Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am going through Banking, and there are a number of Mobile Deposits that are not matching automatically to invoices. The amounts are the same, and I have manually changed the mobile deposit info to reflect the same info as on the invoice, but for some reason they arent matching automatically. When I try the manual "find match," it says "we could not find matching QBO transactions for the date and search criteria above."

I've double and triple cheked the deposit dates, and the serach criteria dates, and they all are correct and matching. Yet, it wont match my mobile deposit to the invoice. Should I just exclude this deposit, or is there a way to match it from my Banking to my Invoice?

Solved! Go to Solution.

Thanks again for sending this my way.

I'd also like to check for the following criteria that could prevent the program from matching the deposit to the payment:

If you're still unable to find the match, you have the option to Exclude the transactions instead of matching them. This will simply move the transactions out of the For Review tab, and won't impact your books since you've already recorded the payment.

Here's how:

Please reach back out if there's anything else I can do to help.

Hi Cpattison1,

I'd love to help you get this bank deposit matched.

QuickBooks looks for various types of transactions to match bank deposits to, one being payments received against invoices, not the invoices themselves. The following article will show you the other types it looks for: https://community.intuit.com/articles/1164872. It sounds like the payments against these invoices have yet to be entered, so the program doesn't have anything to match the deposits to. You can either create the payments manually and then match the deposits to those payments, or you can create the payments manually and exclude the deposits.

If you have any questions along the way, I'd be happy to lend a hand.

The payents have already been entered. I entered them on the invoice after clicking "recieve payment" and used the check number as the reference number. Any way to get the system to match the deposit listed in Banking to the invoice?

I appreciate you providing these additional details.

I see in your original post that you changed the information of the deposits to match the information on the invoices. I recommend matching the information to the payments instead, since this is the type of transaction QuickBooks Online matches deposits to.

I appologize, but I am not quite sure I understand your answer.

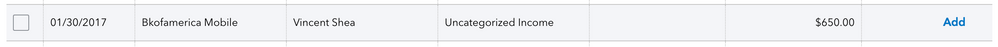

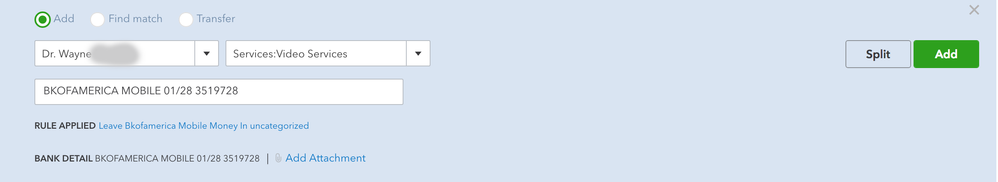

I changed the information of the deposit item original because they are all just listed as "BKOFAMERICA MOBILE" since they are all mobile deposits (take a photo of a check through the Bank of America App and deposit it). I just changed the info to reflect the client name (same as on the check and in the invoice) and the service type (same as on the check and in the invoice) .

What are you suggesting I change the information on the deposit items too?

I wasn't aware of what was originally changed on the deposit, and wanted to be sure those changes matched the payment information. If this is the case, there's no need to change anything.

Can you please send me a screenshot of 1. the deposit in the review tab and 2. the payment you'd like to match it to? This will help me uncover anything that may cause the program to not find it as a match. Please cross out any confidential information before sending.

Thanks so much for your time.

