Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Welcome to the Community, BayAreaBooks.

The possible reason why payroll taxes stop calculating is that the tax table isn't updated, and the payroll item has reached the annual limit. To get this fixed, you'll have to make sure that your payroll taxable is up to date.

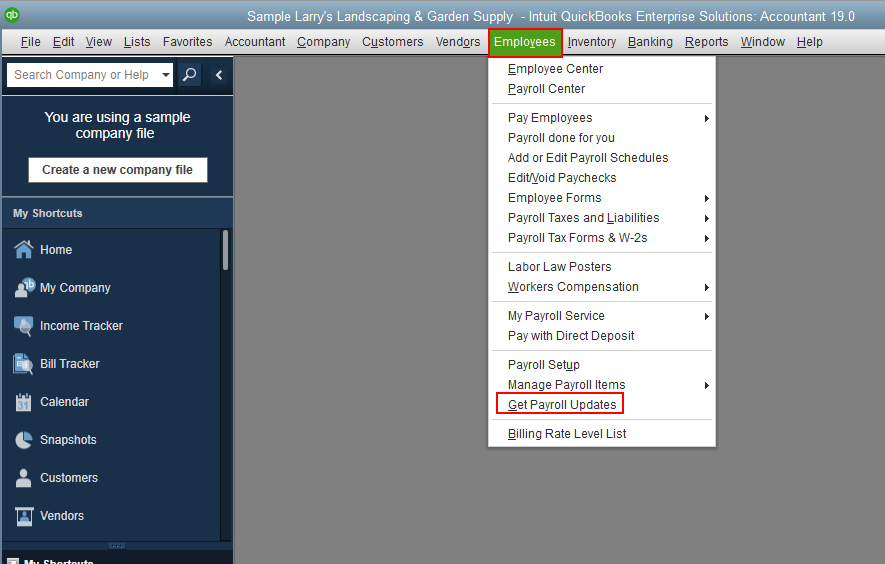

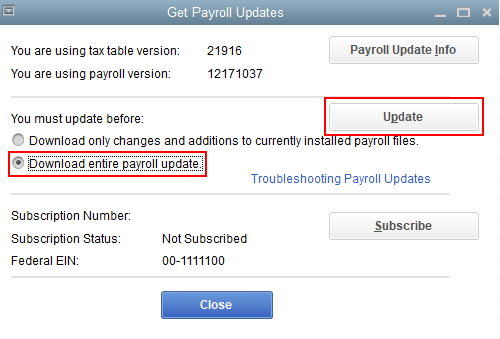

Here's how to download the latest tax table:

Once done, a window will appear when the download is complete.

You can read this article for your reference: Get the Latest Payroll Tax Table Update.

To proceed, you'll have to delete and recreate the paycheck if you already created it. This way, we can check if the payroll taxes are now calculating.

However, if you haven't created it yet, you can revert the paycheck. Let me guide you how.

Here's an article you can read on for more details: How to Save or Revert Pending Paychecks.

You might also want to check out this article for more information: QuickBooks Desktop Calculates Wages and/or Payroll Taxes Incorrectly.

You can always get back into this post if you have more questions. The Community team and I are always here to help. Happy Holidays!

I did all the updates. Restarted computer. Closed/Opened QBs. No one had reached the maximum limits. The issue required QBs support to remotely fix the problem. Thank you for the reply.

I did all the updates - QBs & Payroll. Restarted computer. Closed/Opened QBs program. Used the rebuild utility. No one had reached the maximum limits. The issue was resolved by QBs support remotely fixing on my computer. Thank you for the reply.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here