Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowFirst of all, I am new to QuickBooks, but not new to accounting. I accidentally entered a check twice the first month I was here (June). I cleared the check and thought I deleted the double entry with help from the help desk. The next month the check showed as uncleared, but I was able to reconcile. I am unsure how to correct this now in QuickBooks.

If need to mark the check as cleared next month I won't be able to reconcile. My thoughts are to mark the check as cleared and then make a journal entry to offset the entry, but I am unsure of the specifics of the journal entry.

Thank you in advance for your help!

Challis

Thanks for providing details of your concern, @Challis. I'll provide some information to help you with resolving your uncleared check in QuickBooks Online (QBO).

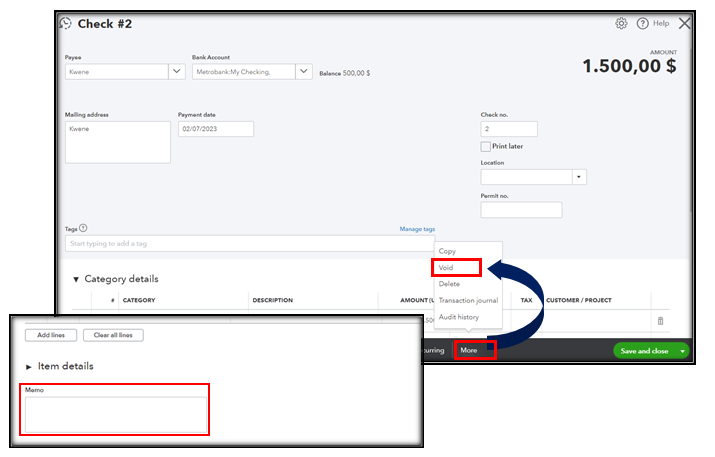

If the check isn't included in the bank statement that needs to be reconciled, we can void it so it won't affect your books. Additionally, we can utilize the Memo field to add notes about the duplicate entry. To do this, open the transaction, select More at the bottom, and then choose Void. See the screenshot below for visual reference:

Alternatively, while creating an offsetting journal entry is feasible, we may be unable to provide specific details about the affected accounts. Therefore, I suggest reaching out to your accountant to guarantee the accuracy of your books. If you're not affiliated with one, we can help you Find a ProAdvisor.

You may want to check out this article as your reference to guide you in doing and fixing reconciliation issues in QBO: Learn the reconcile workflow in QuickBooks.

Stay in touch if you have any additional questions or other reconciliation concerns. Drop your comment below, and I'll ensure that you receive the assistance you need.

@Nicole_N - thank you for your response. The check is currently an uncleared check, however, it is shows cleared in the June reconciliation, but shows up the next month (July) as uncleared.

So, I guess my have two questions.

1. How does Quickbooks allow you to enter two checks with the same check number.

2. How can I tell if a check is cleared?

Hi, there @Challis.

I'm glad my colleague helped you. Let me share an insight that will save you time.

it's not typical to create checks with the same check number, QBO does allow this. However, it will prompt you that the check number has been used in a past transaction. You may disregard the warning.

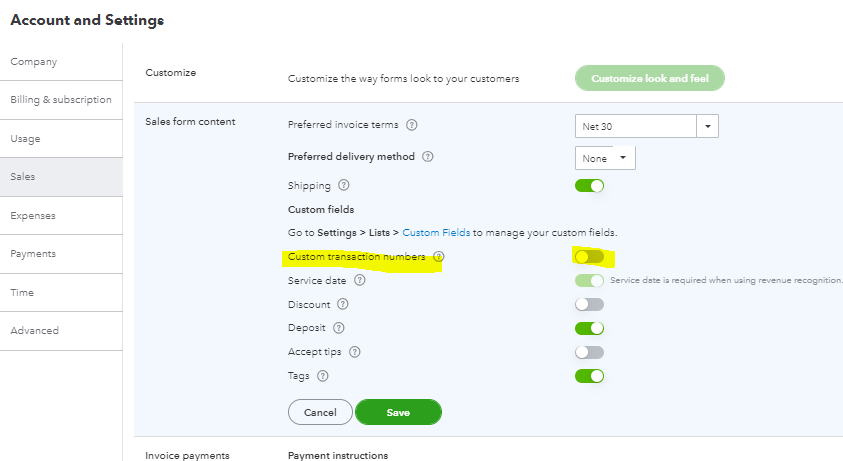

Just a tip: You can turn off the "Custom transaction numbers" in the account and settings under the Sales tab and then Sales from Content section, so QuickBooks will not auto-create check numbers in sequence.

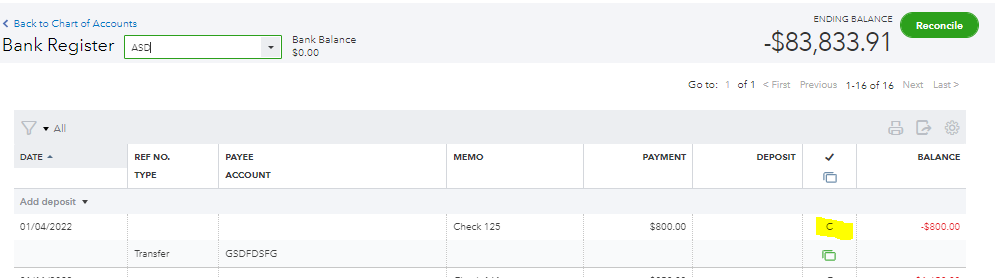

QuickBooks can't automatically know if a check has cleared the bank. But when the transaction appears in your bank records, gets downloaded to the Banking page, and matches the check in QuickBooks, you can tell QuickBooks that the check has cleared. Also, cleared transactions in your bank register are marked with a "C" status, as shown in the screenshot.

I want to share this article to create a report in QuickBooks Online of checks that haven't cleared yet: Run a report of uncleared checks in QuickBooks Online.

Don't hesitate to reply if you need further guidance or clarification about reconciliation. I'm just around to continue helping you.

"If need to mark the check as cleared next month I won't be able to reconcile. My thoughts are to mark the check as cleared and then make a journal entry to offset the entry, but I am unsure of the specifics of the journal entry."

To reverse the entry, create a deposit in QB (New > Bank deposit) and assign the same account to the deposit that was assigned to the check. Creating a deposit serves the same function as creating a journal entry. It creates a debit entry to your bank account and a credit entry to whatever account you select under ACCOUNT. Then, clear the deposit against the check the next time you reconcile.

@Rainflurry - Thank you very much! Challis

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here