Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, flatridgelawncar,

You'll want to check your bank's website first to see if there's a bank maintenance or a notification that needs your attention. Once confirmed that it's working fine, go back to QuickBooks Online and manually update the connection.

Here are some articles on connecting your bank accounts in QuickBooks Online:

I'll be around if you need more help.

I am having the same problem. This does not help. I've re-connected the account several times and every time I log off and go back on it gives me the Error 185 message. I've used the MFA each time. It works ok until I log out and log back in.

How do i resolve this?

Hi there, @SunnyBrooks.

Let me share some information about error 185. This error happens as a result of the bank requiring a one time passcode (OTP) when accessing the account. Some banks require verification from a third-party application to connect or download data.

I suggest contacting your bank to get transaction history in a CSV file format. In that way, you can manually import transactions inside QuickBooks.

Here are some helpful articles you can refer to when connecting bank accounts in QuickBooks Online:

Please fill me in if you have additional queries. I'd be glad to help. Have a nice day!

I am having the same problem - I changed my banking login to see if it would help. No luck. Has your issue been resolved? If yes, what did you do to resolve it?

Thanks for joining us here, SLBarker.

The Error 185 when connecting to Navy Federal account occurs when the bank requires a One Time Passcode to access your account. This issue can be resolved by manually updating your bank.

However, if you're still experiencing the same issue after performing all the steps above, I recommend contacting our QuickBooks Care Support. They can use their special tools to conduct a deeper investigation and help you connect your bank to QuickBooks Online successfully.

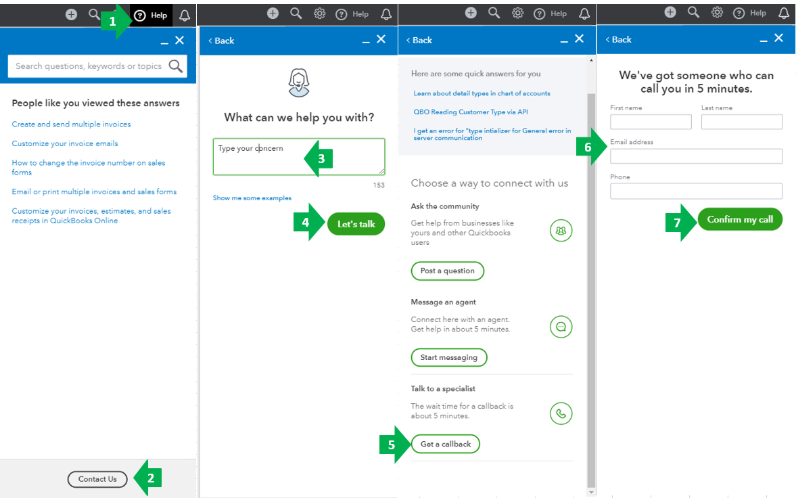

Here's how to contact us:

Also, it would be best to share the link of this thread to the representative so they become aware of the troubleshooting steps that you've taken so far.

You can always get back to me for more questions, Take care and have a wonderful day ahead!

Navy Federal now has a mandatory 2 step verification that can not be turned off

We will have to download the transactions and upload them manually.

Hi there, KC Accounts.

I'm happy to provide you with the steps to follow in order to manually upload your transactions. Please, follow along below:

Step 1: Pick a date range

To make sure you don’t import transactions you’ve already recorded, you’ll need to get the date for the oldest transaction in your account. This prevents duplicates.

Step 2: Download transactions from your bank

Step 3: Review the file format and size

Your bank might give you options for how to download/export your transactions. Pick one of these so you can upload the file into QuickBooks Online:

If you can, use the QBO format. QBO files from banks should already be formatted for QuickBooks. If your file isn’t formatted, you can reformat and upload it. The maximum file size is 350 KB. If your file is too big, shorten the date range and download your transactions in smaller batches.

Step 4: Start your upload

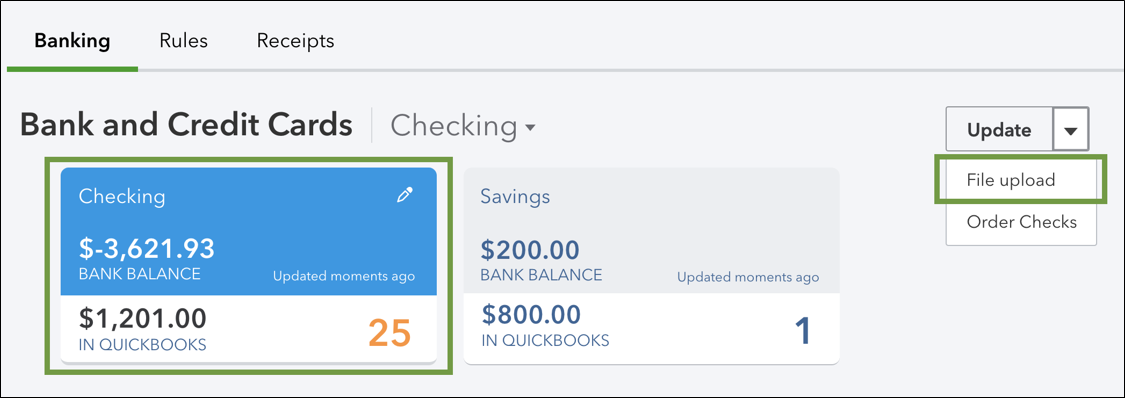

For accounts connected to online banking

If your account is connected to online banking, here’s how to start your upload:

