Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do I record a NEGATIVE deposit correction from the bank?

Hello there, @Cindy H413. I've got two ways for you to record a negative deposit correction from your bank.

The first step is to add a line item that reflects the adjustment amount. However, it is important to make sure that the transaction balance doesn't become negative. Here's how:

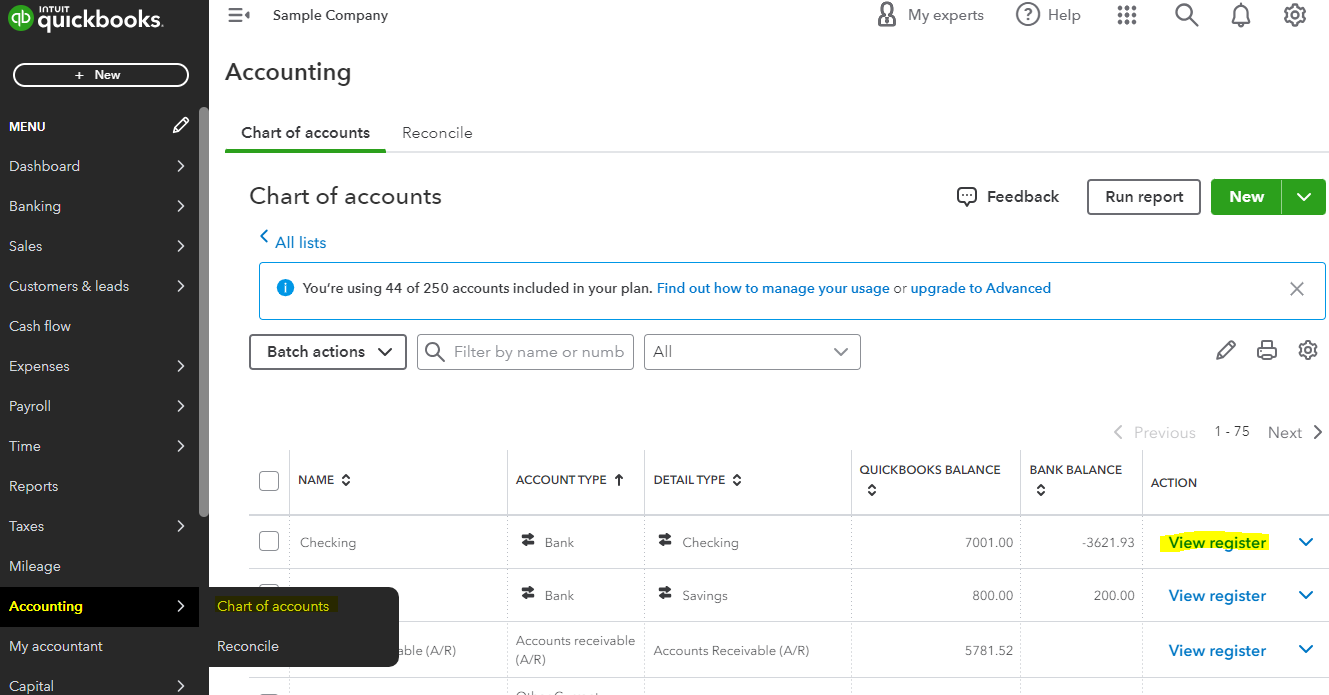

1. Open the Accounting menu and select Chart of Accounts.

2. Locate your account where the deposit is made then click on View register.

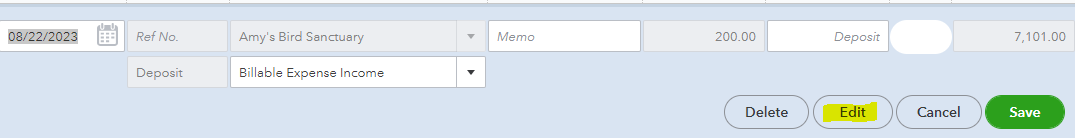

