Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHey there, @bgorlando.

Thanks for reaching back out and letting us know what you did in your account. Allow me to give you some pointers so you're able to get this option.

All you need to do is the exact steps that my colleague gave above. The only reason why you didn't see this message is because you changed several items at one time.

If you still run into problems, feel free to ask any other questions. I'm always here to lend a helping hand. Have a great day!

But they’ve all already been changed. How do you propose I do the exact steps as your colleague mentioned when all the items have already been changed using the Add/Edit multiple items.

I would think there would be a workaround since there’s an option to have them apply to historical transactions editing them one at a time since there’s the ability to change multiple at one time.

I understand how convenient it can be to update the historical transactions, bgorlando.

As of now, what you can do is modify the items manually to apply the changes to the previous data. I'll gladly show you the way.

Also, we'd like to have this opportunity to improve your QuickBooks experience. With this, I recommend sending a feature request directly to our Product Development team.

Please know that we closely monitor feedback submissions and take them into consideration when prioritizing feature development. When you're ready, here's how to send your request:

Additionally, I've included this article that'll help you in managing your items in QuickBooks Desktop:

I'll be right here to continue assisting if you need a hand in updating your items, bgorlando. It's always my pleasure to help you out.

Again, your advice is useless unless you explain HOW to follow the steps given by your colleagues when the items have already been changed. Therefore there is no way to follow those steps.

This is why I rarely reach out to Quickbooks support. Does anyone really know what they’re doing? This is extremely frustrating!!

I know that you've been through a lot, bgorlando.

I can help share additional insights about updating an item that includes the historical transactions.

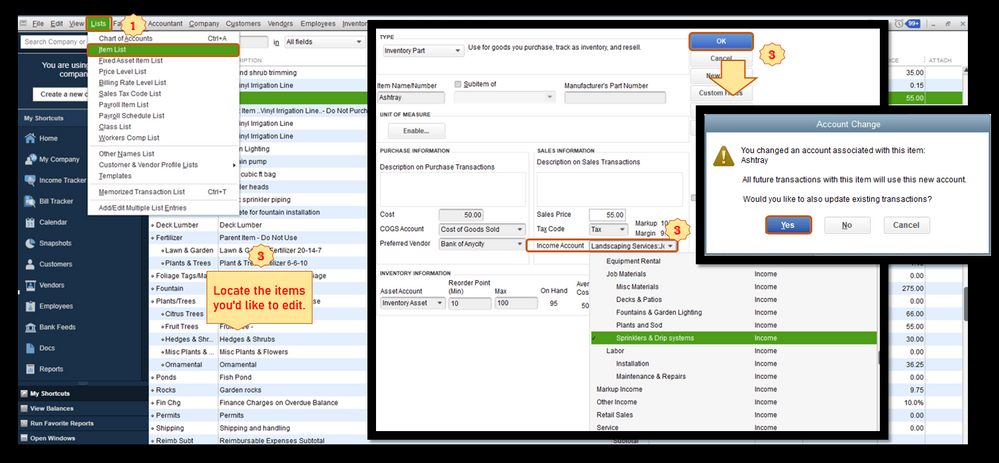

You can only get the pop-up message by opening the item you want to edit and updating the Income Account.

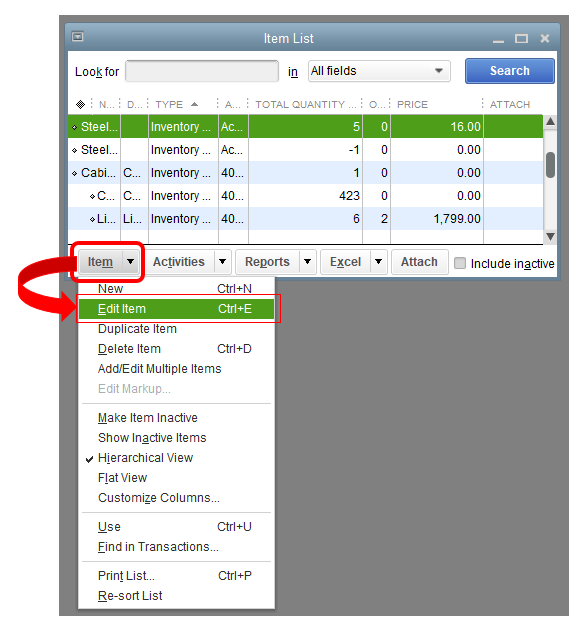

You'll want to continue changing the items manually. And moving forward, you can follow the steps below to ensure all the existing transactions on that item will also update.

Please let me know if there's anything else you'll need. I'm always around to help.

OmGosh, I could not get my Income category to show up on my P&L, I used your method to have my "historical transactions" show up, and that fixed my P&L. THANK YOU.