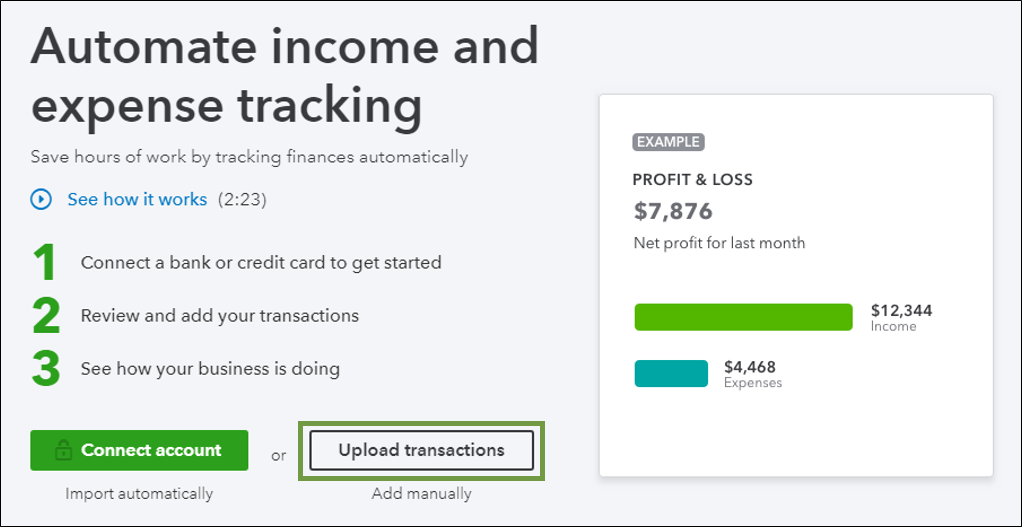

For accounts not connected to online banking

If you don’t plan to connect your account, or your bank can’t connect to QuickBooks, here’s how to start your upload:

Step 5: Upload your file into QuickBooks

See an error message? Here’s what to do if you see an error message while uploading your transactions.

If you haven’t connected your account to QuickBooks, you might not have an account to upload the transactions into. If you don't see one, select Add New ▼ from the dropdown to create a new bank account.

Step 6: Categorize the transactions

Now that your transactions are in QuickBooks, it’s time to match and categorize the transactions. They’re not fully in your accounts until you’ve reviewed them.

Step 7: Reconcile the transactions

Your transactions are in QuickBooks. Now you need to reconcile them. This ensures your books are accurate and there aren’t any duplicate transactions.

For instance, you may need to edit your opening balance if the transactions you just uploaded are older than your opening balance. It’s likely you included some (or all) of the older transactions as part of the opening balance total. You need to reconcile the transactions to make sure QuickBooks isn’t counting them twice.

Focus on your business, not your books.

Get a dedicated team of QuickBooks-certified bookkeepers to set up, import, and categorize all your transactions for you. Learn more about QuickBooks Live Bookkeeping.

If you have any other questions, we're here night and day. Thank you and have a nice Tuesday evening.

Did you ever find a solution to this problem? After review the entire thread, chances are no. I've been experiencing the same error (185) and connection issues between QBO and my Navy Federal accounts.

Did you ever find a solution to this problem? After review the entire thread, chances are no. I've been experiencing the same error (185) and connection issues between QBO and my Navy Federal accounts.

Hi SaylesInd,

I know this hasn't been easy for you.

Our software engineers are currently investigating the connection issue (Error 185) between Navy Federal Credit Union and QuickBooks Online. I definitely understand that you're in a tough spot right now. Rest assured, we're doing our best to get this resolved as soon as possible.

For now, you'll want to give us a quick call or chat again so we can add your contact information to our notification list. Once we get this rectified, you'll receive an email update. Here's how:

You can also provide this investigation number for a faster transaction: INV-49974. Additionally, I've enclosed some articles that you can read to help speed up the review process of your online banking transactions:

Just click the Reply button below if you have any other concerns or follow-up questions. The Community is always here for you

Thanks for the response. It appears this has been going on for years, is there any timeframe as to when this issue will be resolved? It may be worthwhile for QuickBooks to look into a third-party software solution to help verify bank accounts such as Plaid. Otherwise, I'm certain it will continue to lose more paying customers.

I see Navy Federal Credit Union is on the list. Utilize the trial period of SlickConnect to isolate the issue.

https://www.moneythumb.com/?ref=110

SUCCESS!!

Call Navy Federal and get someone to transfer you to the technical team. Explain to them you are trying to do a Quickbooks download and ask to suspend two factor for some period of time like a day or two. Go back to QB and do the synch!

UPDATE: SEPT 2021

I am a Navy Federal Business User with multiple accounts and have an external bookkeeper that does my administration.