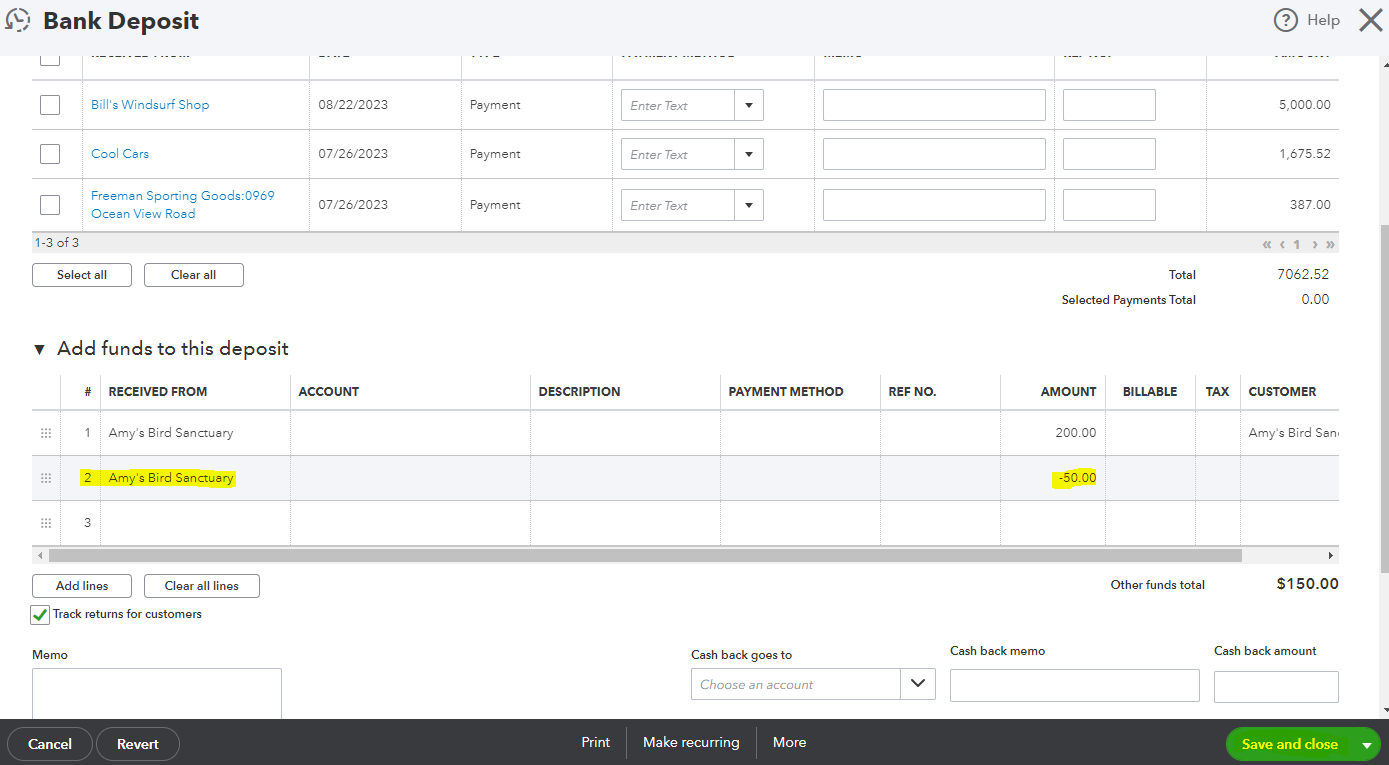

3. Find and tap the transaction. After that, hit Edit.

4. Go to the Add funds to this deposit section and enter another item.

5. On the Amount field, add the correction amount.

6. Once done, click on Save and close. See the image below for reference:

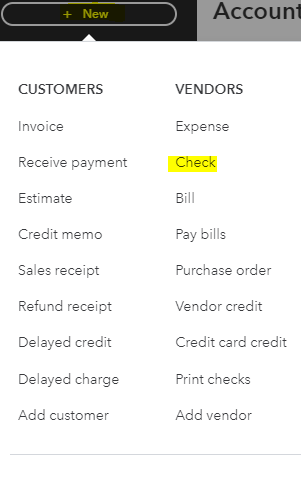

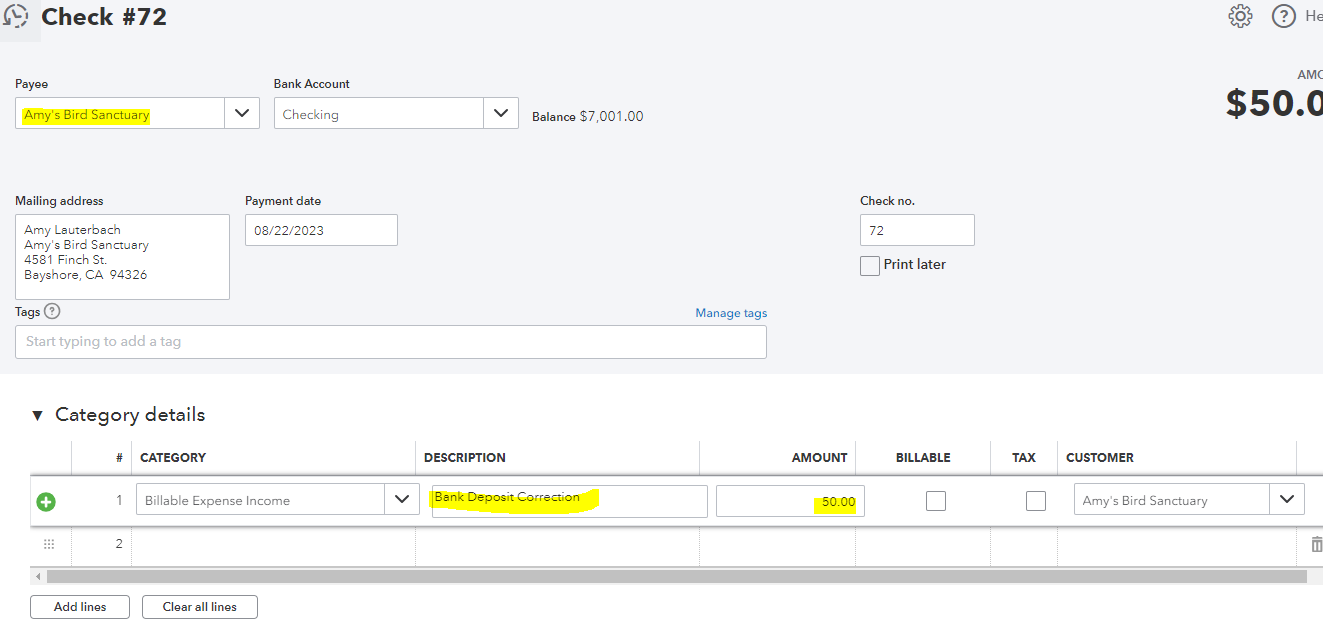

Another option is to issue a check. In this case, you'll need to input the correction amount as a positive value since writing a check is already a money-out. This will help balance the transaction and offset the previous error. I'll show you the steps to do this:

1. Click on the +New icon then select Check.

2. Choose a Payee from the drop-down.

3. Select a Category and enter the amount.

4. Fill out all necessary fields and click on Save and close once done.

I'd also recommend reaching out to your accountant for any additional accounting-specific advice to keep your books in order.

I'm also including this module with information to learn more about fixing discrepancies on your account balances: Reconcile account in QuickBooks Online.

That should do it. Comment back for more assistance with banking and I'd be glad to guide you through. Have a good one!