"We want to make sure your previous transactions and inventory reports have the correct information."

This is ridiculous! I don't care about the previous transactions or old inventory reports. What I DO care about is being able to adjust the income account historically for our products so that I can run reports that actually make sense!

Even if Intuit doesn't think it is valuable or necessary, for many people it most certainly is valuable and necessary.

How can I adjust the current price in QB without affecting the previous months?

I’m here to help you adjust the current item price in QuickBooks, Paul.

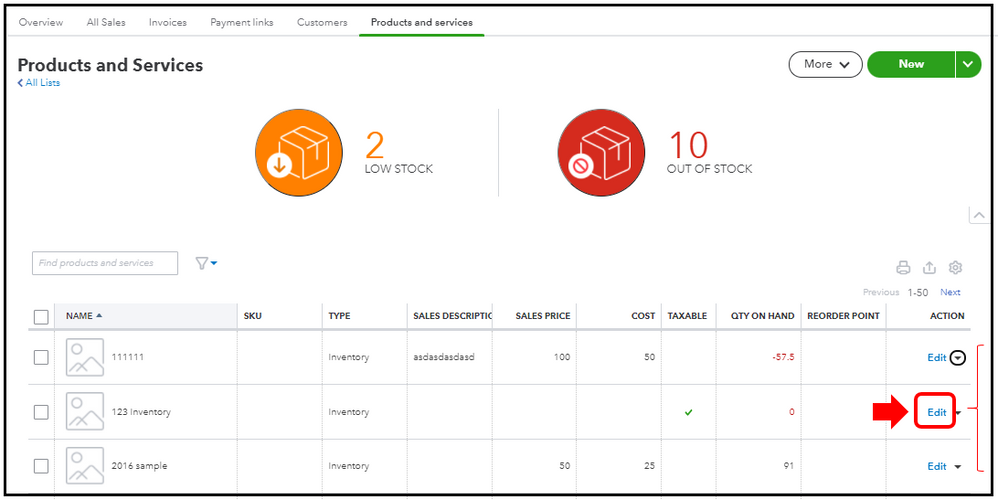

In QuickBooks Online (QBO), you just need to open the item to adjust the price. No worries, it won’t affect previous months' transactions. As mentioned in this thread, the updates will only apply to future transactions.

Here’s how:

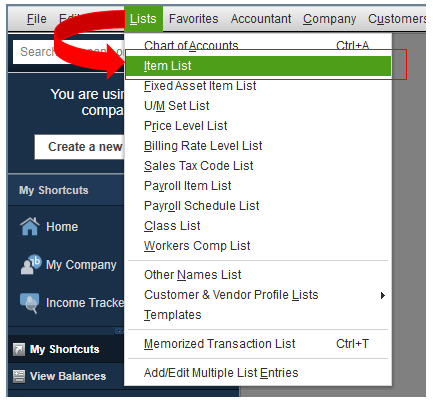

The same thing if you’re using QuickBooks Desktop (QBDT). You’ll want to open the item to adjust the value. I’ll show you how to do it:

You can use these resources to see your inventory status, performance, and how to track them at different sites or locations:

Don’t hesitate to tap the Reply button below if you have other questions or concerns besides adjusting item price. I’ll be here to help. Have a great day and always take care!

Since this question came up in 2020 I'd like to resurface it again with a twist.

Our situation is that we need to make an update to an Income Account for several part numbers (Type = Inventory Part) but we DO NOT want to effect any previous years of reporting.

In May of 2020 the answer says the change will NOT effect 'inventory' type item numbers. Is this still the case?

Also, we are using QuickBooks Enterprise Solutions: Manufacturing and Wholesale 20.0 and I believe this person was asking about Quickbooks Online.

HELP! Thank you.

I appreciate you for joining this thread, AVarrone.

When you make an a value adjustment of the inventory it will not affect the previous month's transactions. Here's how to do it:

In addition to, you can run the Inventory Stock Status by Item report to pull the data of your inventories. Here's how to run the report:

You can customize your inventory reports to focus on the details you needed the most. You can learn more about this through this article: Customize reports in QuickBooks Desktop.

I'm just around if you have other concerns or follow-up inquiries about reports. Keep safe!

2023: This is still an unanswered question. If an item has its income or expense account adjusted, will the affect be retroactive to previous transactions?

Example: I set up and purchase Widget A into inventory in October with income account 1 and expense account 1. I sell the item in November. The transaction applies cost to the original expense account 1 and revenue applies in income account 1 that were set up in October. November business concludes with both values in the appropriate accounts.

I then decide that I need to change both the income and expense accounts for Widget A in December.

Will the sale of Widget A in November credit the original accounts and credit the new ones that I changed them to in December, and apply that change to the concluded month of November?