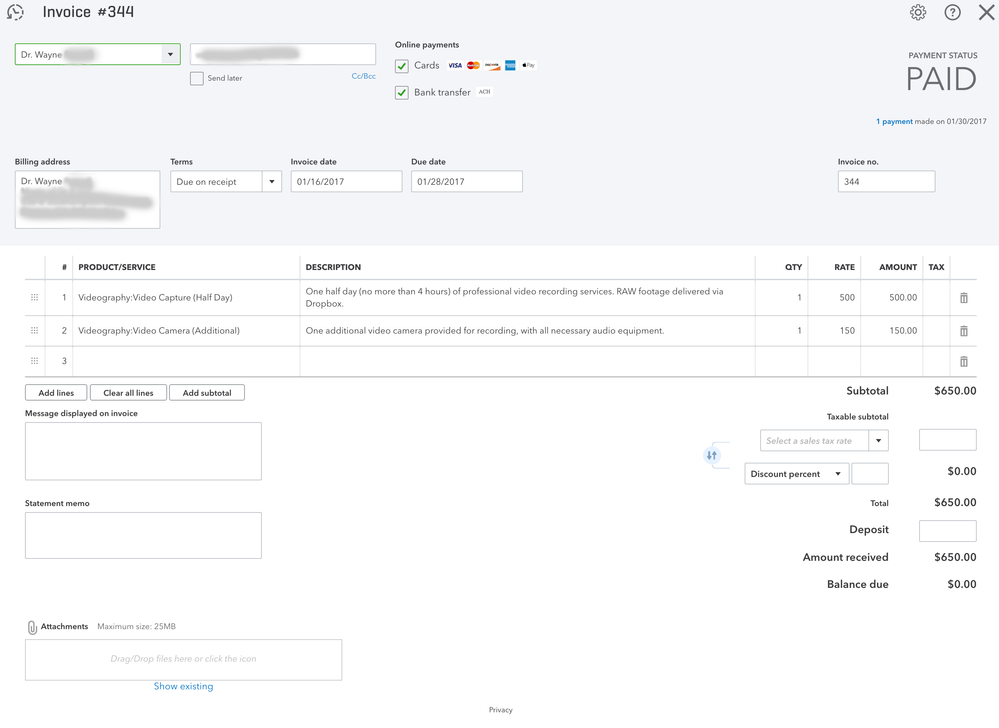

Sure thing, thank you. Screenshots are attached. :-) Before item change, after change, after change with details, and the original invoice trying to match it too. Last names and details are greyed out, but I have triple checked to make sure they all match in in all documents.

Thanks so much for sending those screenshots my way. They're extremely helpful.

QuickBooks matches deposits to the payment of an invoice, not the invoice itself. Can you please send me a screenshot of the payment instead of the invoice? If you're still on the invoice screen, you can click the blue text at the top right corner of the screen that says "1 Payment made on 1/30/2017".

Here is the Screenshot of the Payment :-)

Thanks again for sending this my way.

I'd also like to check for the following criteria that could prevent the program from matching the deposit to the payment:

If you're still unable to find the match, you have the option to Exclude the transactions instead of matching them. This will simply move the transactions out of the For Review tab, and won't impact your books since you've already recorded the payment.

Here's how:

Please reach back out if there's anything else I can do to help.

I have just entered many checks into QuickBooks. I'm trying to match them with downloaded transactions and none of the downloaded transactions offer a MATCH. When I click on the transaction, it has ADD checked. When I check MATCH, it takes me to a page with multiple checks to select from. How do I get the downloaded transactions to offer the matches when I click on them.? All of my other QuickBooks Online clients show that option - this one does not. I am listed as an accountant for the client I'm having troubles with. I'm listed as a user on my other clients.

Hi there Holly1,

Thanks for reaching out here in the Community for support. I'm glad to lend a hand with matching checks.

In order to match the checks to downloaded transactions, you'll want to double-check the dates, amounts, descriptions, and check numbers to make sure that information aligns. An additional reason for only seeing the add option could be that a downloaded transaction has previously been matched to a check with the incorrect number. Once the check numbers are in order, the system will take over from there and automatically provide matches.

You being listed as an accountant versus a regular user wouldn't make a difference in this situation.

Here's an article that breaks down the process of matching bank transactions: https://community.intuit.com/articles/1501491-add-and-match-bank-feed-transactions.

This information will get you back to business and I wish you continued success. Please let me know if I can help with anything else.

Ok, so when I enter a check manually, I use the date I wrote the check. When QBO goes to match the deposit of that check to the bank records, it does not find a match even though the check number and amount match. What I hear you saying is that I have to manually change the date on that check in my QBO register to the deposit date. This is a lot of work when numerous checks. Please have QBO offer a 'Match' option in the case when check number and amount (or even maybe just amount) matches. If I choose to match them, then have QBO change the date to the deposit date. I will be submitting this as a request, but in the meantime, I wanted to point out that the computer should be doing the work not us!

I am having the same issue with checks not matching. I use several QBO files and this is not an issue in my other files. I am not finding any preferences that could be the reason.

You should never be changing the dates on checks to match the bank feed. When someone cashes a check should not have an impact on your financial data.

I have a similar issue. Mine is even when people pay an invoice online through quickbooks itself. NONE of my deposits match automatically. The client pays online quickbooks deposits the funds into my bank account several days later but the transactions don't automatically match and this is actually done through QB and their payment system. If I bank a check after receipting it in quickbooks then it never matches QB then asks me several days later to review and match manually. I have hundreds of clients also its impossible to know what deposited funds belong to which QB receipt. So now I have hundreds of bank deposits sitting in my qb account that would take forever (If possible to match). Why does QB not match deposits to payments and invoices this is weird.

Hello there, @blue kiwi.

Allow me to provide some details on how QuickBooks Online handles matching of your bank transactions.

