Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- CA 2022 SDI rate

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

CA 2022 SDI rate

I see the 2022 CA SDI rate will be 1.10 and to date the rate hasn't been changed in Quickbooks. I know there was an issue with this last year and hope that will not be the case again this year. Will Quickbooks automatically change the rate prior to January?

Solved! Go to Solution.

Labels:

Best answer December 31, 2021

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

CA 2022 SDI rate

RE: The new update for CA 2022 SDI tax rate is currently not being rolled out in QuickBooks Desktop.

Really? Intuit isn't going to update California's SDI tax rate? That's a somewhat preposterous claim, really, since that's what payroll subscribers pay for.

Oh, and also because Intuit has already delivered the update you claim doesn't exist.

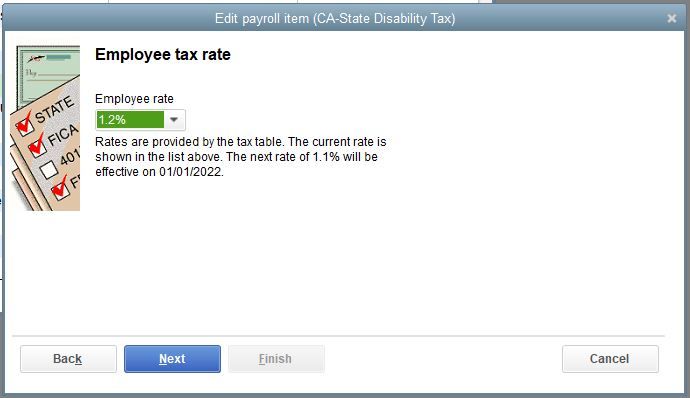

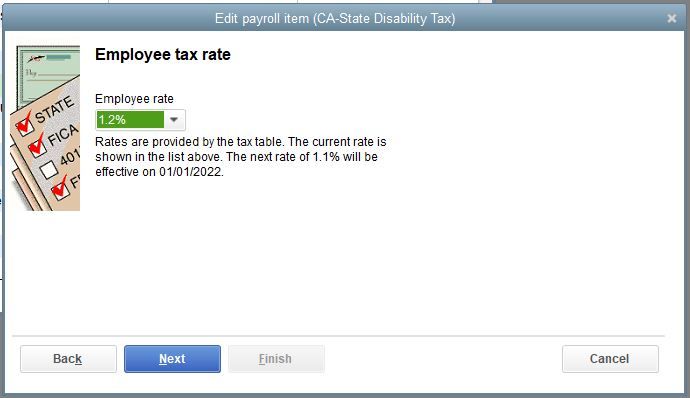

My tax table update says:

"Wage limit for state disability insurance (DI) increased to $145,000 from $128,2898."

"State disability insurance (DI) rate decreased from 1.2% to 1.1%."

And when I edit my SDI item, I see this:

Seems updated to me.

3 Comments 3

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

CA 2022 SDI rate

Your issue ends here, @Brenda25.

The new update for CA 2022 SDI tax rate is currently not being rolled out in QuickBooks Desktop. Any changes to the rate are bound and provided by the tax table updates.

Once it's released, QuickBooks will update the payroll tax table automatically. You can also update the latest payroll tax table manually. To do so, please follow the steps below:

- Open your QuickBooks Desktop company file.

- Go to the Employees menu, then select Get Payroll Updates.

- Click the Download entire payroll update option and select Update.

I'm adding this article for more guidance: Get the latest payroll tax table update.

To stay updated with the latest payroll updates, you can check out this article: Latest payroll news and updates.

Please know you can continue to reach me here with any additional concerns with payroll taxes. Thanks for coming to the Community, wishing you continued success, @Brenda25.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

CA 2022 SDI rate

RE: The new update for CA 2022 SDI tax rate is currently not being rolled out in QuickBooks Desktop.

Really? Intuit isn't going to update California's SDI tax rate? That's a somewhat preposterous claim, really, since that's what payroll subscribers pay for.

Oh, and also because Intuit has already delivered the update you claim doesn't exist.

My tax table update says:

"Wage limit for state disability insurance (DI) increased to $145,000 from $128,2898."

"State disability insurance (DI) rate decreased from 1.2% to 1.1%."

And when I edit my SDI item, I see this:

Seems updated to me.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

CA 2022 SDI rate

RE: I see the 2022 CA SDI rate will be 1.10 and to date the rate hasn't been changed in Quickbooks.

Good news! It has been changed, actually.

Note that the tax table can hold multiple rates for each tax. It will typically hold last year's rate, this year's rate, and next year's rate. Or something like that. If you're looking at the rate on payroll items list, you'll see the current rate, not next year's rate, until... next year. Then you'll see that rate.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Related Q&A

Featured

Small businesses are the vibrant heart of our communities.From your

favorit...

Launching a small business can be an adventure filled with excitement

and t...

Join us today on SmallBizSmallTalk as we discuss practical strategies

for d...