Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- Cross Border Employees

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

Hello,

We use QB Enterprise 20 and are located in Detroit, MI. I have been using QB for over 20 years. I am attempting to use QB payroll for the first time.

We have a bunch of Canadians that reside in Canada, but work in the US and have US (state, local, & federal) taxes withheld from their USD paychecks. I do not need Canadian tax withholdings calculated and the employees are paid in US dollars to US bank accounts.

I just need to be able to enter their home address with Canadian province and Canadian postal code into their QB payroll record so their paystubs & W-2 are produced correctly at year end.

I had an unfruitful call with a very crowded offshore center where the support person said this is not possible. I find it hard to believe that there are no other employers near the 5,000 mile Canadian border that have a similar issue.

Anyone out there find a way around this?

Solved! Go to Solution.

Labels:

Best answer January 10, 2020

Solved

Best Answers

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

I appreciate you providing detailed information about your concern, @mbutts4901.

At this time, we won't be able to enter the home addresses of your Canadian employees to show in their paystubs and W-2 form. As a workaround, you can consider pulling up the W-2 form, then manually enter or override the home address of the employees resides in Canada.

Here's how:

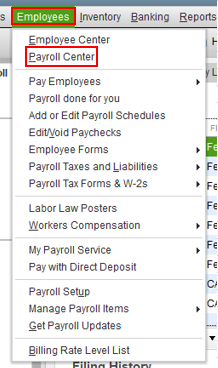

- Go to the Employees menu, then select Payroll Center.

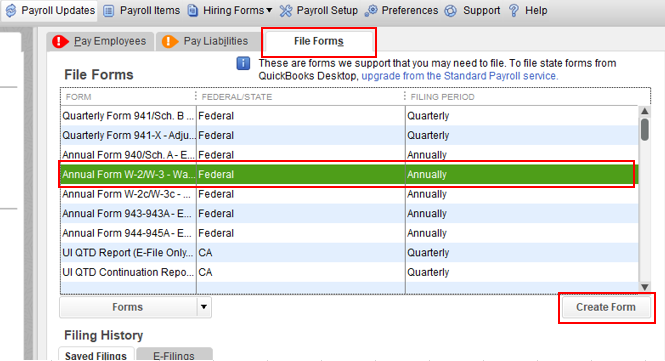

- In the File Forms section, select Annual Form W-2/W-3.

- Click Create Form.

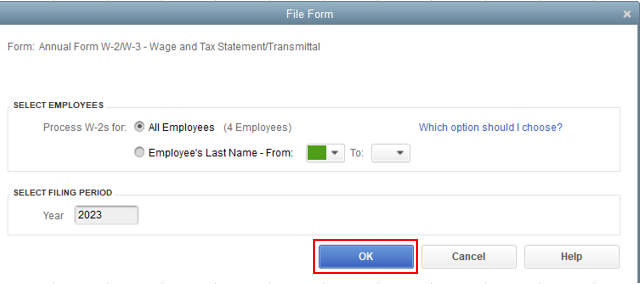

- Select the appropriate employees, then choose the filing period and click OK.

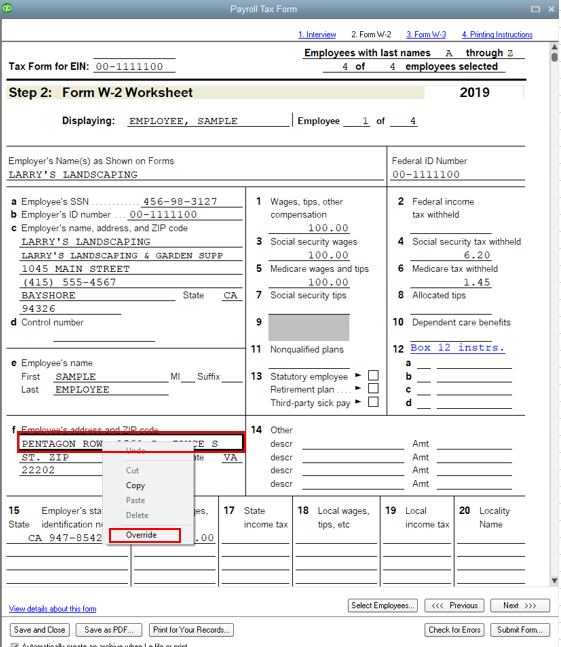

- In the Payroll Tax Form, click Next until you reach the Form W-2 Worksheet page.

- In the Employee's address and Zip code section, right-click the address, then select Override.

- Enter the home address of your employee, then select Next once done.

You might also want to check out this IRS article and go to page 15 for the employee's name and address in W-2: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a good one.

10 Comments 10

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

I appreciate you providing detailed information about your concern, @mbutts4901.

