Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI received an email from Quickbooks said that our company needs to make tax deposits more frequently. Instead of paying taxes once a month, we'll need to make state and federal deposits each time we run payroll. And the email also mentioned Quickbooks has updated our account to reflect these changes.

However, after I ran the first payroll for 2021 today (we pay twice a month), the tax due date generated on the payroll tax page is 2/16/2021, seems no change has been made to the deposit schedule. Do I need to update the filing schedule by myself in order to meet the IRS requirement?

Solved! Go to Solution.

I'll help you update your state deposit schedule in QuickBooks Online (QBO), @glennharnett.

Changing your state deposit schedule is a breeze. I know the steps needed to help you achieve this.

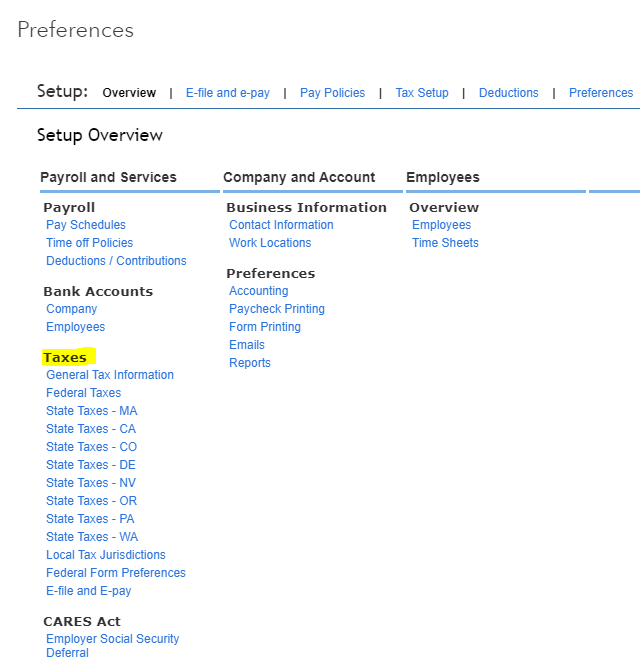

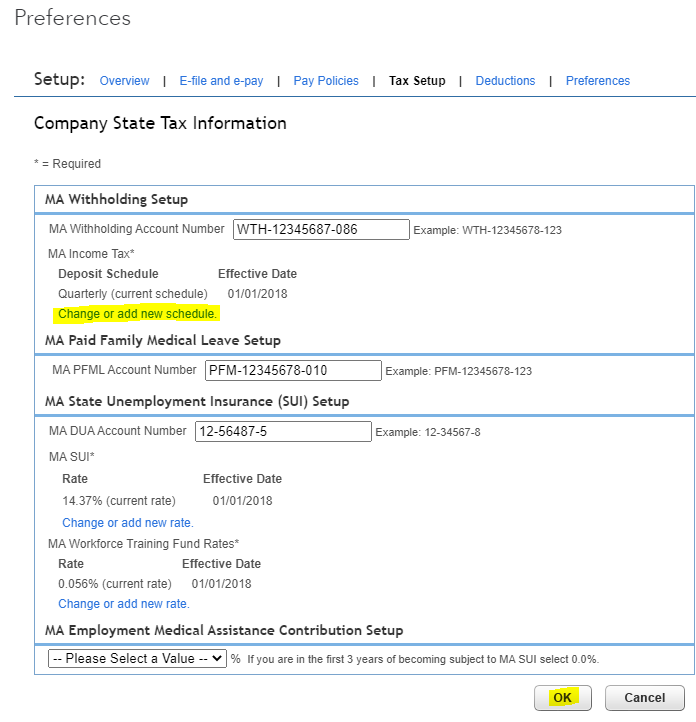

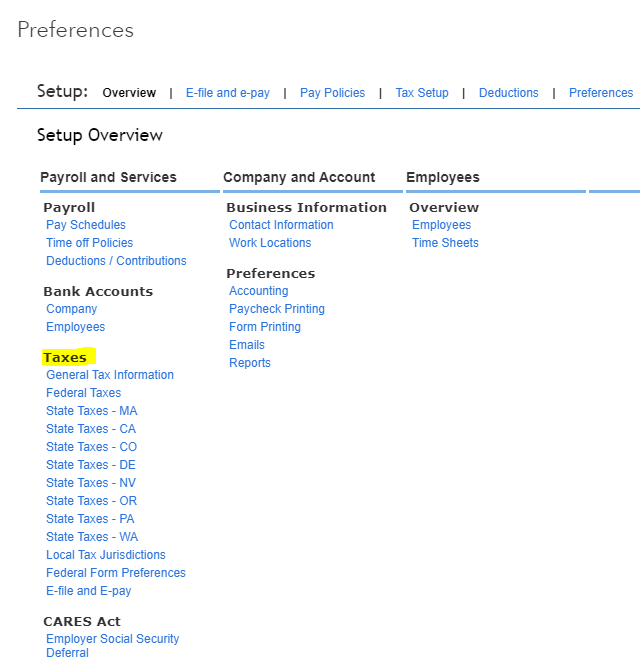

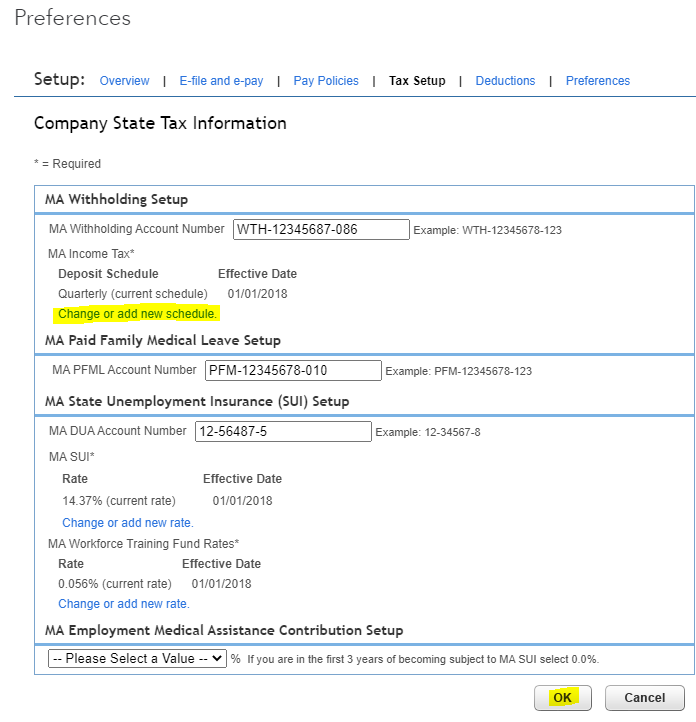

Here's how:

Also, QuickBooks supports some deposit schedules. If yours isn't supported, then you'll have to pay electronically through your state website.

If you have QBO Full-Service payroll, I'd suggest getting in touch with our support team. This way, they can update the deposit schedule for you and check further why it now takes 2-4 weeks (tax deposit) on your end.

After that, you can now pay and file your taxes. This helps ensure you're compliant and stay organized.

You can mention me in the comment section if you need more tax or payroll tips. I'll be here to back you up always.

I'm here to share some information about the filing schedule, zoe_wsj.

The system will automatically update the schedule when you exceed the thresholds. If you haven't exceeded, we can change it manually.

