Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

District of Columbia's Paid Family Leave payments starts July 1, 2019. Is QuickBooks Online ready for this? See attached.

Glad to have you here, @Anonymous!

With the joint efforts of our engineers and payroll tax team, rest assured that you'll be able to track and file DC Paid Family Leave this coming May 2019.

Filing your payments can be available in the whole month of May this year. Thus you can go back and file your payments on or before May ends.

Let me know if you have any other questions about your payroll taxes. I'll be always around to lend you a helping hand.

This information pertains to the Washington State Tax process not DC.

Thank you for the callout, @JW-CSM.

All Intuit payroll services are anticipating to release the D.C. Paid Family Leave update in May 2019. Our Engineers are working hard to add and implement this in QBO payroll on the said month. As long as you have an active payroll subscription, there's nothing to worry for we release all the updates automatically.

We publish our updates about the District of Columbia (Washington D.C.) Paid Family Leave in this link: D.C. Paid Family Leave.

If you have any other payroll questions, just let me know by leaving a message for me. The Payroll feature is one of my expertise. Have a wonderful day!

I have set up the new expense account for paid family leave; set up new payroll item; added it to all DC employees; set up payment schedule. Now I need to make a manual liability adjustment to this new account. My Quickbooks DOES UC30 report says I owe a particular amount. I have validated that this amount is correct but I don't see it in any particular account. What adjustment do I need to make? Do I have to adjust each individual? Thanks in advance.

Hi there, misspenny.

By default, QuickBooks will assign the Payroll Expense account the company portion of the paid family leave item. Since you created your own and you’ve verified that the amount is correct, there’s no need to make an adjustment. You’ll just want to assign your expense account to the leave item, so the amount will reflect on it.

After changing the account, please back up your company file because you'll be running a Payroll Checkup. In this process, you'll only want to click on Continue on each page until you're finished. The purpose of this is just to refresh your payroll data after changing the account.

Please let us know if you still need more help with your WA paid family leave.

Have a good day!

Hi there, my understanding is the DC paid family leave tax only applies to employers that have employees working in DC and are required to pay DC unemployment insurance.

We have a DC resident who works in Virginia and accordingly we pay Virginia unemployment insurance on this employee.

When running our first July payroll, the DC paid family leave tax was automatically calculated on this employee. The state worked field is clearly marked Virginia for this employee. Is the employee's address triggering the tax calculation? And shouldn't the driver be the 'state worked' field rather than the employee's address?

Hello there, @accountingdept1.

Thanks for posting your concern here in the Community. I can help share some information about the payroll tax calculation in QuickBooks Desktop (QBDT).

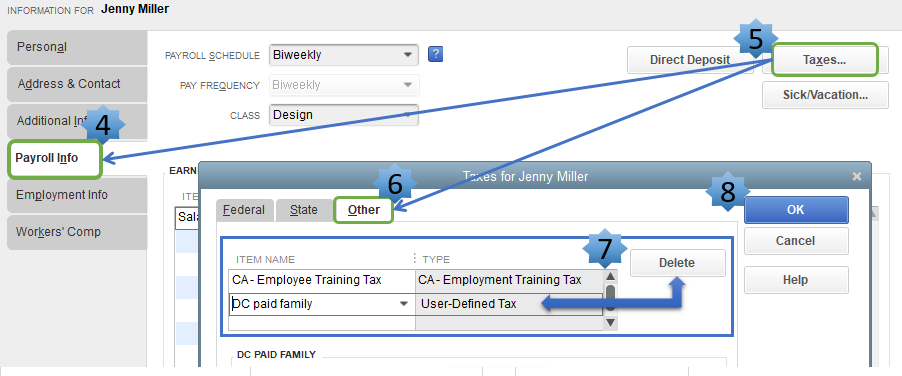

The State Worked you've set up on your employee's information which in Virginia, is correct. Make sure to remove the DC Paid Family Leave tax on the Other tab of payroll tax info to ensure the tax calculation is accurate.

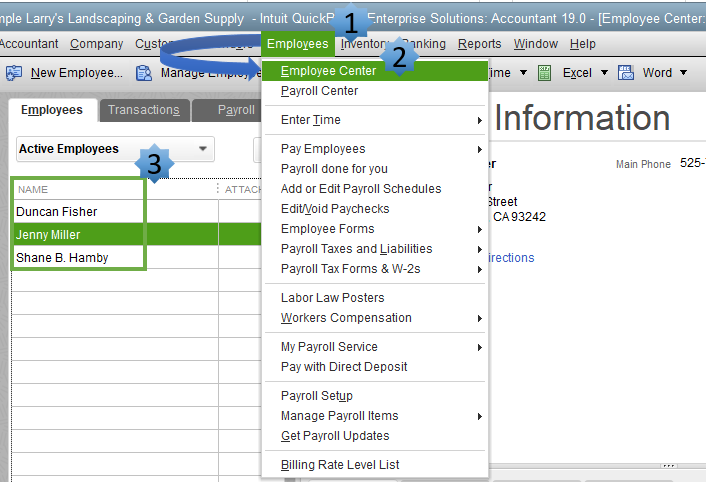

Here's how:

Since the paycheck was created last July, you'll need to use a liability adjustment to correct an employee's year-to-date (YTD) information contained in Payroll Items such as company contributions, employee addition, and deduction payroll items.

If you need further assistance with the steps, I recommend contacting our QuickBooks Desktop Support Team. They have additional tools to pull up your account and do a screen-sharing.

Here's how to contact our customer support:

Also, to learn more about the payroll processing and tax calculations, you can always visit this article:

That should do it! Please know that I'm just a post away if you have any other questions about QuickBooks payroll. I'd be happy to answer them for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here