If the answer is yes, what affect does actually closing the accounting periods at month's end have on these transactions?

We appreciate you for joining in the thread, Alan Roden.

With regards to your question if an item has its income or expense account adjusted if it will be retroactive to previous transactions, then it depends if it is a service and non-inventory items or inventory items. If you are using QuickBooks Online (QBO), for service and non-inventory items, we have the option to select the Also update this account in the historical transactions checkbox after step. This updates all transactions that use the item. However, for inventory items, the checkbox doesn’t appear. This is because inventory items track quantities on hand using First In, First Out (FIFO). FIFO affects your assets and Cost of Sale (COS) differently from service and non-inventory items.

Just in case the past transactions aren't updating, change the income account then switch it back to the correct one. To learn more about changing the income account for any of your product or service items in QuickBooks Online, you can check out this article: Change the account for a product or service item in QuickBooks Online.

For the expense account, we can update the account to track how much you spend on a product or service. Here's how:

You can track them on your financial reports. I’m also adding an article that tackles recording an item to an incorrect account. Please know the steps are from the desktop version, but some of the solutions will apply to QBO: How to Fix Items Posted to The Wrong Account in QuickBooks.

Also, we can run the Profit & Loss report since it is fed by your business income and expense accounts, including the cost of goods sold accounts as well as other income accounts like interest earned or other expense accounts like depreciation expenses.

I want to make sure I've got you covered. You can click the Reply button below for follow-up questions and clarifications about mapping accounts with your products and service items. I'll be in touch.

We appreciate you for joining in the thread, Alan Roden.

With regards to your question if an item has its income or expense account adjusted if it will be retroactive to previous transactions, then it depends if it is a service and non-inventory items or inventory items. If you are using QuickBooks Online (QBO), for service and non-inventory items, we have the option to select the Also update this account in the historical transactions checkbox after step. This updates all transactions that use the item. However, for inventory items, the checkbox doesn’t appear. This is because inventory items track quantities on hand using First In, First Out (FIFO). FIFO affects your assets and Cost of Sale (COS) differently from service and non-inventory items.

Just in case the past transactions aren't updating, change the income account then switch it back to the correct one. To learn more about changing the income account for any of your product or service items in QuickBooks Online, you can check out this article: Change the account for a product or service item in QuickBooks Online.

For the expense account, we can update the account to track how much you spend on a product or service. Here's how:

You can track them on your financial reports. I’m also adding an article that tackles recording an item to an incorrect account. Please know the steps are from the desktop version, but some of the solutions will apply to QBO: How to Fix Items Posted to The Wrong Account in QuickBooks.

Also, we can run the Profit & Loss report since it is fed by your business income and expense accounts, including the cost of goods sold accounts as well as other income accounts like interest earned or other expense accounts like depreciation expenses.

I want to make sure I've got you covered. You can click the Reply button below for follow-up questions and clarifications about mapping accounts with your products and service items. I'll be in touch.

I am doing the opposite. I am trying to change the income/expense account for specific inventory items and it goes back to the beginning of time. Is there a way to change it from a certain point forward?

Hi there, @MLH114. I can share details about how QuickBooks Online (QBO) works in changing posting accounts for product and service items.

Upon changing the income or expenses account associated with your product and service item, there's no way we can select a specific period where we can apply the changes retroactively. We can either select the Also update this account in historical transactions box and manually delete then re-create the transactions you want to keep from its original income/expenses posting account. Otherwise, we can change the account section and apply changes for future transactions.

To void or delete transactions, please follow the steps below:

Moreover, you can visit this article to see your best sellers, what’s on hand, the cost of goods, and more: Use reports to see your sales and inventory status.

You’re always welcome here in the Community if you have more concerns with managing inventory items or any QuickBooks topics. Stay safe!

if we dont see the pop up message "

I'm here to help you show the pop-up message when updating products and services in QuickBooks Online (QBO), Ssharif.

Please note that the message will only appear when you update your products and services in QuickBooks Desktop (QBDT). If you use this product, consider following the steps provided by my colleagues in the thread.

However, if not, you can easily Edit the transaction in the Product and Services tab to update an existing transaction. To do that here's how:

If you want to make changes in a service or non-inventory item, check the Also update this account in historical transaction box after step 3 to modify all relevant transactions.

However, the checkbox won't appear for inventory items as they keep track of the quantities on hand using First In, First Out (FIFO). This affects your assets and Cost of Sale (COS) differently from service and non-inventory items.

To learn more about changing the income account for any of your product or service items in QBO, you can check out this article: Change the account for a product or service item in QuickBooks Online.

I'll be adding these resources to help you see your inventory status, and performance, and how to track them at different sites or locations:

Don’t hesitate to reach out to us if you have further questions about updating your items in QBO. I’ll be here to help. Have a great day and always take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here