Thanks for the info. I basically entered it as a -.01 deposit with a memo and QB moved it from the deposit column to the expense column. That works for me. (So basically your option number 2)

Thank you,

Cindy

Thanks for following up with the Community, Cindy H413.

I'm happy to hear Mich_S was able to help with recording negative deposit corrections in QuickBooks.

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

Please feel welcome to send a reply here or create a new thread if there's ever any questions. The Community's always here to help. Have an awesome Monday!

In my case the bank deposited more than the check was for by $30.00. Later in the month they withdrew the amount. I attached the original amount they paid to their invoices which left them with a $30 credit. My reconciliation is balanced but now my customer is left with a $30 credit that I can't attach the withdrawal to. How do I zero out my customer's invoice?

Hey there, @lapoppis75. We're thrilled to have you as part of the Community forum and happy to help with any questions you have. It's our pleasure to provide the information you need. Let me walk you through how to zero out the invoices in QuickBooks Online (QBO).

Before anything else, know that this will be a long process, but I have faith in you that you can easily accomplish this. When an invoice becomes uncollectible, you'll want to record them as a bad debt and then write them off in your company. This way, your accounts receivable and net income stay updated.

You'll want to take note of other possible invoices or receivables that are considered bad debt. To do that, you'll need to run the Accounts Receivable Aging Detail report. These are the simple steps:

After taking notes of the transactions that you considered as bad debt, you'll want to create an expense account where you'll record them. Here's how:

For more information, use this article for reference: Create and apply credit memos or delayed credits in QuickBooks Online. It will set a negative balance on the customer's account.

In addition, here's also an article that is related to credit memos: Handle a customer credit or overpayment in QuickBooks Online.

Lastly, refer to this article as your reference when you reconcile an account to ensure your accounts in QBO are balanced: Reconcile an account in QuickBooks Online.

@lapoppis75, I'm rooting for your success on this. Also, feel free to get back to me if you need further assistance writing off invoices in QuickBooks. As always, it'll be my pleasure to help you out again. Take care, and have a good one!

I have this exact situation, did you find an easier way to resolve this issue?

Thank you for sharing your concern with us, @Jen2017.

We aim to provide you with the best possible solution to your issue. Could you please confirm why you need to record a negative deposit? Is it because your deposit record is overstated, or are you attempting to rectify a customer payment?

I am eagerly awaiting your response.

Our bank erroneously deposited a check to our account in March. We caught it within a week when we downloaded bank transactions to QBO. When the bank reversed the deposit, it was already April. So to be able to reconcile both March and April statements, I cannot delete the deposit from March. How do I show the deposit in March and then reverse it (make a negative deposit?) in April?

Thanks for joining this thread, WID.

Yes, you don't have to delete that transaction. To record it, you can make a separate bank deposit for March.

I can help you create a bank deposit if you haven't created yet.

Here's how:

However, if you've already created a bank deposit, you can match it to your bank transactions.

Here's how:

For April, you can create a write check to balance your account in QuickBooks Online. This has the same process that I provided above.

Once your account is balanced, you can proceed with reconciling your account.

Additionally, you can check out these articles if you have challenges in reconciling your account:

If you still have concerns about reconciliation, comment or reply to this thread. I'll keep an eye on your reply.

okay so the Bank made a wrong deposit to my account and then took it out the next day and I wanted to know how to label it?

I appreciate you for chiming in the thread, @abullard0714. It sounds like you’ve encountered a bit of a hiccup with that bank deposit. I’m here to help you sort it out.

