Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowDoes anyone have instructions on how to add the 2% S Corp health insurance premiums paid on one check at year end.

We are able to do a net $0 check in QBO, but I am not finding how to do this in QB desktop?

Can anyone assist?

Hi there, @dmcintire33.

I'm happy to lend a hand with recording the 2% S Corp health insurance premiums.

Since you're using QuickBooks Desktop, you'll need to create the payroll item and enter a liability adjustment to record the premium correctly. If you are a 2% shareholder and offer the same medical insurance plan to all your employees, follow these steps to set up the payroll item.

To create a payroll item:

For more information about setting up the payroll item, click on this link: S-corporation medical payroll item.

Once done, you can perform a liability adjustment. This is to ensure the premium is reported on the W-2.

I also wanted to share a similar thread where users are helping each other with this same question. There is a lot of helpful information within it: https://quickbooks.intuit.com/learn-support/en-us/employees-and-payroll/how-to-add-s-corp-owner-s-he...

I'm here if you have any questions or concerns. Take care!

Thank you for your assistance. I have followed the instructions provided, but when I go to run the W-2s, the additional amount does not show up as part of the State Wages. It does show up as part of the Federal wages. What am I doing wrong?

I appreciate you for coming back to the thread and adding extra clarification about your concern, dmcintire33. Let me discuss extra details on how W-2s and payroll item works in QuickBooks Desktop. Then, I'll ensure you'll be pointed to the right person to assist you further on this matter.

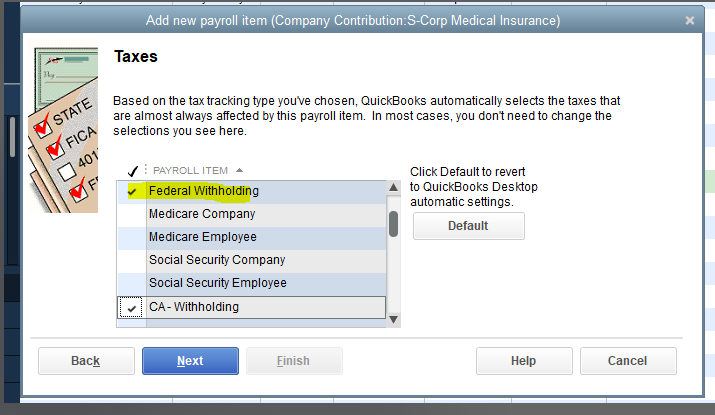

The information that appears on the W-2s is based on the payroll item you selected. Then, the taxes that are always affected on the payroll item are determined by the tax tracking type you've selected when the time you create the item. That said, adding S Corp 2% Health Insurance is subject to federal withholding. That is why the additional amount is not included in the State Wage. I've attached a screenshot below for visual reference.

On the other hand, you can consult your accountant to ask for additional help. They can provide you with complete details on how to properly handle the S Corp 2% Health Insurance so it'll post on the correct taxes.

Lastly, you may refer to this article to see various details about W-2 so you’re prepared for tax season and file this accurately: How to Understand and Fill Out a W2.

Always remember that you can always hit the Reply button anytime you have questions about the payroll forms or the payroll data in QuickBooks. I'm always here to help, dmcintire33. Have a great day ahead.

I need to create a payroll check that only records the 2% health insurance. I setup the payroll items as discussed earlier and created a check that just contains the 2% health insurance a message appears:

"Unable to create a paycheck when there are not earnings or additions items or the earning and additions are all zero. To create this paycheck first add an earnings or addition item with a non-zero amount".

This shareholder is currently not taking compensation but does have 2% medical insurance that should be reported.

Thanks for taking the time to share your concern here in the Community, RJ-16.

Allow me to help you create a payroll check that records your shareholders' medical insurance items. To do this, we'll need to generate a zero net paycheck since your shareholders have a different plan than your other employees, and they won't receive payment for the remainder of the calendar year.

Here's how to do it:

For more detailed information, you can refer to this article: Set up an S-corp medical payroll item for your corporate officers.

If you need assistance running payroll summary reports in QuickBooks in the future, here's a helpful guide: Create a payroll summary report in QuickBooks.

Please feel free to add a comment below if you require further assistance with navigating QuickBooks Desktop Payroll. I'm here to provide any additional support you may need. Stay safe, and take care!

In this example, the state tax is checked, so why is this amount not included in the state wages?

Hi there, @lmiller1977.

Great question! When adding S Corp 2% Health Insurance to wages in QuickBooks Desktop (QBDT), the way the amount is reported for state wages depends on both the payroll item setup and state-specific tax rules. Let’s go over why this isn't included in the state wages despite the state tax being checked.

Why the amount isn't included in State Wages?

It's crucial to consult with a qualified tax professional or accountant to understand the specific tax implications of your situation. They can provide accurate guidance based on your circumstances and the applicable state and federal tax laws.

Moreover, you can also consider learning how to set up, change, or delete employee-paid payroll deductions in QuickBooks Desktop. Payroll isn’t just about paychecks anymore. Sometimes employees need to pay for things like health insurance, retirement contributions, uniforms, tools, or dues.

This appears to be a valuable challenge, but with the right adjustments, we'll ensure your state wages are accurate. Please don't hesitate to leave a reply if you have additional concerns besides S Corp Health Insurance.

Did you ever figure this out?

My problem is slightly more complicated

you seem to have all the answers

would love to connect

I issued the payroll bonus check 12/30

with the medical adjustments if $$44,000

i am having pro posting to the. W. 2

following your instructions set it up for 26

25. Is a problem

help

Hello there, @LZ801.

Thank you for providing the details regarding the 12/30 bonus and the $44,000 medical adjustment.

To begin, could you confirm whether the bonus is being reported under 2026 instead of 2025, or if the $44,000 medical adjustment is being displayed in a different box than anticipated?

Additionally, when you mentioned “set it up for 26 25,” could you clarify whether the paycheck was dated in 2025 or if the tax year assignment was modified? Having this information will allow me to better understand your situation and provide a tailored solution.

In the meantime, please keep in mind that in QuickBooks, paychecks are reported on the W-2 based on the check date, not the pay period. For example, a check dated 12/30/2025 will appear on the 2025 W-2, even if the pay period crosses into 2026.

We'll be waiting for your reply. If you have other questions, click on the Reply button.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here