Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowSolved! Go to Solution.

I found out today that the adjustments to deposit sent to QB from Square are all adjustments inaccurately made for tips to and incorrectly reduced revenue. To fix, I classified all adjustments to Tips which are a credit and debited Product Sales where the adjustment were linked to. Still don’t know why Square is making this adjustment but I have a temporary fix.

Let me share some information to help find and resolve deposit adjustments, @MMM Consulting.

To begin, let's prepare your bank statement and compare the amounts. From there, we can either add the transactions to correct the balances or edit the existing ones.

If the transactions isn't showing, we can manually add them in your account register. Here's how:

If you just need to edit the transactions to correct the balances, you can utilize this link for more information: Find, review, and edit transactions in account registers in QuickBooks Online.

I'm also sharing the following write-up to help guide you in reconciling your accounts in QuickBooks Online: Reconcile an account in QuickBooks Online. This will provide you steps on how to review your account as well as a link to resolve discrepancies.

Keep me posted with questions about deposit adjustments from Square. I'll be right here to provide additional assistance. Keep safe!

I know how to make an adjustment. I am wondering why I have to make an adjustment. Square some of the square tips are being classified as product sales. I am having to make a journal entry for this. However, some days the tips come over just fine and match Square.

Hi there, MMM Consulting.

I appreciate you for getting back to us.

I'm here to share more information about the $2.55 amount from Square.

QuickBooks Online automatically brings in your sales and fees processed by your sales channel. It's possible that the $2.55 isn't an adjustment but a bank service fee. We can verify this by going to the Audit log report to show a change related to your connected bank accounts made automatically by QuickBooks Online.

The best source of truth if the transaction is a valid one is your bank statement. If you see the amount on your statement but not on your QuickBooks account, you can add it manually. You can follow the steps shared by my colleague above.

Also, transactions downloaded on QuickBooks will depend on your financial institution. Thus, on some days the transactions will not match automatically.

To ensure your QuickBooks transactions match your bank statement, you can reconcile it. Here's an article as your guide: Reconcile an account in QuickBooks Online.

I'll be around whenever you need help with the reconciliation process.

Thank you! I didn’t know that existed however no new information there. All the adjustments to tips show as product income there too.

Hi there, @MMM Consulting. Thank you for getting back to us.

To clarify, are you using Sync with Square app? If you do, make sure your tips are mapped properly. This way, they automatically match against the ones you have in QuickBooks. I recommend reaching out to their support for assistance.

Meanwhile, you may consider switching to the Connect to Square app to bring your sales transactions into QuickBooks. When they appear in QuickBooks, you can review and categorize them. Check out this article for more info: Connect your Square account to QBO.

Additionally, you can add tips to your payment forms in QBO. You can change its default account from your settings.

Visit us again if you have further questions about managing square transactions. The Community is always here to help. Have a wonderful day!

I found out today that the adjustments to deposit sent to QB from Square are all adjustments inaccurately made for tips to and incorrectly reduced revenue. To fix, I classified all adjustments to Tips which are a credit and debited Product Sales where the adjustment were linked to. Still don’t know why Square is making this adjustment but I have a temporary fix.

Hello MMM Consulting,

I have reviewed the solution you’ve shared and it's correct and accurate. Thank you for sharing your inputs to help address the issue.

We love to see members supporting one another! Have a great day.

I know this is marked "solved" but we are struggling with this issue ourselves.

There are not just hundreds, but THOUSANDS of Deposit Adjustments clogging up our Square App transactions in one client's QBO.

For two months of activity, it's 98 pages with 25 sales receipts on each page.

This is too many to correct as the OP corrected.

Has this gone away for anyone else with a disconnect and reconnect with Square?

That's our next step after we untangle having partially processed July so far.

We are using the newer, QBO/Commerce, Connect with Square app transactions and are having the same error (see my reply to the OP below).

Hello, @jocecampbell.

Dealing with thousands of deposit adjustments spanning numerous pages is indeed a daunting task. Disconnecting and reconnecting your Square integration with QuickBooks Online (QBO) could be a potential solution to address this issue. This helps refresh the integration and potentially resolve any underlying synchronization problems.

