Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I have my business banking account linked to QBO so it shows all my transactions. I made a payment of $223 to my business credit card that I have with my bank, and it shows that transaction for review in my QuickBooks transactions for review. However, this is my first payment to the credit card that has interest included ($140.18). Unfortunately, my bank, who I have the credit card through, does not have the interest charge shown as a transaction that could then reflect in QBO. Instead, the bank ONLY shows the finance/interest charge on my bank statement. But when I made the payment to the credit card it is only one transaction including the principal and interest payment.

How do I record this transaction in QBO? QB is suggesting I record it as a credit card payment, but the total transaction amount is both paid principal and interest ($82.82 + $140.18). I don't see an option to record this as a split transaction when choosing the "Record as credit card payment" option. Please advise, thanks!

Thanks for the screenshots of the banking transaction, HQS1.

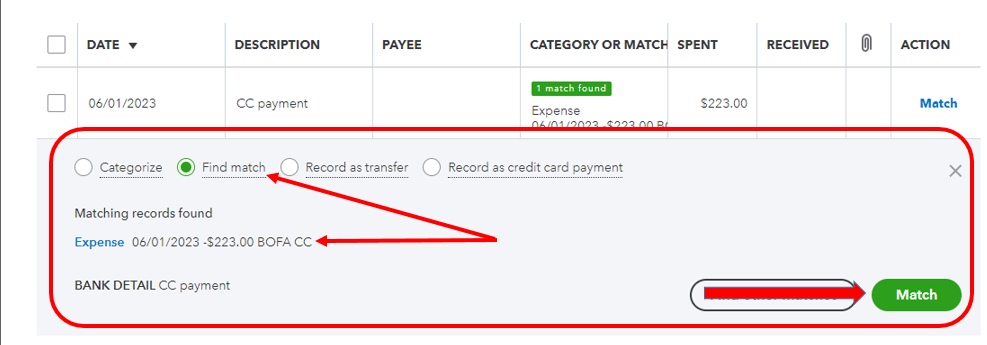

Using the Record as a credit card payment option will only let you record the transaction as one. If you want to track the principal amount and interest paid separately, you'll want to manually record it first in QBO. Then, match it with the downloaded transaction.

I'd be glad to share these steps with you:

Once done, go back to the online banking section and match the transactions.

Other methods you can follow are also shared here: Record Your Payments to Credit Cards in QuickBooks Online.

Let me also share these articles for additional guidance and information when managing banking transactions in QBO:

The Community is always here if you need anything else.

Thanks for the help! I was able to get the transaction recorded correctly as you advised.

Thanks for updating us, @HQS1.

I’m glad that my peer was able to help resolve your payment with an interest charge concern. Please know that you can always reach out to us whenever you need help.

If you need more information about managing your company, feel free to visit our Support page. It contains ways and tips to make sure everything is accurate and organized.

Have a great day, and keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here