Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGreat questions, Barbie.

The payment will be transferred either to the parent account or sub-account, depending on where the bill is.

We can start reconciling the transactions in the sub-accounts. Once done, the reconciled transactions will show on the parent account.

Follow these steps to reconcile the transactions in your book:

I'll share with you some articles that can surely help you as you go through reconciling your accounts.

Ping me anytime if you have other questions. It'd be my pleasure to help you more! Take care!

Thank you so much Regina. Can't believe I didnt think of this. This was the quickest and clearest I have ever found a solution to my question on here. THANK YOU!

Between the issue of duplicates appearing from automatic downloads and the issue of Chase employee credit cards not being supported, working in QBO is more of a chore for me than a convenience. I tell anyone shopping for bookkeeping software to avoid it.

Is this still an issue with QB and Chase? I still have to do a journal entry each month to move the charges from my employee cards to the main master card (mine). Is there a fix yet?

Thank you for joining the thread, @RL817.

QuickBooks only depend on your bank how they manage to sync transactions. You'll want to check with your bank how they send the transactions in QuickBooks Online (QBO).

In the meantime, you can enter a journal entry as you usually do to move your employee's card transactions to your master card account. And consider requesting from your bank to sync the transactions separately. This way, you won't enter a journal entry for your employee's card transactions manually.

I'm adding this article for more details: About bank or credit card subaccount setup.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

When will this be fixed? Isn't having multiple cards on a parent account one of the most common things in all of business accounting? If Quickbooks can't do it now then it is a problem that needs a solution.

I appreciate you for sharing your sentiments with us, Ethan at Props.

QuickBooks Online (QBO) gets information on whatever the bank allows. It's the Chase credit card's discretion on how they handle the transactions downloaded to sync with QBO. I suggest reaching out to your financial institution for advice.

In addition to Mark_R's answer, you can check out this article to learn about adding and matching downloaded banking transactions.

Also, you might need this article for your next step which is about reconciliation in QBO:

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day.

After way too much time trying to parse out the answer on QBO's website and numerous phone calls with customer service who couldn't succinctly answer the question, here's the short answer to handling Chase credit cards in QBO:

1. Create the parent account - this will NOT be connected to chase.com.

2. Create a subaccount for each cardholder. Don't worry about the primary and additional, everyone is a subaccount under the parent account.

