Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowWelcome to the Intuit Community, @jujuinman.

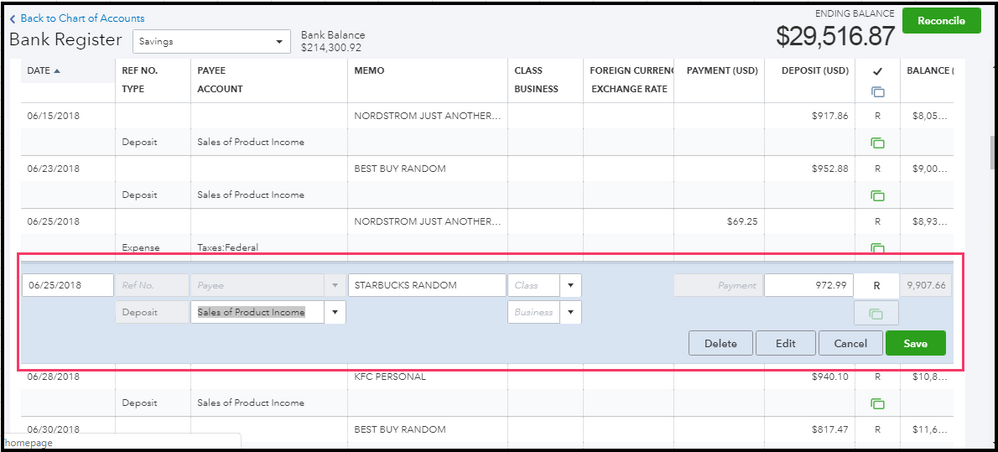

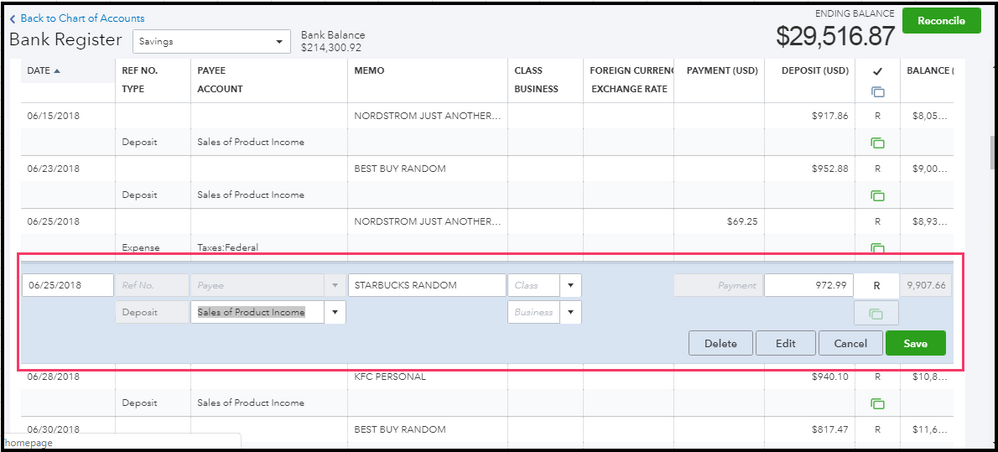

You'll be glad to know that you can change the category of the reconciled item. No worries. This doesn't affect the balance in your bank register.

