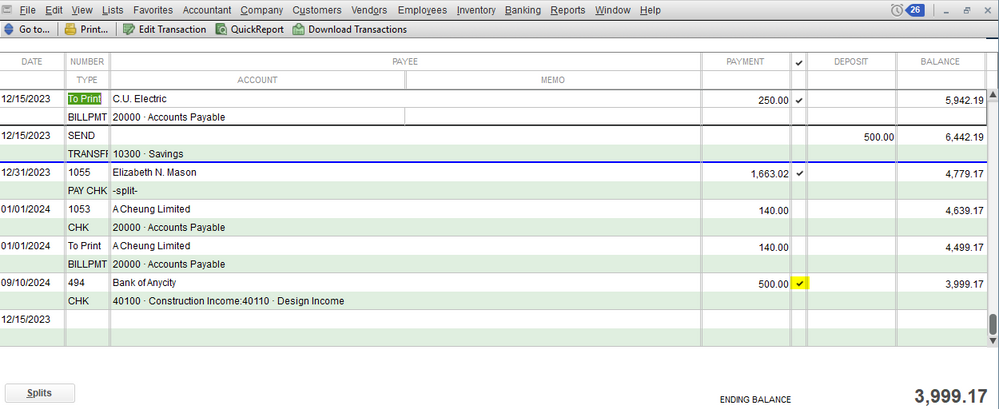

Buy nowHello, We initiated a check on our bank's website at the end of 2017. Since the bank always has a time lag, the check wasn't written by the bank until 2018. In QB, the bill was recorded as paid on the date the request was put into the bank. Since we use Bank Feed Center to pull in all of our bank detail, we won't be able to match the paid invoice per QB to the transaction that is coming in from the bank (since it was 2018). We normally don't worry about the check initiation date; but in this case, the company wanted to show it as paid so they could estimate taxes better. When I try to do the December bank reconciliation, the invoice is showed as paid on QB, but of course it's not in the bank statement. So therefore I have a reconciliation discrepancy. What should I do? (One other thing to note: We do cash rather than accrual based accounting. We are a small business.) Thank you in advance for your assistance.

The date you initiated the payment is really all that matters. The download should work fine to match a check dated a few days after the one in QB. That is the normal way banking works (checks written clear later.)

There's no issue with reconciliation. Check off the items that cleared the bank, on the statement, and leave the other's unchecked. That's all there is to the reconciliation. The month or year does not matter.

"I can no longer "Select Bills to Be Marked as Paid.""

It should have shown as an Auto-Match, if the banking download matches to the Bill Payment Check that is already in the Bank account in QB.

"We normally don't worry about the check initiation date;"

But you should Always pay attention. You write a check in Nov, and it doesn't get presented to the bank until Jan = the Wrong Tax Year for you. Your check date is the date you Spent it. The Bank Date is the date they Processed it, as part of Verification on the way to Reconciliation to confirm it Cleared for the same amount that you thought you spent.

"will I leave it unchecked?"

You start the reconciliation. In the second screen, at the bottom, you click on Matched. You provide the date, for the statement cutoff, so that it does not Checkmark anything that has already been Verified (lightning bolt) but is not on this statement.

You checkmark anything that Is on that statement and has cleared the bank, whether or not you also use Banking Downloads as a helper function.

I suspect the responders don't fully understand the issue here. I have just encountered a similar one, so will try to articulate it. Client uses payroll service, so transactions import to QBO automatically. The tax payment was dated 5.01.19 by the payroll service, but the bank showed it as cleared on 4.30.19. When reconciling April, the transaction is not available within the month parameters, so cannot be checked off. It ends up being a discrepancy for the month of April due to the anomalous timestamps on the transaction. Because the transaction originated with the PR provider, it cannot be modified; thus the account cannot be fully reconciled for the period. Obviously, it will resolve the following month, but it's problematic in the current period. I have never seen this happen before, but users should be aware that it can happen.

The same just happened to me. What should I do? Not complete month end for October and wait for November month end?

You should be able to reconcile the current period by adding a reversing journal entry to the period for the amount in question. Thus you will have an entry to check off and reconcile in the current period, the journal entry will reverse in the following period and wash against the delayed automatic entry; subsequently the following period should reconcile cleanly as well. Make sense?

Hi Christine88! That can be an option, too. Thanks for sharing it.

Hello, Exec2000! You won't need to wait till end of November.

You can reconcile your October transactions right now. Just select the ones you see in your bank statement. If you have October transactions in QuickBooks that remains un-cleared for the month, you can skip them. Then, select them when you reconcile in November as long as they show in that month’s statement.

The key here is to only reconcile the entries that show in your bank statement.

I've got articles about reconciliation that you can use as reference in the future:

If you have any follow up questions about reconciling uncleared entries, let me know.

hi there,

What if we issue a check for the month of Aug and mail it to our vendor in July and our vendor deposits the check right away in the bank. when I am reconciling there is a discrepancy in July reconciliation, since the check has been cleared in the bank prior its date which is Aug! I appreciate your help.

Hi there, @Somi.

Since the check has been cleared in the bank, you'll have to manually mark it as cleared from your bank register as well. This way, it'll show as cleared when you reconcile your July transactions and won't affect any discrepancies.

Here's how:

Once done, you can now proceed with reconciling your July transactions.

I'm also adding this article to learn how to fix discrepancy when reconciling: Fix issues when you're reconciling in QuickBooks Desktop.

I'm always here to listen if you have additional concerns with reconciling accounts. You're welcome to post again or leave a reply below. Have a great day and stay safe.

I appreciate it.

I am trying to follow the instructions above - similar scenario to the question above.

I am working in QB online.

QB Payroll was set to process payroll by Direct Debit on July 3 2020.

Business owner decided he needed to be paid early and wrote himself a check for the amount and deposited it on June 30 2020.

The check deposit is on June 30 Bank Statement.

The Payroll expense in the register is dated July 3.

I have added 'C' to show the amount has cleared the bank in the register but it does not show up on the reconciliation screen.

How to fix? Thank you kindly in advance for any help...I really need to get on with this. :)

Hi there, Janet Bee.

Thanks for bringing your question forward here in the Community. I'd be glad to lend a hand so you're able to complete the reconcile in your QuickBooks Online account.

To make sure I'm on the same page, are you working on the reconciliation for the month of June? If so, I believe the expense amount isn't showing on the reconciliation screen due to the differing dates. I recommend changing the date of the expense to June, and then attempting to complete the reconcile once more.

It's always a good idea to double check with your accountant before completing these types of actions regarding a reconcile. In the meantime, I have an article for you that outlines the process of reconciling an account in QuickBooks Online.

Please don't hesitate to reach back out with any other questions you may have. I'm only and comment or post away.

You dont HAVE to match everything from the bank feeds. You do not have to use the bank feeds feature at all! You can click off on it and click exclude from list to make it go away.

Hey I have a question for you if you don’t mind

I have a client who wrote a check in August and it cleared the bank in September. I did went to reconcile the month of September and it is off by the amount of the check written the previous month and I cannot reconcile. Should I do an adjustment? If so should I use the date of the month the check cleared or the month it was written?

Hey Can I ask you a question? I have a client that wrote a check in August but wasn’t cashed until September. The account will not reconcile and it is off by the amount the august check was written for. I have combed the entire account looking for another discrepancy but cannot find one! Should I make an adjustment and if so should i be using the date the check cleared or the date the check was written? Thank you so much for your time.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here