Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am using QuickBooks Desktop Premier for Nonprofits. We use both class tracking and job (i.e., customer, which is our donors) tracking.

We have just had to change our preferences to "Assign one class per earnings item" since we now have employees being paid from two different projects.

The problem is that now the company contributions and federal tax withholding are showing as unclassified! This is absolutely wrong since no transaction can be unclassified. They are correctly being assigned proportionally to the customers using the same ratio as the earnings items use (based on hours). We use one payroll addition, and it is correctly being assigned proportionally to class and customer with the same ratio as the earnings items. That is what I expected for all payroll additions, deductions, and company contributions, due to the way the payroll items were assigned proportionally to customers (according to the hours on the earnings items) with the "Assign one payroll item per paycheck" preference.

What setting do we need to change so the company contributions and federal tax withholding (and all payroll items) are assigned proportionally to the correct classes just like they are to the correct customers?

Solved! Go to Solution.

Yes, that’s right, @User987654321.

The ability to assign a class to the company contributions and the payroll deductions of a paycheck is unavailable. I recognize how your idea helps your reporting to clearly identify the corresponding classes.

You may consider sending feedback to our Product Development team, as I’ve mentioned above. This way, they can take a look and might consider this as part of the future enhancements.

I’ve attached some references to efficiently handle your contribution and deduction items in the program:

If you have any other questions or concerns besides class, don’t hesitate to add a comment below. The Community team is always here to help. Take care!

I admire you for sharing the details of your concern, @User987654321. I'd be delighted to help you set up your QuickBooks Desktop preferences so you can assign contributions, federal tax withholdings, and payroll items to the correct classes.

Before proceeding, let's turn on the class tracking feature. Here's how:

From there, we can now manually edit the existing transactions to add classes. Please ensure to create a backup company file before making any changes to secure your data if you ever run into problems.

Once done, we can assign a class on each earning item if you select Assign one class per Earnings item in preferences. Here's how:

The class depends on the transactions of the employee. You'll have to ensure that the class is associated with the employee's paycheck. To learn more about the process, please refer to this article: Tracking Payroll Expenses by Class, Department, or Location.

Moreover, I've added an article that'll help you pay or file your payroll taxes online: E-File and E-Pay in QuickBooks Desktop.

Please feel free to tag me in your reply if you need more help managing your payroll or QBDT. I'll be more than happy to work with you again. Keep safe!

However, a payroll deduction (that is, the corresponding liability account) and a company contribution (expense and corresponding liability account) are assigned like this (according to the reports):

- 1/2 of the total payroll deduction liability is assigned to Customer B

- 1/4 of the total payroll deduction liability is assigned to Customer C

- 1/4 of the total payroll deduction liability is assigned to Customer D

- the total payroll deduction liability is UNCLASSIFIED.

Similarly, the company contribution has the same problem:

- 1/2 of the total company contribution expense is assigned to Customer B

- 1/4 of the total company contribution expense is assigned to Customer C

- 1/4 of the total company contribution expense is assigned to Customer D

- 3/4 of the total company contribution expense is assigned to Class X

- 1/4 of the total company contribution expense is assigned to Class Y

- 1/2 of the total company contribution liability is assigned to Customer B

- 1/4 of the total company contribution liability is assigned to Customer C

- 1/4 of the total company contribution liability is assigned to Customer D

- the total company contribution liability is UNCLASSIFIED.

On the Balance Sheet by Class Report, I now have an UNCLASSIFIED column which I did not have before. That column has no business meaning except that there are errors in the data entries. It is really important that the liabilities show under their respective projects (classes). In particular, certain employees' life insurance policies accrue for every paycheck but are only paid once per year, and it is important that the liability shows in the correct class, since that project is responsible to pay it. Liabilities for employee and company contributions for EOBI, which works like Social Security and Medicare, show in the Unclassified column. These are always paid off the following month, but the balance sheet at the end of each month and fiscal year also needs to show these liabilities under the correct project (class), not in a general Unclassified column.

So, what other setting needs to be changed for the liabilities to be assigned to the correct class? Or is this an obscure bug in QuickBooks?

(Part 2 of 2)

Thank you for your reply, @Carneil_C . Actually all the instructions you gave are the settings we were previously using and it was working fine. However, now we needed to change to "Assign one class PER EARNINGS ITEM" and it is not showing correctly.