Issue Part 1: It needed constant re-authorizations to get balances and sometimes would not connect at all or lose connectivity constantly. This is NOT A QB issue! It is a Navy Fed issue by design.

Solution Part 1:

(1) You MUST call the "Digital Services Department" (Tel: [Removed]) other departments do not have access to the options needed OR do not know how QB works.

(2) Ask the Rep to set accounts to "BYPASS 2 STEP VERIFICATION FOR ONLINE BANKING" - This option is ONLY visible and AVAILABLE to this department!

(3) Verify while on the phone that you can now Sync without constant "Re-Authentication" by hitting the accounts Update button. DO NOT HANG UP UNTIL YOU CAN DO SO...the change is near-instant.

Issue Part 2: The Digital Services Department Rep also discussed another issue that keeps accounts from Sync via 3rd party connections. The Security Questions for your account are sent to you on a RANDOM schedule. If by chance the 3rd party app does not "pass" your security questions to you, the bank authentication goes on a "loop". Because you cannot answer the questions, because 3rd party cannot pass them to the screen for you to answer, it will block you endlessly.

Solution Part 2: SAME AS SOLUTION 1

Hope this Helps many with Navy Federal...Please hit the CHEER button so the answer comes up for fellow members.

Thank you for posting this. I have a client who banks with navy fed and will be following these steps to get this taken care of very shortly. I will let you know if it works! The number got deleted so I’m assuming he will have to ask around to get to that department.

Just called the main number; The first rep I talked to had the ability (I just kept saying "talk to a person" until I got someone). I'm not sure if business services can disable it forever, but the rep I talked to could only do 12 months max.

With that said; a HUGE shoutout to Trinia who took my call and got it all taken care of!

Both my bookkeeping client and I were able to get on the phone with Navy Federal Credit Union's Digital department and have them turn off the two-step verification setting on the client's bank account login. If the client has more than one business account that you're trying to connect to QBO (e.g., checking, savings, credit card), then you will have to request that they remove the two-step verification for each account.

NFCU is extremely difficult about this process EVEN when you get transferred to "advanced digital services". The first line rep CAN suspend 2 step for up to 12 months, but that is it. Also - digital services plays dumb and has to go to a supervisor to get it done as they give the answer that is CANNOT be done. NFCU was putting the blame on QBO since "they are supposed to support 2 step". Nice game these two are playing where the business owner suffers!

Just tried this today and NFCU says they will not disable MFA unless the account holder is a deployed service member. Not sure what changed but I got a supervisor and they flat out refused and said they will not dIsable MFA to enable 3rd party integration.

I see these post are from 2022- But I a having the exact issues with NAVY FED. Navy won’t disable the verification process. NAVY FED argues that this is third-party issue and should be resolved with them. QBO has not resolved this problem since MARCH 2023, when I first report it. It is frustrating. I am about to cancel my QB suscription, any suggestions? Banking with another institution is not an option for my company at this point. Looking forward to hearing your advice / comments. Laur a

I'll let you know right now... the easiest solution, by far is to get another business bank account from one of the banks that work a lot easier with QBO!

The fact that there are still connection issues between QBO and NFCU is absolutely ridiculous given we pay monthly for these services. It requires me to do more work and manually upload each monthly statement to a shared fold with my bookkeeper just for my accounts with Navy Federal. Here are the best solutions I have:

1) Fix QBO -- needs to fix its system or use a 3rd party system like Plaid which actually works properly with NFCU.

2) Leave QBO -- Why continue to waste more money on a service that does not address and fix issues for its customers? I really despise that most accounts solely work with QBO and not other services.

3) Switch Banks -- This is not ideal whatsoever. It would be less work to switch QBO than banking. NFCU is an exclusive banking service that not everyone has access to with added features. Leaving them is not ideal for me or my business.

Alternatives: I actually don't use QBO for invoicing clients, I use Wave Apps. Which is fantastic and has an accountant/bookkeeping system in it just like QBO minus the issues. I have not switched to them yet but after reading the new responses on how this issue is still unresolved, I think it's time for me to make a switch away from QBO as well as my current accountants if they refuse to branch away from QBO. Maybe once enough customers drop their subscriptions, QB will finally take this issue seriously and fix the problem.

Yes, I agree, but QB's lack of response or updates is very concerning…. Well, after six months, I finally got an official answer from QB. Bad news thou! Awful news, QB blames the Navy, and they do not have an expected timeline on when this will be resolved if it gets fixed. For those who are canceling QB, what software are you using? Any recommendations are greatly appreciated.

Dear Valued Customer,

Our engineers have looked into the issue "Navy Federal Credit Union, Error 324", and our product team has determined that your NAVY FEDERAL is blocking our access. We have opened communication with the Financial Institution and are working to resolve this issue. Unfortunately, we don't have an expected timeline on when issue will be resolved. Our next scheduled update will be 8/4/23.

The QuickBooks Online Support Team

Any recommendations are greatly appreciated.

I can recommend 3 cloud based accounting apps to explore and compare. But the real question is how do you convert your data? Will you accept the purchase of conversion services?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here