Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'd gladly help you record your returned ACH payment using the Record Bounced Check option, hfrantz.

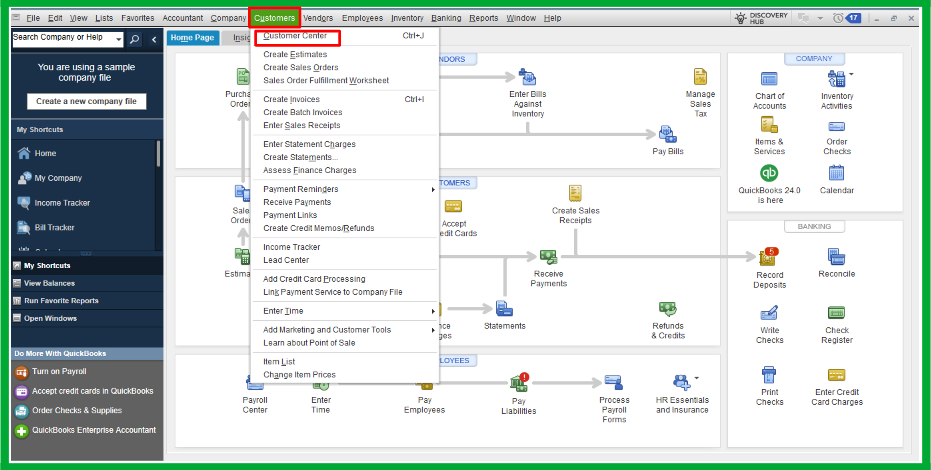

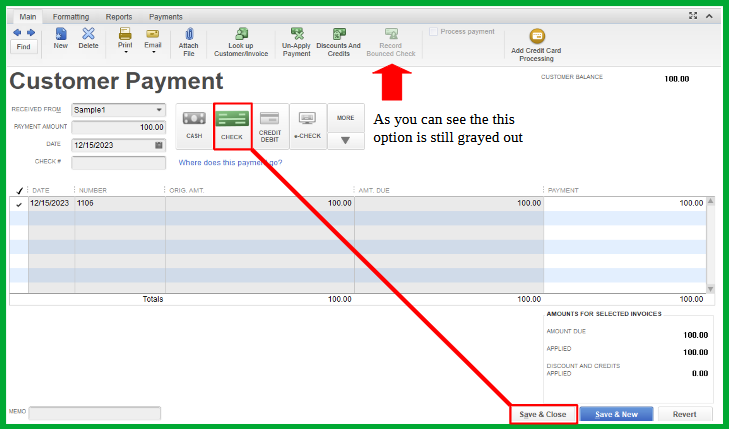

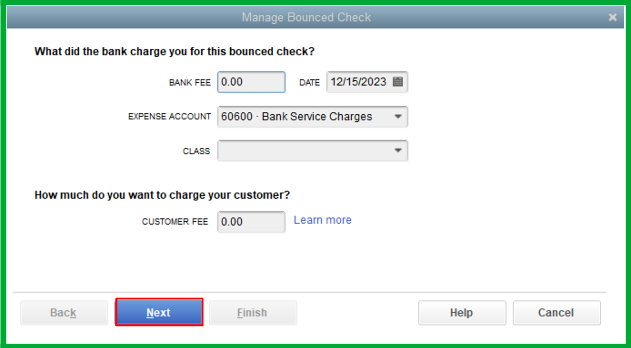

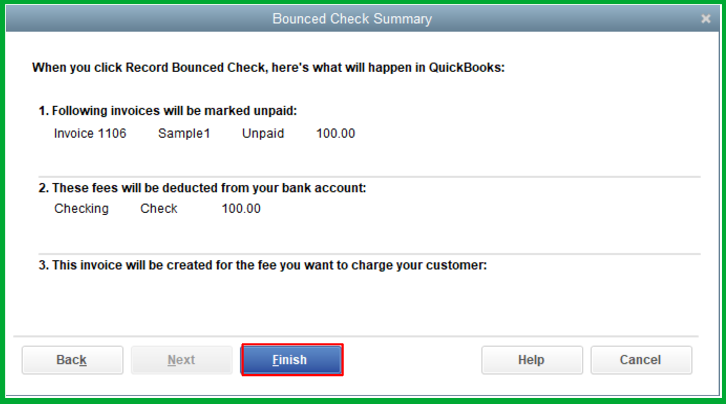

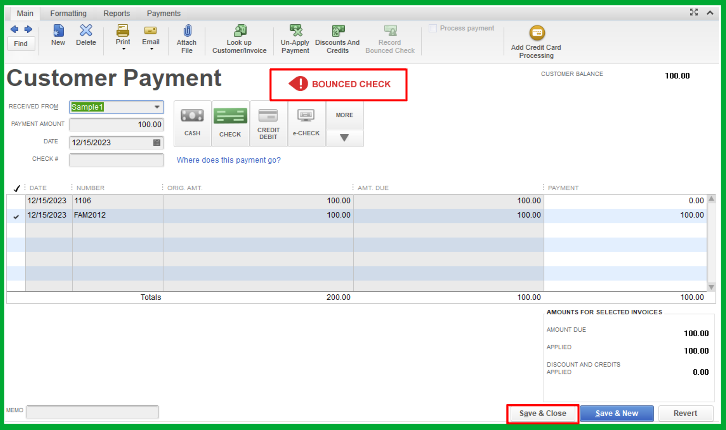

To begin with, it is important to note that the Record Bounced Check icon remains available and can still be used in QuickBooks Desktop. You'll need to change the payment method to Check to make this option available when recording your returned ACH payment. Let me guide you through the process.

In this sample, I recorded the payment using the Cash method. Now, let's change this to Check.

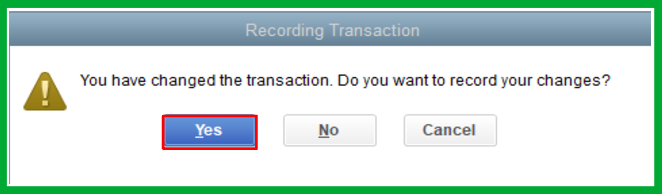

Here's how:

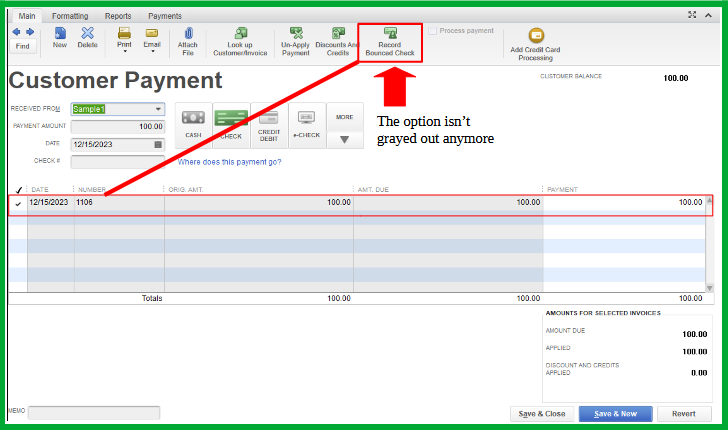

Now, let's proceed in recording the bounced check.

Moreover, you might want to check this article on handling returned checks from your vendor by journal entry and bill payment check: Manage a bounced check you wrote.

Keep your questions coming if you have other concerns about recording bounced checks in QuickBooks Desktop. I'll be here to lend a hand.

I already did all of steps outlined. I am very familiar with how record bounced check works which is why I reached out....because it's not working as it has in past. I did explain all of this in at least 2-3 comments

re: record bounced check feature not working

Since the Record Bounced Check isn't working, @someone4, you'll have another way to enter it in QuickBooks by hand.

Before that, create an item and income account for tracking bounced checks and their associated charges.

Here's how:

Then, create a non-taxable Other Charge type item called "Bad Check Charge".

Once done, you can follow the second instruction in Option 2: Handle Non-Sufficient Funds (NSF) or bounced check from customers. This way, you can create a journal entry to reverse the original payment.

Please let us know if you have further questions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here