Since you’ve created your transactions prior to downloading from your bank, QuickBooks Online tries to automatically match them with the downloaded ones. Regardless if you’ve processed the transaction in QuickBooks, oftentimes the system will not be able to automatically matched it.

When your customer make a payment on the invoice, you’ve sent to them, the actual payment recorded in the bank is not usually the exact amount in the invoice since processing fees will be deducted from it. You’ll need to manually find the match for it.

Feel free to click the Reply button if you have other questions about matching your invoice payments and downloaded transactions in QuickBooks Online. I’m here to help.

Actually that is not how quickbooks processes transaction payments. QB merchant services do not take fees out of the deposits, they deduct fees from your bank account a few days after the deposit is processed so the deposit is the exact amount that is receipted in quickbooks. In addition it also carries the customer name invoice number and id from QB merchant services and displays it but wont auto match. When you look on QB it even says the name of the client, the invoice number it was paid for. QB batches the payments on a daily basis not sure if this throws it off but you would think QB should be able to automate from their own payment system to recognize invoice and client as the information is right there displayed it just does not automatically do it. Same with checks, mobile deposits etc. If I simply treat it as a deposit then QB says to me that is extra income so I have to some how match multiple deposits to payments even though its done in QB already. Makes for much longer and harder process than using a pen and paper supposed to simplify life not make it more difficult.

Hi,

We got the payment related to invoice, But Somehow QB did not get that one transaction from the bank. What do we do for this kind of stuff to record the payment in QB?

Hi Krishnav,

Let's get that missing transaction recorded.

You can try to click the Update button on the Banking page. We call this manual update, and it downloads transactions from your bank. If the transaction is still not downloaded, you can record it in QuickBooks. Then, when your bank downloads it in the next few days, you can match it with the transaction you'll create.

Please go back to this thread if you have additional questions.

I'm having the same issue and triple checked everything. Clearly, this is a coding issue on QuickBooks' end. I'm not sure if they realize it or not or care enough to fix it. Either way, it's more than just an annoyance. Please fix QB!

Hello there, @Anonymous.

We want to make sure this will get addressed right away and I'd like to redirect you to the best support to help you with your deposit transactions concern.

To make sure this issue will be addressed properly, I suggest contacting our QuickBooks Customer Care Team. This way, they can investigate further why your deposit transactions don't match automatically.

To reach them, click Help (question mark icon) at the top right, then hit Contact us.

Please keep in touch with us here in the Community should you need any further assistance. We're always here to help.

No none of what you say works it still is an issue an your customer service sucks

Thanks for joining us here, blue kiwi.

QuickBooks (QB) offers smart suggestions to match your downloaded transactions to speed up the work for you. The system will see this as a possible Match so long as the other criteria is met.

Here are a few reasons the match may not have been recognized:

For more in-depth information about finding a match in QuickBooks, refer to these articles:

Please leave a comment below if you have any questions. I'm always here to lend a hand and help further. Have a good one.

We are just noticing this problem recently. From time to time we have had matching issues but they have always been related to something silly we were doing on our end like the stuff in the list JaneD and others on this thread have supplied. I have already checked all the items we are having problems with and they are not silly things we are doing. The transactions are recorded in the same way as the thousands that QB has successfully matched up until about a month or so ago.

I have 2 observations

1. The only transactions that are not getting matched are Checks. Not some checks or a few checks ... all checks.

2. The problems started about the time when we were forced to do that new 2 step verification thing with the bank in order to keep downloading transactions.

My suspicion is that the two may be related (the third item in JaneD's list). Something with the way the bank and QB are talking to each other that is invisible to all us mortal customers.

I have 2 questions

1. Has anyone noticed a correlation between the matching problems they are having and signing up for the 2 step verification?

2. Can anyone from QB either confirm or deny my suspicion?

I appreciate you sharing your thoughts with us today, @eftbookeeping.

I've got you covered in providing clarifications about matching bank transactions in QuickBooks Online.

The two-step verification procedure is intended for your account's security. Thus, when matching transactions, QuickBooks is dependent on the information that is transmitted from your bank institution.

Also, we haven't received any similar observations reported to us. For now, to match your checks in QuickBooks Online, you'll need to make sure that the information is correct especially the dates and amounts. If QuickBooks doesn't show your checks as matching entries, you can click on a bank transaction and select Find Match.

For information on this, please see the following article: How To Add And Match Downloaded Banking Transactions.

If you've encountered an error while on the process, you may reach out to our Customer Care Team. They have the tools to check on your transactions securely and help verify what's causing the issue.

This will keep you going today, eftbookeeping.

Should you have questions about this, I'm just a few clicks away. Cheering you to continued success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here