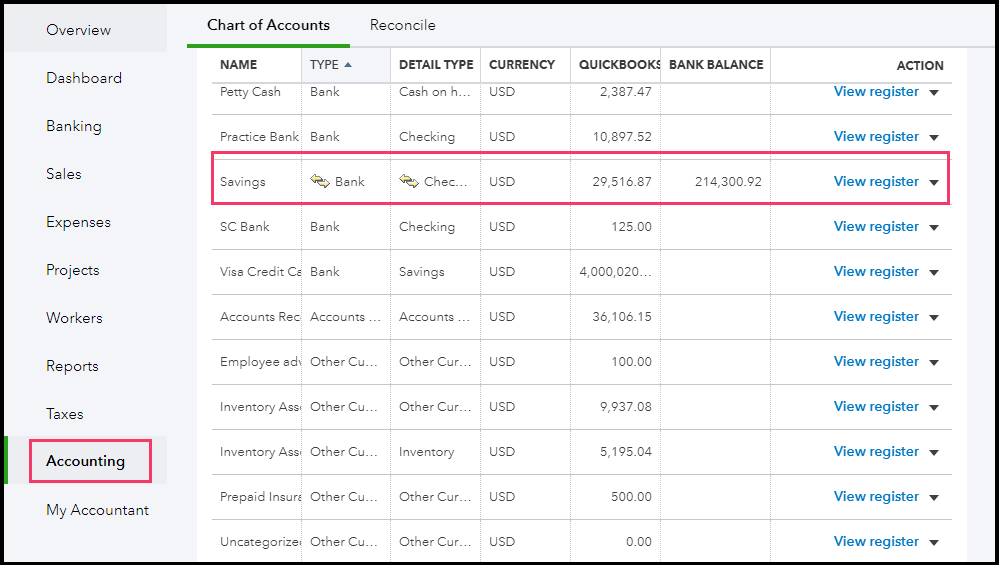

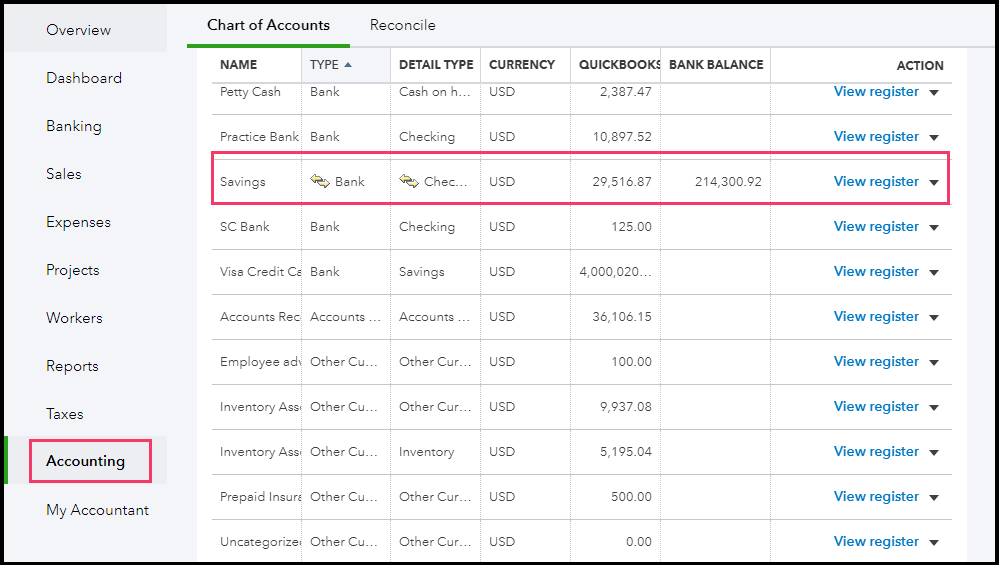

Here's how:

If you need to change the reconciliation status, you can go through these articles: How to unreconcile a transaction or undo a reconciliation.

Should you have any other concerns, you can always start a thread by posting here in the Intuit Community. Thank you and have a wonderful day.

Welcome to the Intuit Community, @jujuinman.

You'll be glad to know that you can change the category of the reconciled item. No worries. This doesn't affect the balance in your bank register.

Here's how:

If you need to change the reconciliation status, you can go through these articles: How to unreconcile a transaction or undo a reconciliation.

Should you have any other concerns, you can always start a thread by posting here in the Intuit Community. Thank you and have a wonderful day.

Thanks! This really helped.

That's fantastic to hear, @jujuinman.

If there's anything else I can help you with today, please let me know by replying to this thread.

I'm always around here in the Intuit Community whenever you need help.

Have a wonderful day ahead!

Hi

when i change categories after reconciliation will it reflect in the P&L report?

Hi there, @royalpain.

Thanks for joining in this thread. The Profit and Loss report is driven by income and expense accounts. Hence, any changes made that affect these specific categories will reflect in the P&L report.

Read through this article for more insights about what is reported in the Profit and Loss report. It also includes ideas to troubleshoot missing income and expense transactions in the P&L report.

Feel free to visit again if you have additional concerns. We're delighted to assist you some more.

Hi I did it that way now my beginning balance is off when I try to reconcile. How do I fix it?

Hi there, @terrystreeserv.

Thanks for sharing the complete details of your concern.

It's possible that you've accidentally undone some of your reconciled transactions. Or else, someone entered an incorrect opening balance when you created the account in QuickBooks. This is the reason why your beginning balance is off.

In order to fix this, double-check what you've entered for the opening balance. Sometimes it doesn't include transactions that were still pending when you made the account. Here's how:

Once done, compare the balance to your real-life account and review your account register. Just follow steps number 2 and 3 in this article: How to review the opening balance entry in QuickBooks.

If it's correct and you're still getting the same issue, review your beginning and ending balances. Just follow the steps in these articles to find the reason behind it and make the necessary changes.

Once you know what you need to change, you can go ahead and edit the transaction.

To learn more about reconciling and related errors, check out our reconciliation guide.

Please let me know if there's anything else I can do to be of assistance. Just place your concern by clicking Reply and I'll get back to you. Have a wonderful day and stay safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here