Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

New client has Credit Card used for business expenses.

Over the years, the card number has changed due to fraud, etc. Each time, client set up a new chart of account for the new account number and did not disable the link not make inactive the old chart of acct. So, all six credit card payable accounts are active & can be linked to bank -- all six Chart of Accounts for ONE credit card.

Client's CPA just journaled & reclassed the balances of all defunct credit card accounts so only balance in active credit card payable account. Did not disable old chart of accounts for credit cards.

However, now TWO credit card payables accounts have balances due to bank feed confusion.

COA = Chart of Accounts

Credit Card A is dormant. Credit Card B is new number. COA for Credit Card B was getting info from bank correctly until last month. Now bank feed transactions are going to COA Credit Card A.

Client asked CPA what to do & CPA disabled Credit Card B in Chart of Accounts. Client is frustrated because this COA Credit Card B number has the new, correct number and now isn't linked.

I need to re-enable Credit Card B. Move transactions from COA Credit Card A to COA Credit Card B, then disable COA Credit Card A so that this doesn't happen again.

Can this be done? Can I re-enable a COA CC that was disabled?

OR -- This is the fix I rather think is the easiest way to move on: use Chart of Accounts for Credit Card A. Rename it with new number and physically move transactions from Credit Card B to A. Then, just move forward with COA Credit Card A as that is where bank is linking transactions and Credit Card B is disabled.

I have also instructed client not to set up new Chart of Account number when fraudulent credit card replaced.

Hi there, debabe.

I'm here to show you the easiest way on how to handle duplicate accounts and their transactions.

Let's reactivate the second credit card account first. From the Accounting tab, select Chart of Accounts. Click the small Gear icon beside the print button and check the Include inactive so that all inactive accounts will appear. Locate Credit Card B and click Make active.

There are two ways on how to fix the transactions. You can either manually transfer the transactions from A to B or merge them. If you choose the manual way, you'll have to delete them and recreate them to the correct account.

If you want to merge the two, you'll have to delete the transactions that are already on the other account. This is to avoid additional errors and discrepancies because all transactions will be moved to the account you want to keep.

In addition, the merging process isn't reversible and you also need to disable the Online Banking feature temporarily. Please check these articles for the detailed steps:

Just a tip, it's best to save the reconciliation reports first before merging the accounts.

Post again here if you have additional concerns. Stay safe!

Didn't actually make the chart of accounts for the credit card inactive, only used the 'disable' option to make it disconnect from the bank.

I want to merge the accounts and exclude any duplicates. I believe that this is the most efficient solution.

If I merge a credit card account that is DISCONNECTED from the bank with a credit card account that is CONNECTED with the bank, will the remaining credit card chart of account category be connected to the bank?

The accounting file has been fixed and tampered with so many times by so many well-meaning folks, I want to get this item entirely correct so that there is no more mess to try undo or fix.

Yes, the disconnected credit card category will be connected to the one that is set up for Online banking, debabe.

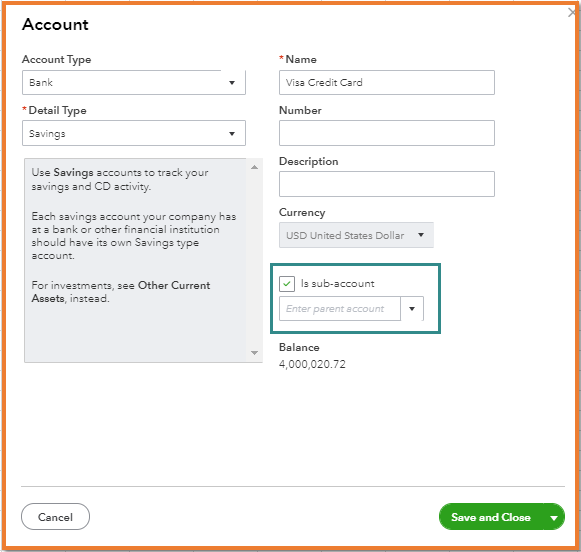

The disconnected credit card will become the sub-account when you merge it to the connected one, which is the parent account. Also, all transactions will roll up into the parent account. Hence, you only need to reconcile the parent account.

Let me show you how to merge them:

Learn more about merging accounts through these articles:

Stay in touch with me if you need anything else about merging accounts in QuickBooks. Just tag my name, and I'll be around to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here