At this time, we won't be able to enter the home addresses of your Canadian employees to show in their paystubs and W-2 form. As a workaround, you can consider pulling up the W-2 form, then manually enter or override the home address of the employees resides in Canada.

Here's how:

- Go to the Employees menu, then select Payroll Center.

- In the File Forms section, select Annual Form W-2/W-3.

- Click Create Form.

- Select the appropriate employees, then choose the filing period and click OK.

- In the Payroll Tax Form, click Next until you reach the Form W-2 Worksheet page.

- In the Employee's address and Zip code section, right-click the address, then select Override.

- Enter the home address of your employee, then select Next once done.

You might also want to check out this IRS article and go to page 15 for the employee's name and address in W-2: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf.

Please touch base with me here for all of your QuickBooks needs, I'm always happy to help. Have a good one.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

Thanks for the reply. This would work, but I will be dropping QB as my payroll provider before I run my first payroll. This is too much of a "band-aid" approach on official payroll records. If an employee needs a paystub for proof of employment for a mortgage application, for example, how do they explain that their home address does not appear on it?

BTW, if you could let Intuit management know, I appreciate their quest for efficiency in moving the support for payroll to an offshore call center. However, the support was terrible (he was clearly just reading from the Help in QB and had no idea how employees get paid, the background noise was deafening, and it took me two days to get an appointment to speak with someone). This is the main reason I'm not going forward with QB payroll.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

Hello again, mbutts4901.

I appreciate you reaching out to our phone support and I'm taking note of the feedback regarding your experience. We’re receiving high call volume, so hold times may be increased. Now that you’re in the Community, I’ll do everything in my power to help fix or resolve the issue you have.

If you have Canadian employees, for you to enter their address, you may want to use QuickBooks Online Payroll or QuickBooks Desktop specific for Canada region.

You can test out our product for 30 days to help you decide which product suits your needs. Here are some useful links:

- QuickBooks Desktop: Download a trial of QuickBooks Desktop

- QuickBooks Online: https://quickbooks.intuit.com/ca/pricing/

If you need anything else, you can leave a comment below. I'm here for you. Take care.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

Mark,

I do have QB Canada for my Canadian employees (of my Canadian company) that live and work in Canada.

For the Canadian employees (of my US company) that commute to the US daily (we're less than 15 minutes from the Canadian border and about a zillion people cross the border every day), those people need to have US taxes withheld and be paid in US dollars. Neither of those can be handled by QB Canada.

Thanks for the quick reply. I think our needs just exceed the ability of QB payroll at this time.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

I'll take note of your experience, mbutts4901.

At this time, we're unable to recommend on how you will set up employee's taxes and reportable wages based on your scenario.

You'll want to reach out an accountant or tax professional for better guidance in reporting your Canadian employees' taxes.

Just in case, check this article if you want to determine the proper employee setup for the most common visa types in the future: Exemption status of foreign employees with particular visa types.

Let us know if you have any other concerns. We're here to help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

My employees under H2A Visa program have home address in JAMAICA, West Indies and I need to prepare my W2-W3 for them. I use QuickBooks Desktop payroll. I will use the override as described in the reply to the original post. I will also check the IRS publication as referenced.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

How do I update an employee address in Quickbooks from US to Canada. When I try to override it I'm unable to save the changes. The states only show US.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

Thanks for reaching out to the Community, b-samuel-lodige-.

Currently, there's isn't a process for entering Canadian addresses for employees. I can certainly understand how this could be a useful ability and have submitted a suggestion about it as of today.

You can also submit your own feature requests while using QuickBooks.

Here's how:

- In the top menu bar, go to Help, Send Feedback Online, then Product Suggestion....

- Choose a Type of Feedback and Product Area (optional) from your available drop-down menus.

- Enter any suggestions/feedback in the Here is my suggestion: field.

- If you'd like, include your name/email in the My name is: (optional) and My e-mail address is: (optional) fields.

- Click Send Feedback.

Your feedback's definitely valuable to Intuit. It will be reviewed by our Product Development team and considered in future updates. You'll be able to find the latest news about your product by reviewing our QuickBooks Blog.

I've additionally included a couple detailed resources about working with employee profiles that may come in handy moving forward:

If there's any questions, I'm just a post away. Have a great day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

Wow, I've been using QB for 25 years and didn't know about the Feedback button. I have added my vote to "allow the Canadian addresses" feature.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Cross Border Employees

This is great, but how do we do this inside Quickbooks Online Payroll. All the menus are different and I cannot find where to do this.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Featured

Small businesses are the vibrant heart of our communities.From your

favorit...

Launching a small business can be an adventure filled with excitement

and t...

Join us today on SmallBizSmallTalk as we discuss practical strategies

for d...