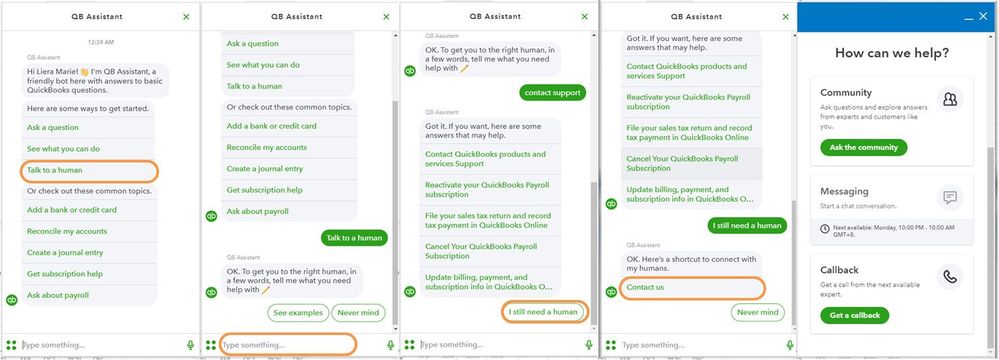

Before taking any further steps, I highly recommend reaching out to our Customer Care Support team. They have the expertise to thoroughly investigate the situation, understand the specifics of your case, and offer tailored solutions. If necessary, they can raise the issue to our engineering team for a more in-depth resolution.

Here's how:

You can also check out this article for more info on how to manage the app: Sync Square with QBO.

Thank you for reaching out about this ongoing challenge. Rest assured that our support team is dedicated to helping you find a solution and ensuring a smooth experience with QBO and Square. Please let us know if there's anything else we can assist you with during this process.

Thank you, @LieraMarie_A for the reply, but we have determined that these thousands of deposit adjustment transactions are originating from Square. They might be tied to Square merchant fees, and not tips, for us.

We are still not clear why and will be investigating more.

Sorry all! I agree it was tips in the beginning for me. However, last month a whole can of worms. Now it is other things but netting the payments so (I.e. gross sales and discounts need to have a correcting journal entry). Days have to be reconciled and sometimes come over just right other you have to add 5-7 days together to reconcile and figure out the correcting journal entry. I disconnected and reconnect every two months and it doesn’t seem to solve the issue.

Thanks for the update @MMM Consulting.

We learned what our debacle was from.

The owner let us know she set up 10% to be deducted from sales and put in a Square savings account.

So now, we are getting deposit adjustments for this for EVERY transaction instead of just one entry on each deposit.

Gah.

We have selected a daily summary sales receipt in the app, NOT every transactions, and would like these deposit adjustments to also summarize daily if possible. Not sure yet whether to start with Square or Intuit, but have to get taxes filed first, then will attempt to untangle more.

I am having a different issue related to the deposit adjustments. I have deposits that have large amounts added to the bottom of the deposit after all the merchant fees. It is just one line going into the sales account but listed with exempt tax. The amounts are $800 - $1500 and the detail says Deposit Adjustment. The amounts are not listed in Square when I look at the deposit there. My client sells at markets and does not accept tips. Any ideas?

Good day, @Mj1123. Thanks for joining the conversation.

To clarify, can you help us verify if these deposit adjustments are coming from the Square app? If so, transactions downloaded on QuickBooks will depend on the data transmitted by your financial services platform. Thus, I'd recommend reaching out to their support so they can review your account and diagnose the issue.

If not, I'd suggest reviewing your Audit log to check where the transaction is coming from and troubleshooting the problem. This is where QuickBooks records all account activity such as user sign-ins, changes to QuickBooks settings, edits to customers, vendors, employees, and payroll submissions. Here are the steps:

QuickBooks automatically creates specific user profiles to track certain actions in the audit log. If you see a user you don't recognize, we can review the "Learn about users created by QuickBooks" section of this article to know who made the changes: Use the audit log in QuickBooks Online.

If you're still unable to find out where the adjustments are coming from, reach out to our QuickBooks Team so they can review your account.

Please let me know if you have further questions about deposit adjustments from Square. I'll be right here to provide additional assistance. Keep safe!

We have had odd amounts added at the bottom of a deposit that came in from the Square app from any of these items:

--subtractions going to Square savings - these often say "deposit adjustment"

--payments to Square business loans

--other adjustments for refunds, etc.

You might need the Square transfer details report to figure out what the amounts are for. Square doesn't put these "deposit adjustments" in their normal transfer summary or sales reports or transaction reports.

We've had to use pivot tables with the transfer details report to find how much went to the savings account, how much to business loan, etc. per deposit.

It's a mess.

Good luck!

Hi! I am having this same issue as you where square is adding thousands in deposit adjustments on some transactions. We do not do tips, square savings or any square loans. Did you find a solution? It will add those deposit adjustment amounts to my income but it isn't categorized like it's not attaching it to a sales receipt to categorize the items? Thanks!

I have the information you need for possible reasons why your transactions are adjusting, af1991.

QuickBooks Online will depend on what kind of transaction is from the apps connected to it.

For the deposit transactions, I recommend contacting Square Support to help you check what are the adjustments for. They have the resources to assist you.

Moreover, refer to this article about categorizing your Square transactions: Review Square Transactions in QuickBooks Online.

Please let me know if you have additional concerns regarding the Square app. I'll be here to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here