Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy credit card processing company collects their fee from the customer.

If I have a total sale of $100.00 and run it through my terminal my customer ends up paying $104.00 (example).

$100 for the sale and $4 for the fee. I have a receipt showing exactly that.

The bank deposit shows a deposit of $104.00 and then the next day or so another transaction for the -$4.00, netting me my $100.

How do I record this sale in Quickbooks Online correctly? I have tried several ways but nothing has proven solid.

I can think of one way to help you get around your concern, Plumbguy1.

You'll have to receive the payment ($104.00), deposit it to the Undeposited Funds, then deduct the fee ($4.00) from there.

First, you'll have to receive the invoice payment. Here's how:

Then, deposit the payment and add a line item for the fee. Here's how:

If transactions are downloaded automatically from your bank, you can match the deposit to the payment.

Get back to this thread if you have more questions. We're right here to help you. Take care!

Let's try this scenario. I'm not in the office for the sale and the service manager writes up a paper invoice totaling $100 and runs it through the terminal. The terminal adds $4 to the customer making the transaction total $104.

2 days later in my quickbooks online connected to my bank account, I see a transaction from merchant services for $104 and another for -$4. This nets me my $100 sale.

For the life of me, and I followed your example as best I could, I can't get it to work. Mind you I have yet to enter the invoice so I can do it the way you describe but there is nothing to match the 2 bank entries to in the end.

If I am not making sense please let me know.

1. I believe I only want to record invoice at $100. I don't want to fudge any numbers there to cloud my sales numbers.

2. I don't think it matters where the fees go or what they are called because they will always end up at a 0 balance (hopefully) because I have nothing to do with the fees themselves.

3. I have to be able to clear the bank transaction pulled from my account that shows the original sale plus the fee and the following credit for the same fee.

Thank you for getting back to us, @plumbguy1.

Being able to clear the bank transactions from the bank feeds would be handy as you won't have to enter them manually in QuickBooks. However, the steps provided by my colleague would be the best way to handle this kind of scenario. For the detailed steps, refer to this article: Enter a bank service fee while using a third-party merchant service.

Make sure to enter the fee as a negative amount on the Bank Deposits screen when depositing a payment. This way, it will zero out the bank fee. Then, you can just remove the transactions from your bank feeds. After that, manually clear these entries from your bank register.

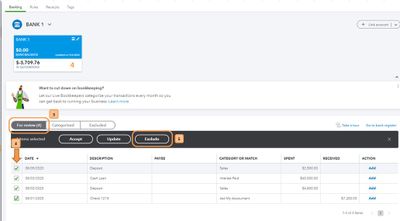

These instructions will show how to delete them from the For Review tab:

Once done, manually clear these transactions in QuickBooks:

Should you have any additional questions or concerns, the Community will have you covered. Thanks for reaching out, best wishes.

My client's customers pay 100% of their own credit card fees. The cc processing company does not deposit the sale+cc fees into our account, only the net sale. The credit card merchant copy slips show the charge, and a separate line: Cust Svc that is the credit card fee.

Since the business only receives the net, do we have to record that credit card fee as revenue and then negate it by recording it as an expense? It will net zero so this seems unnecessary. Can someone advise from an accounting standpoint?

Thank you!

"Since the business only receives the net, do we have to record that credit card fee as revenue and then negate it by recording it as an expense? It will net zero so this seems unnecessary. Can someone advise from an accounting standpoint?"

Yes, the CustSvc fee charged should be recorded as Revenue and the cc fees as an expense. If they net to zero, so be it. Most businesses add 3% (or whatever they decide) as their fee but the actual fee charged by the cc processing company isn't exactly 3%, so there will be a gain or loss on the difference. If your client's fee nets to zero, you still want to record it as Revenue so the amount paid by cc matches the 1099-K they will receive from their payment processor.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here