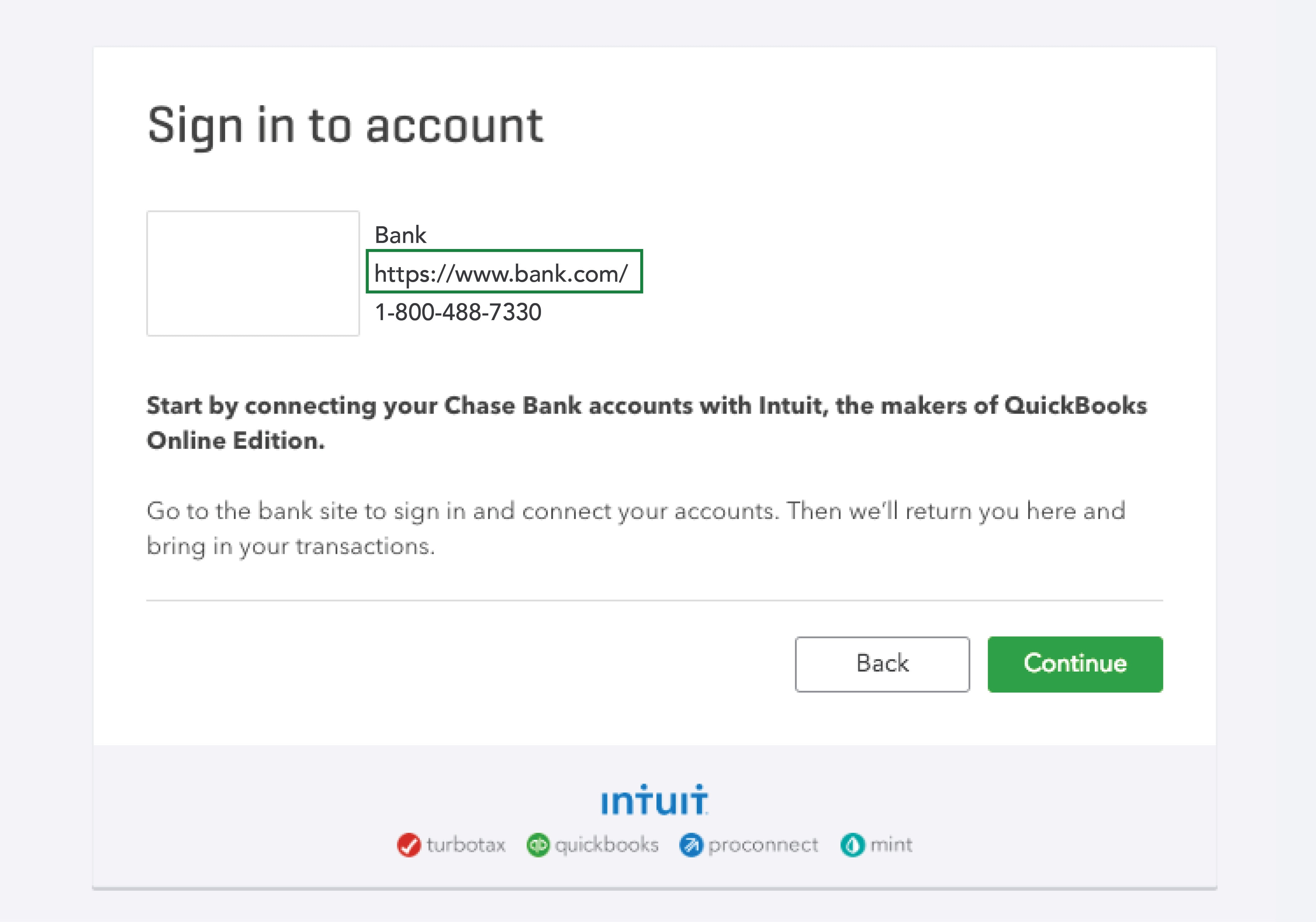

3. Connect each cardholder's account to chase.com. QBO does a nice job of allowing to showing you the one-to-one account connection.

4. When you reconcile the credit card statement, choose the parent account and start reconciling. All of the transactions for all cardholders will show up in the reconciliation window.

NOTE: the statement payment will always flow into the primary cardholder's account. You can either break up the payment by cardholder account or leave as the net effect of the subaccounts will be reflected in the parent account - this is where you see the accurate, sum-total balance of the credit card account and all card holders.

After way too much time trying to parse out the answer on QBO's website and numerous phone calls with customer service who couldn't succinctly address the issue, here's the short answer to handling Chase credit cards in QBO:

1. Create the parent account - this will NOT be connected to chase.com.

2. Create a subaccount for each cardholder. Don't worry about the primary and additional, everyone is a subaccount under the parent account.

3. Connect each cardholder's account to chase.com. QBO does a nice job of allowing to showing you the one-to-one account connection.

4. When you reconcile the credit card statement, choose the parent account and start reconciling. All of the transactions for all cardholders will show up in the reconciliation window.

NOTE: the statement payment will always flow into the primary cardholder's account. You can either break up the payment by cardholder account or leave as the net effect of the subaccounts will be reflected in the parent account - this is where you see the accurate, sum-total balance of the credit card account and all card holders.

Is there an ETA to a fix or is this a known bug that will never be fixed?

I did exactly as suggested. Parent Account had a balance of -12,345.67 and Sub-Account had a balance of -12,345.67. After creating a journal entry to transfer the balance to the parent account, the sub-account has zero balance (Bank Balance and In Quickbooks both zero), this part is good now.

The Parent Account remained with a positive balance of -12,345.67 that also shows on the Balance Sheet Report as Total Credit Cards $ -12,345.67 (Total Current Liabilities $ -12,345.67).

@MaryLandT and @Regina_Lend_A_Hand_Accounting, thank you for the previous help and please let us know how to fix this.

Thanks for joining the thread, @YTK. Allow me to share some insights with you.

You can consider creating a journal entry to correct these negative balances. In your case, I also suggest checking your bank statement and consulting your accountant to ensure you're accounting for the amounts correctly while using the journal entry. If you need one, you can check this website: Find a ProAdvisor.

Once you're ready, I'd recommend performing this process monthly to monitor your books accurately. For the step-by-step guide, you can reference this article: Reconcile an account in QuickBooks Online.

Furthermore, take a look at this article for more details on how to set up a bank or credit card subaccount in QuickBooks Online connected to your online banking.

Let me know if you have other QuickBooks Online concerns. I'll be checking my notifications to help you soon. Take care and have a prosperous day!

I have 30 sub accounts/users with the Chase card. The feed used to pull in all transactions at the parent level up until last month. It just stopped doing that. I do not want to add 30 additional accounts to the COA. How can I get the feed back to the parent level again and why did this just stop?

Thanks for joining this thread, mbell1.

Since your parent account isn't downloading transactions from its subaccounts, I'd recommend checking with the bank to confirm if there were any changes to how they send transaction data. If they've changed to where they send data for individual accounts, then you'll need to connect each of the subaccounts.

In the event they still send data to one account, you can keep your parent account connected. If transactions aren't downloading into your books automatically, you'll want to perform some troubleshooting steps. The first thing I'd recommend trying is a manual download.

Here's how:

This will update all of your connected accounts. The number of transactions in each account will increase if new transactions are downloaded. If you see a message about additional authentication, follow your on-screen steps to continue with the update. Not all banks require this, but some do.

If performing a manual update didn't bring in any new transaction data, you'll want to check your financial institution's website:

Once you're signed in, check for any messages, notifications, or alerts. Look for any display issues as you navigate their site. Display issues can block QuickBooks from downloading new transactions. Check for any announcements about new security requirements.

If you haven't found anything which could relate to transactions not downloading, next you'll want to try updating your bank information in QuickBooks.

Please feel welcome to send a reply if there's any questions. Have a lovely day!

I do journal entries when I reconcile each month. I use the total of each card off the bank statement. Then debit/credit from the subaccounts to the main card to zero out the balance.

Thank you, someone who knows what they are talking about.

Yo inverti y no puedo tengo acceso a mi dinero

Thank you for posting here in the Community, Newbuzoldways.

Can you share more details about your concern? We just want to make sure that we're giving you the right steps and information to sort this out. A screenshot of your view will be very much appreciated.

Keep me updated in the comments below. Hope to hear from you soon. Take care always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here