Let's take this one step at a time, Billy. I'm committed to guiding you until your account is resolved and balanced.

Before we proceed, I recommend running the Audit Log to verify any changes made to the bank account transactions that caused the discrepancy. Understanding whether these changes were intentional or created by someone else with access to the account is crucial for accurate resolution.

Once done, let's access your account register to identify transactions that need to be unreconciled. Then, address each transaction individually to resolve any discrepancies.

For detailed steps, here's how:

- Go to the Bank Transactions menu and select Chart of Accounts.

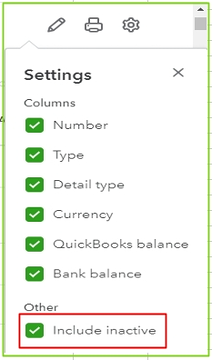

- Filter the register to Include inactive accounts.

- Find the account and select View Register.

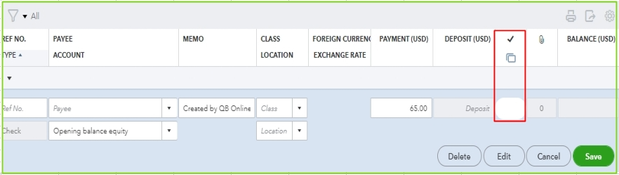

- Review the check column. If the transaction is balanced or reconciled, you’ll see an “R.”

- Choose the box and keep clicking it until it's blank. It removes the transaction from the reconciliation.

After you've unreconciled and edited the necessary transactions, take a moment to review the identified entries. Then, head back to the Bank Transactions tab and choose Reconcile to finalize the balancing process.

Additionally, you may consider inviting your accountant to collaborate on your QBO account. It will enable them to offer tailored insights and support, ensuring your financial records remain accurate and up-to-date. If you don’t have an accountant, please visit our QuickBooks ProAdvisor website for assistance.

Furthermore, to deepen your understanding of the reconciliation workflow in QBO and effectively address any errors, I suggest bookmarking these valuable resources:

Keep this thread handy for future questions or concerns about balancing your account in QBO. My team and I are here to ensure you feel supported and confident in managing your finances. We always look forward to assisting you.