Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, emcllcja.

If you haven't run your first payroll in QuickBooks Online, then yes, you can add the payroll information through prior payrolls.

Here are the steps:

You can also check this article for more information: Set up a prior payroll for QuickBooks Online Payroll.

Otherwise, contact one of our Payroll Support Specialists if you no longer have the option, or if it affects multiple paychecks.

Here's a link where you can get our contact information: https://payroll.intuit.com/support/contact/?infosrc=qs&service=64.

Feel free to reach out to me if there's anything else you need. Thanks.

I’m setting up online qb payroll. I’ve paid myself ( I’m only employee) 7xs so far this yr 2021. How do I go back and add these pay periods or dates I paid myself? I usually pay every other wk so 24 yoga lay periods for the yr...

Hi, @Moman.

Thank you for choosing QuickBooks Online Payroll as part of your business. I'm here to help you with recording your paychecks for 2021.

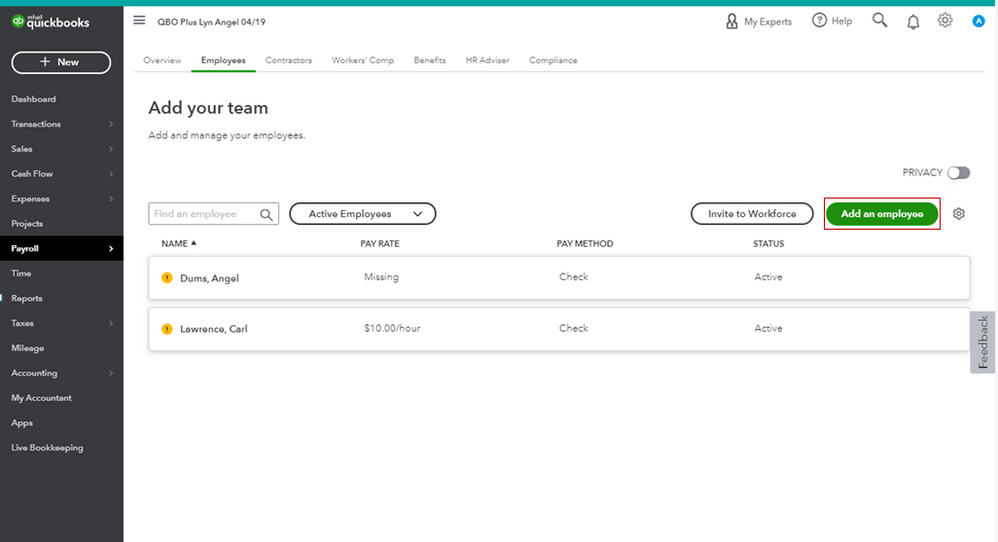

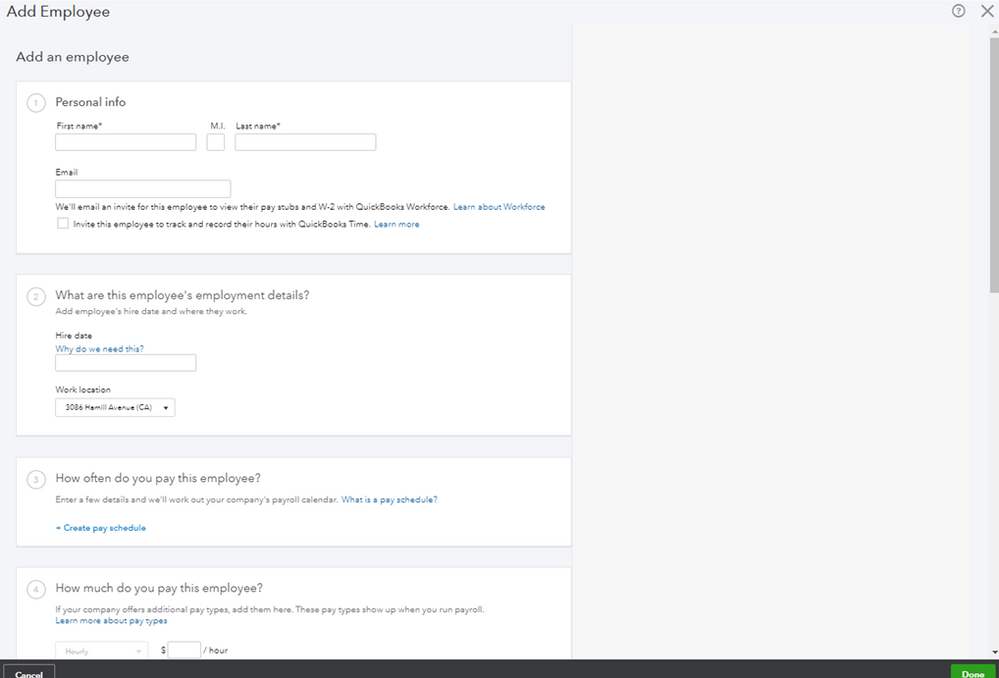

If it's your first time using payroll, you need to set up your name as an employee. Here's how:

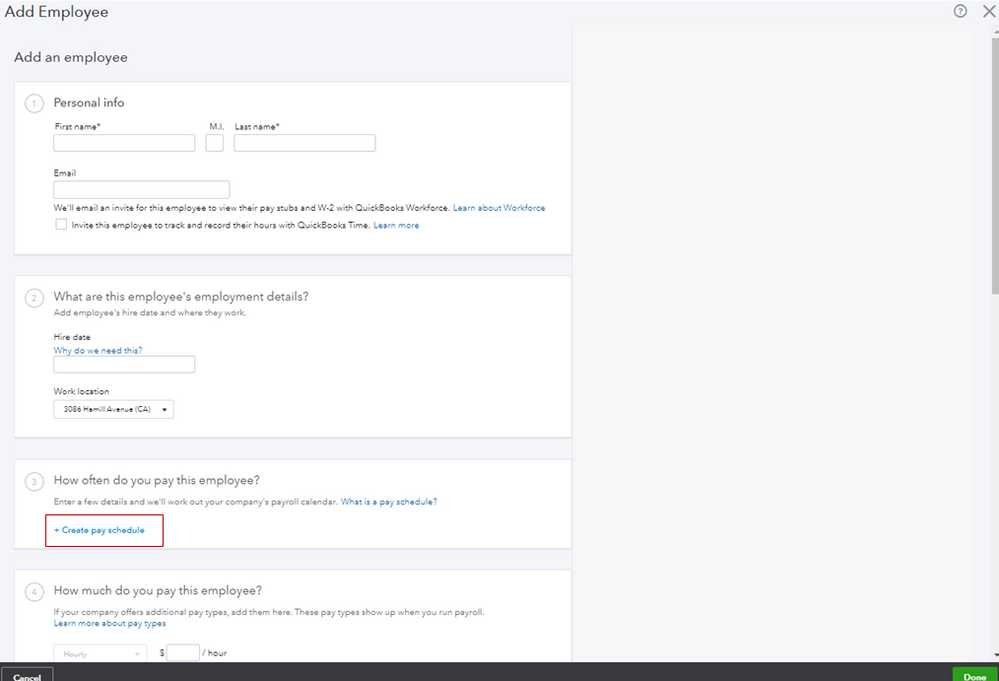

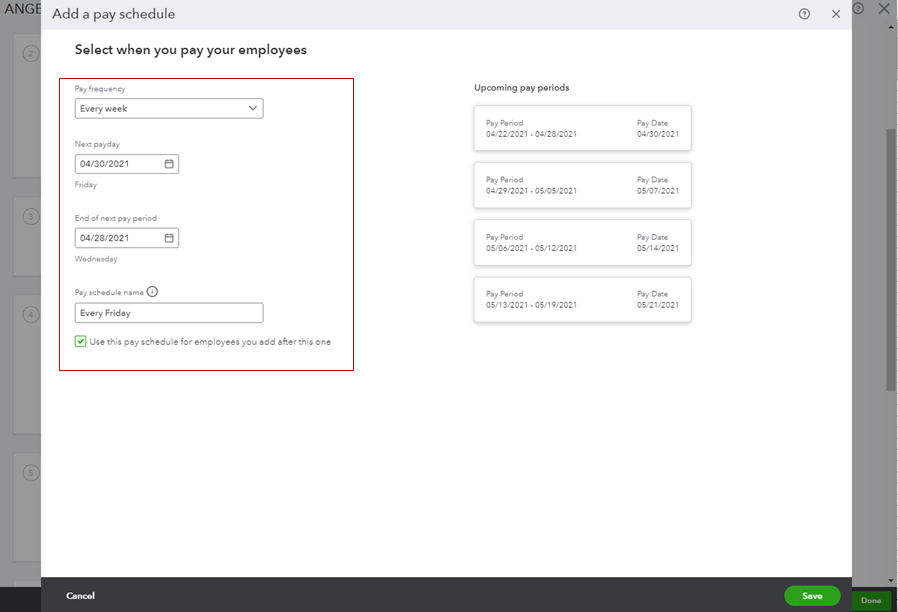

Then, create a pay schedule.

Once done, you're now ready to create your paychecks.

For more tips about running payroll in QuickBooks, you can check out these links:

When you're ready to file and pay your payroll taxes, you can also open this article as your guide: Pay and file payroll taxes online.

Please let me know how else I can help you with your payroll transactions. I'm always here to help. Have a good one!

I’ve already received pay for those previous pay periods. If I add them in to payroll how do I just enter them and not have money direct deposited. I don’t need to carry check??

Thanks for getting back to us here, @Moman.

I'll share some information about recording the received paychecks. As mentioned by my colleague @RenjolynC, you'll see an option to Enter [Year] prior pay details if it's your first time running payroll in QuickBooks. If that's the case, you'll want to follow the steps provided by my peer above to record prior payroll.

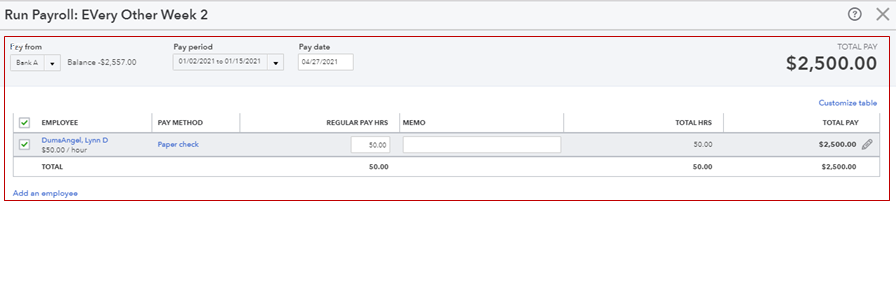

However, if you've already created paychecks in QuickBooks, you can process your payroll to record the prior paychecks. Here's how:

Learn more about processing payroll in this guide: Process or run payroll.

Additionally, here's a link that covers all the tasks you can do when using the payroll feature. Just look for responses that fit your concern.

Don't hesitate to reply anytime if you still have questions or clarifications about payroll. I'm more than happy to assist you. Take care and have a great day ahead.

How do you override the popup for payroll taxes being late when doing after the fact payroll?

Thank yoU!

Just to make sure I understand how to address pay that has been paid but nit done through QB.

