Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello QuickBooks Online Community,

I hope this message finds you well. I recently received an email from the Washington Employment Security Department regarding adjustments to Paid Family & Medical Leave premiums for the year 2024. I'm seeking guidance on how to accurately make these adjustments in QuickBooks Online.

Here are the key details from the email:

2024 Paid Family & Medical Leave Premiums:

I'll provide some information on how you can accurately make these adjustments, Amin.

Generally, you can check out the Washington Paid Family & Medical Leave website and their Premium Calculators to learn about your rates. Also, the size of your company will determine how much you'll pay.

Since you already have the available rates for the 2024, you can set up these rates to your employees. To do so, follow the steps outlined below:

Please know that taxes will deduct from your employees paychecks on the effective date.

In case you have employees that are exempted from Washington Paid Family and Medical Leave, check out how you can set them up from this article: Set Up Washington Paid Family And Medical Leave.

Furthermore, learn what certain report you can which shows information you need like employees, wages, taxes, and deductions. I've added this great resource for your reference: Run Payroll Reports.

You can always comment or leave a reply below if you have any questions about Washington paid Family and Medical Leave. Always remember, we're here to make sure we can help you and provide the resolution you need. Have a nice day ahead!

Hello MariaSoledadG (QuickBooks Team),

I followed the instructions provided by you in QuickBooks Online, and I've encountered a couple of issues that require your attention.

Total Premium Rate: The total premium rate in QuickBooks Online is currently fixed at 0.58%, and it seems that I don't have the option to update it manually. As per the recent communication from the Washington Employment Security Department, the new total premium rate will decrease to 0.74% starting Jan. 1, 2024. Could you please update the system to reflect this new rate at your earliest convenience?

I understand that QuickBooks Online may handle these updates automatically, but if there's any action required on my end or if you can provide an estimated timeline for the system update, it would be greatly appreciated.

Thank you for your prompt attention to this matter. If you require any additional information or clarification, please do not hesitate to reach out.

Thanks for giving those steps a try, aminnjmi.

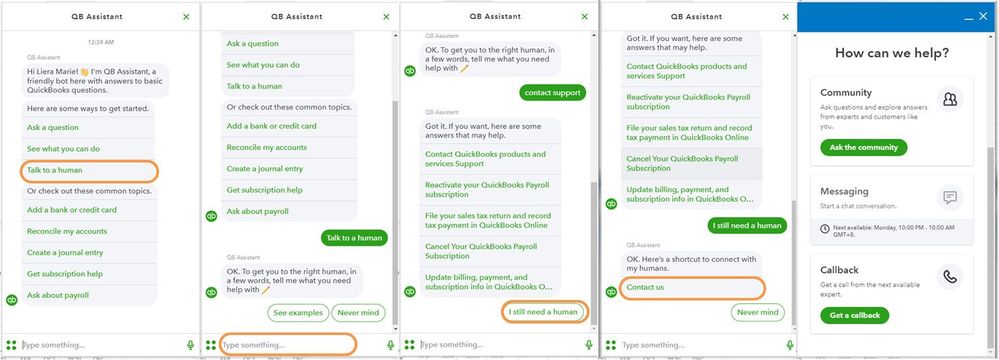

In this instance, I recommend reaching out to a member of the QuickBooks Online Support Team. Agents have specialized tools, like the ability to share your screen, to walk you through making these necessary adjustments. Here's how you can get in touch with team:

1. Click the Help (?) button.

2. Select either tab to get started:

- Assistant: Get quick, personalized answers. Select a suggested option, or type a question or topic you need help with. If you decide you need further help, you can still Talk to a human.

- Search: Search the QuickBooks Online knowledge base directly, or select Contact Us and choose a way to connect with us:

a. Start a chat with a support expert.

b. Get a callback from the next available expert.

The following article provides these steps if you ever need them again in the future: QuickBooks Online Support

Please let me know if you need additional assistance with the entries. I'll be here to help in any way that I can.

When I go to change the rate it doesnt show effective date 1/1/2024. It will only let me pick 4/2024. However even picking the new rate and 4/2024 I hit save and it wont save it. This is an error we need this to be 1/1/2024 and actually save the changes.

