Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowVersion: QuickBooks Online

The Issue: I need to roll back a reconciled bank account because the starting balance is off.

Some Context: While importing account data, the dropdown menu only had one option, which was the name of the bank account and the company. I assumed it was correct, so I imported multiple accounts into the dingle entry. This felt wrong, so I logged out and logged back in, and it the dropdown had multiple of accounts.

The Problem: I now have duplicate content in multiple accounts, so I started deleting. I went too far and deleted a few items from the previous year, which is causing issues with my starting balance for the next month.

Any help would be greatly appreciated, as neither I nor my accountant see a way to roll back the reconciliation. I'm sure it's easy, but it's not intuitive.

It's great having you here in the QuickBooks Community, @menro.

You can consider using the Audit log to recreate the deleted reconciled transactions, and manually mark them as reconciled. This will correct your beginning balance for the current month without having to undo the entire previous reconciliation of your bank account. I can guide you through the process.

Here's how you can view the deleted transactions from the Audit log:

Just a heads up, kindly ensure to enter the recreated transactions into the original bank account.

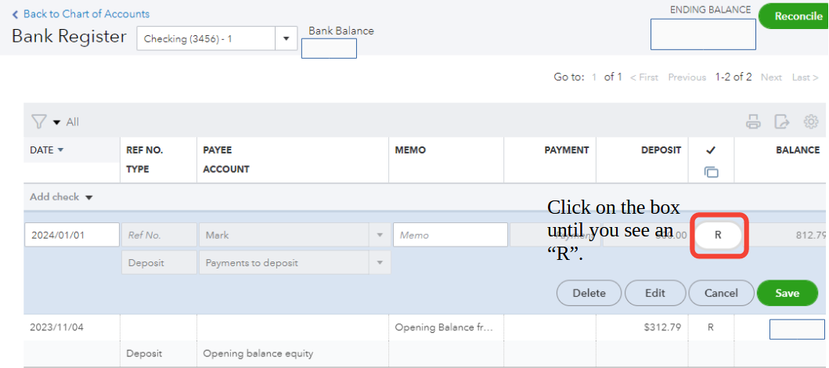

Once done with recreating the transactions, here's how to manually mark them as reconciled:

As further help in correcting your beginning balance for the current month, let me add this article: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

Let me add this article as a guide in printing and viewing your reconciliation report: How do I view, print, or export a reconciliation report?

Keep us posted if you have any updates recreating the transactions or reconciling accounts in QBO. We're committed to offering ongoing support. Take care.

Thanks, @AlverMarkT. I deleted over 1000 entries because they were imported into the wrong chart of accounts. After deleting, I reimported the data, so if I do what you're suggesting, I believe I'll have double entries. This is why I was hoping to just roll back as far as needed to get an accurate starting balance.

Thanks, @AlverMarkT. I deleted over 1000 entries because they were imported into the wrong chart of accounts. After deleting, I reimported the data, so if I do what you're suggesting, I believe I'll have double entries.

This is why I was hoping to just roll back as far as needed to get an accurate starting balance.

Thank you for getting back to us, menro. Let me chime in and help you fix your starting balance issues so you can begin reconciliation.

Recreating the previously deleted entries from a past reconciliation will not cause duplicates. Instead, it's the direct way of bringing back the deleted data. If you imported the entries in the Banking page, it will not cause duplicates yet. You still have to categorize them.

Since you have already recreated the transaction, we can manually Find match or match it to the imported data. This way, we can ensure they aren't added to your register as separate transactions.

Afterward, we can exclude the unneeded transactions to prevent duplicates on your account register. Now, we are ready to reconcile the account. However, if you still encounter discrepancies, you may run discrepancy reports to ensure the difference between the ending balance in QuickBooks and your bank statements is $0.00.

Also, you can check out this article for more info: Fix issues for accounts you've reconciled in the past in QuickBooks Online.

Lastly, since you mentioned you have an accountant, I recommend inviting them as an accountant user and letting them undo the entire reconciliation period.

Don't hesitate to leave a comment if you have additional concerns about correcting your reconciliation in QBO. The Community space is available anytime to offer assistance. Keep safe always!

I'm still not able to undo a reconcile.

Thank you for getting back on this thread, @menro.

We appreciate you for trying the steps shared by my colleague. Let me step in to shed some light on how you can undo reconciliation in QuickBooks Online (QBO).

If you're unable to undo the reconciliation, I recommend seeking assistance from an accountant who uses QuickBooks Online for an Accountant. They can help you reverse the reconciliation and provide guidance on how to correctly reconcile your accounts.

I've also added some articles for your reference. These will discuss more on how to undo reconciliation in QuickBooks Online:

You're always welcome to post again here and ask any other questions about managing your reconciliation. I'm always ready to lend you a hand.

Thanks for the response,

I, when viewing as my accountant can't see how to undo the previous reconcile and my accountant does not see how do it.

Frustrated.

I've got you covered, menro. I'll help you undo a reconciliation in QuickBooks Online.

Undoing an entire reconciliation is only available for accountants who use QuickBooks Online Accountant. Make sure you've opened your client's company file in QuickBooks Online Accountant. Once you're in, find and open your customer's QuickBooks Online company and follow the steps below.

Here's how:

On the other hand, I recommend to do some troubleshooting steps if you're still unable undo reconciliation. Please start by using incognito window. This will prevent your browsing history from being saved. You can use the following keyboard shortcuts based on the type of browser you are using:

If the private browsing session works, you can clear the browser's cache to improve the program's performance. You can also use other supported, up-to-date browsers as an alternative which will provide the best and most secure experience with QuickBooks.

Additionally, you can refer to this article if you want to view your business financial report: How do I view, print, or export a reconciliation report in QBO.

Feel free to comment on this thread if you need further assistance undoing a reconciliation. We're always here to help you out. Stay safe.

None of these suggestions are working.

I can imagine the hurdle you've been through trying to fix the reconciliation issue, @menro. I'll make it up to you by ensuring you'll get the urgent help you need.

I recommend contacting our support team. This way, they can take a closer look at your account and provide a resolution.

Here's how:

Our support team is available during the following hours:

In case you need to close your books and prevent changes to past transactions, you can check out this article for more guidance: Close your books in QuickBooks Online.

Please let us know if you need any further assistance besides reconciliation. We're always here to help you out in any way we can. Stay safe!

thank you

Hi menro,

Glad to know my colleague was able to route you to the right support. If you have additional questions about managing your reconciliation, please don't hesitate to get back on this thread.

Keep safe always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.