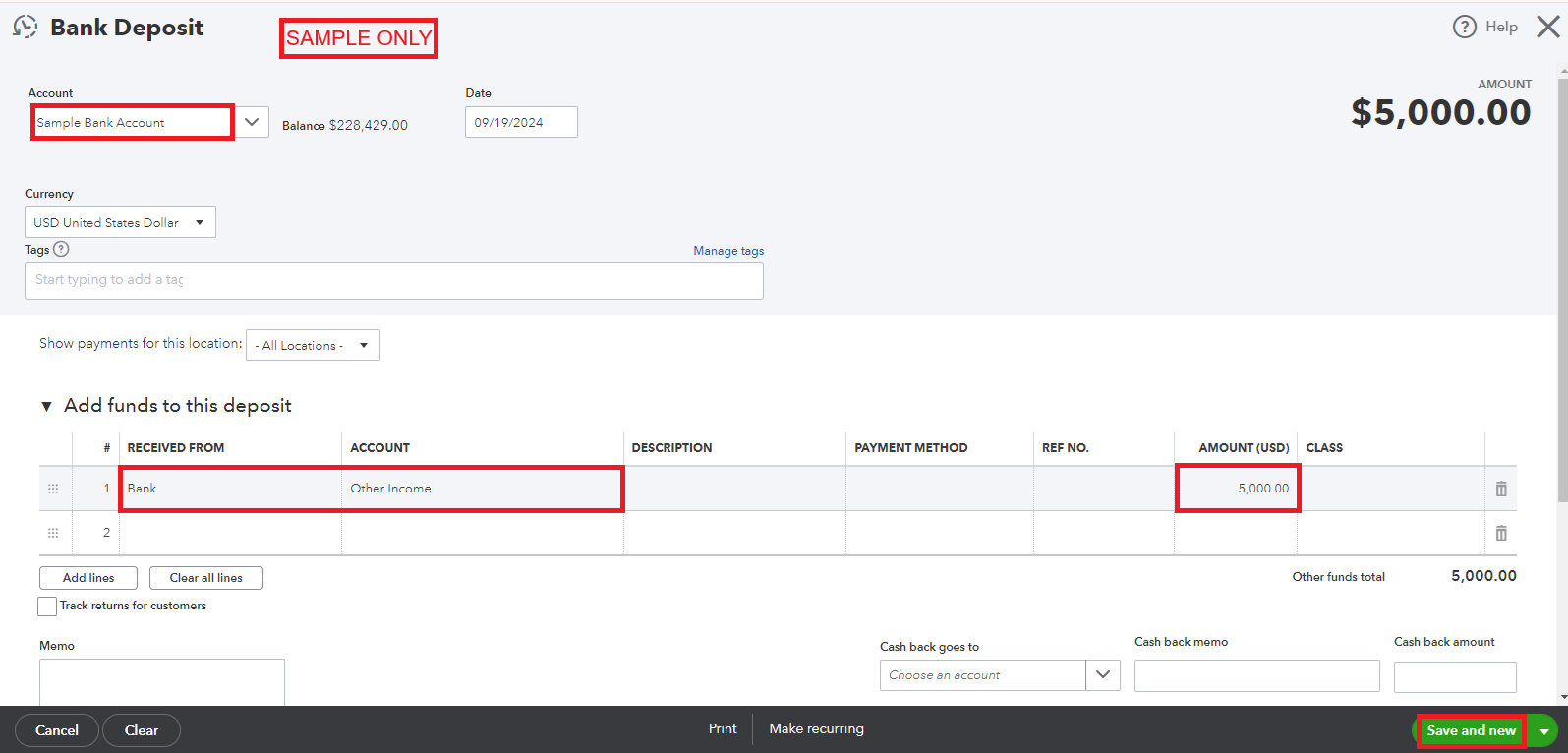

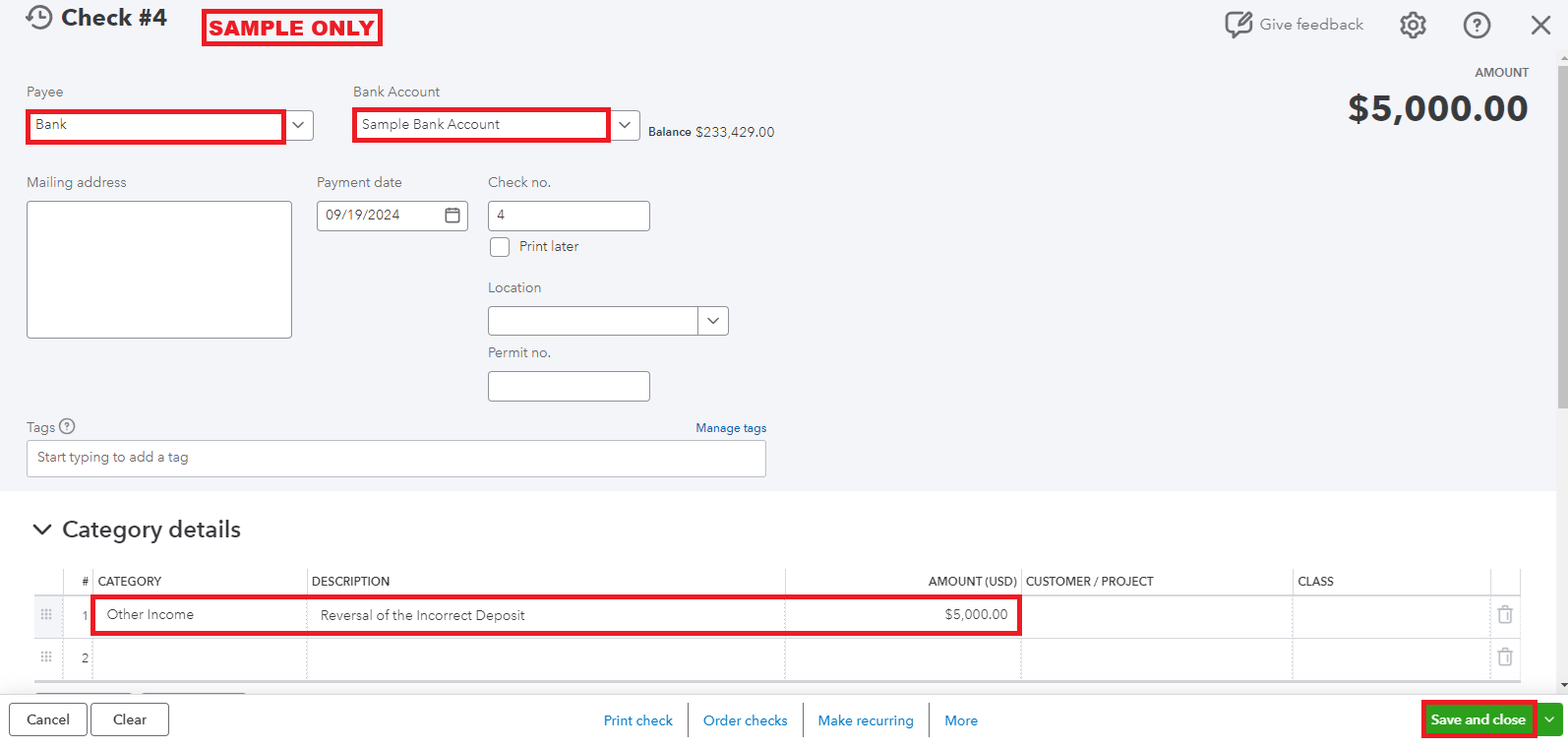

First, you'll need to record the incorrect deposit made by your bank. Doing so will ensure your books reflect all transactions in your account, even if they're erroneous. Here's how:

Next, record the withdrawal. This step captures the reversal of the initial deposit, documenting the money taken back by the bank. This entry allows you to balance your accounts and indicate that the funds weren't available for your use. Follow these steps:

Once you’ve completed these steps, make sure to reconcile your bank account to ensure everything matches up.

If you have any more questions or need extra guidance, don’t hesitate to reach out. I’m here to help. Take care and happy accounting!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here