Hello there, DriftwoodAcc.

I understand the frustration of being unable to change the rate to 1/1/2024 and save the changes.

To update the changes, I suggest contacting our Customer Support Team. This way, they can pull up your account securely and provide specific guidance to resolve the problem.

Here's how:

Furthermore, you can send your payroll tax notice if you can't change the current year's rate to assist with the setup.

Additionally, I've added this article for reference on managing worker's compensation: Understand workers’ compensation insurance.

Let me know if you have other questions about the payroll tax rate in QuickBooks. I'm always here to help. Take care.

I am having the same problem. Once again QBO can't get PFL correct. I had issues last year too. We shouldn't have to call to make the system show the new tax rate date 1/1/2024. That only makes common sense.

You will need to contact support, they will have to change the rate for. It is very simple, quick and easy. Several rates have not been updated yet so a lot of people are having this issue, QBO support can definitely fix it for you.

This is ridiculous. I am having the same issue and support is just saying I have to send them the notice. Why have the option for the change, but it won't save. My notice came as an email not a separate notice. This should be so simple.

They did change mine, but I had to screenshot the info from the state. They don't understand that EVERYONE has the same rate. Still, these are steps that are not necessary. For the amount of money that everyone pays, this should have been taken care of.

I too went in to select our .7143 employee and 0% employer effective 1/1/24 Hit save, then done BUT when i go back into WA tax edit, the new rate and effective date is not there. shows the current rate that was entered in 2022 and another one that was 2019. We have payroll that we have to do today for the pay period 12/23-1/5/24 pay period.

Hello there, @InTheBeginningPreschool.

I acknowledge the importance of being able to update the adjustments for Paid Family and Medical Leave premiums in QuickBooks Online. The best action we can take is to contact our support team to investigate this matter and assist you in entering the proper rate since they have the necessary tools and skills. To do so, here's how:

Also, if you've received a notice, ensure it is in hand since our support team needs it.

Furthermore, I've provided these resources to assist you in preparing for the tax season. This will help you ensure that everything is filed correctly.

Let me know if you have other questions about the QuickBooks adjustment rate. We're always here, ready to help you.

Same issue. Received an email notice "Action required! Update your Washington Paid Leave rate" but rate would not update after multiple attempts over multiple days. Chatted with support for 15 min and they could not help. Then had support call me, took a full half hour to get updated. Frustrating. Have had to do this in past years as well. Intuit, please get this fixed.

I have went through the step to change the rate for WPFML for 2024 and it will not change to the correct rate for 2024, will only stay at the 2023 rate. Why won't it save the edit?

It's nice seeing you post your concern here on this thread, @mh2102.

Let me make it up to you by ensuring you can update your Paid Family & Medical Leave rate in QuickBooks Online.

To troubleshoot any possible browser-related issues that affect your QuickBooks view and performance, let's start by trying to log in to your account in a private browser. This will help us determine if the problem is with your browser or if there is a different underlying cause.

You can use these keyboard shortcut keys to open it in all supported browsers:

If it works, you can return to your original browser and clear its cache, not the cookies to start fresh. You can also use another supported, up-to-date browser that is already installed to narrow down the results.

If the issue persists, I recommend reaching out to our QuickBooks Online Payroll Support team so they can investigate this matter further. Here's how:

For more insights on setting this up, visit this link for more details: Set up Washington Paid Family and Medical Leave.

You can also use payroll reports to see useful information about your employee's payroll and taxes. To learn more, you can check out this article: Run payroll reports in QuickBooks Online Payroll.

You can always rely on me for additional assistance in managing your state tax rates. I'll be right there to help you whenever you need it.

so i have also spent an hour + to deal with that bug where you can't SAVE your rate

guess what, figured out a way as i was trying to show the support how the bug is.

the rate that i couldn't save is 71.43 for employee, 0 for employer.

choose any other rate that would save for 1/1/2024

then it's saved.

go back and save the actual desired rate of 71.43%/0%

there, finally got it saved.

CHEERS

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here