I enter in previous payroll and run checks then I don't mail them because they have previously been paid. Thus creating a paystub for the employee and a record for me. Correct?

Hello there, SuzanneN64.

I'm here to ensure you'll understand how QuickBooks handles payroll we've run outside the program.

When we use another service to run payroll, it only creates a paystub for your employees and a record for you when tracking them using the steps below.

First, let's create an expense or liability account (depending on the scenario). It will serve as our manual tracking account for the payroll.

Once done, we can utilize the Journal Entry feature to enter the payroll check that was done outside QuickBooks. Before that, we'll have to get your employees' payroll pay stubs or a payroll report from your payroll service. And use them as a reference to proceed with this task. Here's how:

We can read this article for more tips and details: Manually enter payroll paychecks in QuickBooks Online. Also, please note that you can always consult your accountant if you're unfamiliar with this process.

I'd also like to address your concern, taxguru1948. We can override or manually change the payroll taxes after doing the actual payroll in QuickBooks by going to the Taxes menu. I'll guide you thoroughly on how to do it.

We can always visit this article to see several payroll reports we can generate according to our needs. It helps us view information about our business, employees, and payroll taxes: Run payroll reports in QuickBooks Online Payroll.

Let me know if you have more questions about recording paychecks and other details in QuickBooks. I'm here to provide additional help. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here