Let me guide you with these steps:

If you have a Full-Service payroll, I'd recommend reaching out to our Payroll Support team. This way, our agents will verify the email you've received and update it successfully.

You can contact them by clicking the ? Help icon. Scroll down and click Contact Us. You can enter, Update Filing Schedule as your keyword. Then, click Continue. From there, you can choose how you'll want to get in touch with our support.

If you want to pay and file the taxes online, you can check this article: Pay and file payroll taxes online.

Let me know if there's anything that I can help. Keep safe!

Sorry, but you failed to answer the question. How can we update the State deposit schedule? Mine used to pay the state taxes electronically about 2-3 days after running payroll. Now it usually take 2-4 weeks like the the original commenter posted. How can this be fixed???

I'll help you update your state deposit schedule in QuickBooks Online (QBO), @glennharnett.

Changing your state deposit schedule is a breeze. I know the steps needed to help you achieve this.

Here's how:

Also, QuickBooks supports some deposit schedules. If yours isn't supported, then you'll have to pay electronically through your state website.

If you have QBO Full-Service payroll, I'd suggest getting in touch with our support team. This way, they can update the deposit schedule for you and check further why it now takes 2-4 weeks (tax deposit) on your end.

After that, you can now pay and file your taxes. This helps ensure you're compliant and stay organized.

You can mention me in the comment section if you need more tax or payroll tips. I'll be here to back you up always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here