Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi, I have started with a company that is pretty new and their quickbook accounts are a complete mess. I am trying to reconcile all the way back until October of last year when the company started. I have downloaded all the bank statements and matched up the best I could. However there are multiple cash payments that were made towards the beginning of the year that were never deposited into the bank therefore they don't show up on the bank statements. October of last year through May of this year have all ready been reconciled and there are still many transactions without checkmarks from those months that appear when I try and reconcile going forward. Is there a way to reconcile these without voiding them or matching them? I am familiar with quickbooks however I am not familiar with the accounting and book keeping aspect of it. Thanks.

I'm here to help ensure your reconciled reports are accurate, hillm0878.

You can start by making sure all payments are deposited to the correct bank accounts. It's for you to easily match transactions. If not, you need to void them so they won't keep showing up in QuickBooks.

The best process to have the right dates and transactions on your bank is to compare your statement with what's in QuickBooks. Doing this will make sure your accounts are balanced and accurate.

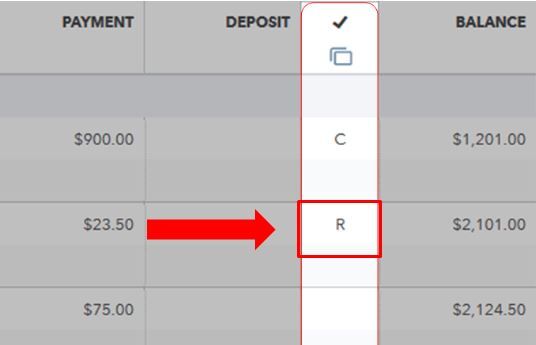

When all good, you can start reconciling your bank. Let me show you how:

You can also refer to this article for additional information: Reconcile an account in QuickBooks Online.

Stay in touch with me if you have follow-up questions by commenting below. Just tag my name, and I'll get back to you.

Thank you MaryLandT, the problem is though that in the past there were payments made with cash and that cash was never deposited into the checking account. This is something that has since been dealt with and going forward all cash will be deposited to match the QuickBooks. However those transactions are just sitting there not matched to anything. The past months have been reconciled already with those just sitting there and I need to know how to get them off.

Thanks for the prompt reply and for sharing additional details, @hillm0878.

I can imagine the situation you’re in right now. I myself would want to ensure that my book is properly recorded. Rest assured I’m here to help and share some insights on how to get around this issue.

What we can do is to undo the reconciliation and delete those transactions since they are not in your bank statement. Let me guide you how:

You can also see this article for more details about this process: Undo or remove transactions from reconciliations in QuickBooks Online.

Then, locate those transactions and delete them. I'd also recommend reaching out to your accountant for further guidance. This way, we'll ensure your accounts are well accounted for after making these changes.

If they have a QuickBooks Accountant account, they can add you to their clients' list and undo the reconciliation easily with their tools. If they don't have one, you can invite them to your account. If you’re not affiliated with one, you can visit our ProAdvisor page and we’ll help you find one from there.

Once everything looks good, you and your accountant are ready to redo the reconciliation.

Let me know if there's anything else I can help in managing your accounts. I'll be more than happy to work with you again. Have a great day and take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here