Let me try to explain again. As you can see, in the paycheck screen, there is an option to assign a different customer and a different class to each earnings item, alongside the number of hours for each. But, payroll additions, deductions, and company contributions do NOT have any option to assign a customer or a class. The customer is automatically and proportionally assigned to each of the payroll additions, deductions (and corresponding liabilities) and company contributions (expenses and corresponding liabilities). This has worked fine for us for several years. I assumed when we changed from "Assign one class per entire paycheck" to "Assign one class per earnings item" that the class would be assigned exactly the same as the customer was.

For example, a paycheck for Employee A has several earnings items:

- Basic Salary for 20 hours for Customer B and Class X

- Basic Salary for 10 hours for Customer C and Class X

- Basic Salary for 10 hours for Customer D and Class Y

- Total of 40 hours

So, a payroll addition of Medical Allowance (10% of the basic salary) only shows a single total in the Employee Summary (adjusted). And after it is saved, then it is assigned like this:

- 1/2 of the total payroll addition expense is assigned to Customer B

- 1/4 of the total payroll addition expense is assigned to Customer C

- 1/4 of the total payroll addition expense is assigned to Customer D

- 3/4 of the total payroll addition expense is assigned to Class X (20+10=30 out of 40 hours)

- 1/4 of the total payroll addition expense is assigned to Class Y

This works fine for both Customer and Class.

(Part 1 of 2)

Thanks for reaching back out and clarifying your goal, @User987654321. I’m here to share some additional information about class tracking in QuickBooks Desktop.

In QuickBooks Desktop Premier, you can assign classes to your transactions, customers, vendors, and employees only. Assigning a class to an account isn’t possible at the moment.

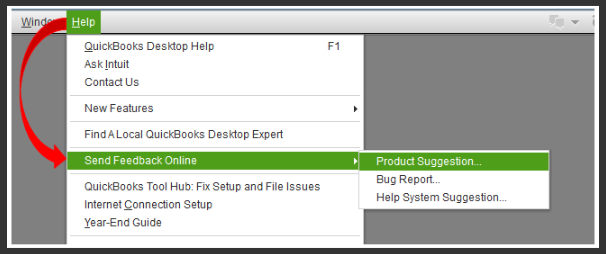

I know how convenient it is to show these liabilities in the correct classes. You can use the Feedback feature to send this matter straight to our Product Development team. This way, they could take action to improve your experience. I’ll show you how:

The Unclassified column in the Balance Sheet by Class report means QuickBooks can’t identify the correct classes for some transactions. You can read these resources to learn why this happens and what you can do to neaten up your report:

Additionally, here are some articles to stay payroll compliant and how to utilize the chart to keep better track of your business’s accounts:

Please let us know if you need more help managing your company file. We'll be more than happy to assist you. Have a good one!

Thank you for your reply @MadelynC. Actually, I did not want to assign a class to a whole account (I apologize if it sounded that way). I need to assign a class to the payroll transactions, specifically the company contributions and the payroll deductions of a paycheck--the liability lines. When the entire paycheck is always assigned to one class (if the setting says "Assign class per entire paycheck"), then those liability lines are assigned to the same class as all the earnings items and everything else. But when the setting says "Assign class per earnings item", so that the earnings items can be assigned to different classes (even if there is only one earnings item on the paycheck), then liabilities are not assigned to any class at all. The liabilities are correctly assigned to Customers when different Customers are selected, and the concept is exactly the same for Classes (as far as the data is concerned), so how do I get the QuickBooks reports to clearly identify the Classes?

I did not see any answer to what I need in your reply, except that this is a problem that needs to be reported. Did I understand correctly that you are saying that QuickBooks cannot do what we need it to do right now, but that we should report it?

Yes, that’s right, @User987654321.

The ability to assign a class to the company contributions and the payroll deductions of a paycheck is unavailable. I recognize how your idea helps your reporting to clearly identify the corresponding classes.

You may consider sending feedback to our Product Development team, as I’ve mentioned above. This way, they can take a look and might consider this as part of the future enhancements.

I’ve attached some references to efficiently handle your contribution and deduction items in the program:

If you have any other questions or concerns besides class, don’t hesitate to add a comment below. The Community team is always here to help. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here