Announcements

Get unlimited expert tax help and powerful accounting in one place. Check out QuickBooks Online + Live Expert Tax.

- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- Employee entered wrong account number for direct deposit. I corrected it but it was after payroll was processed. Can I process payroll again without double paying him?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employee entered wrong account number for direct deposit. I corrected it but it was after payroll was processed. Can I process payroll again without double paying him?

Labels:

1 Comment 1

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employee entered wrong account number for direct deposit. I corrected it but it was after payroll was processed. Can I process payroll again without double paying him?

Hi there, @regina.

If your employee's bank account info is incorrect, the direct deposit may be declined and the money will be refunded to your bank account within 2-3 banking days after the payment date. You can pay your worker with a paper check in the meantime.

You may also contact our Payroll Support team to request a direct deposit trace. They have the tools to look into your account and see the status of your employee's direct deposit payroll.

Here's how:

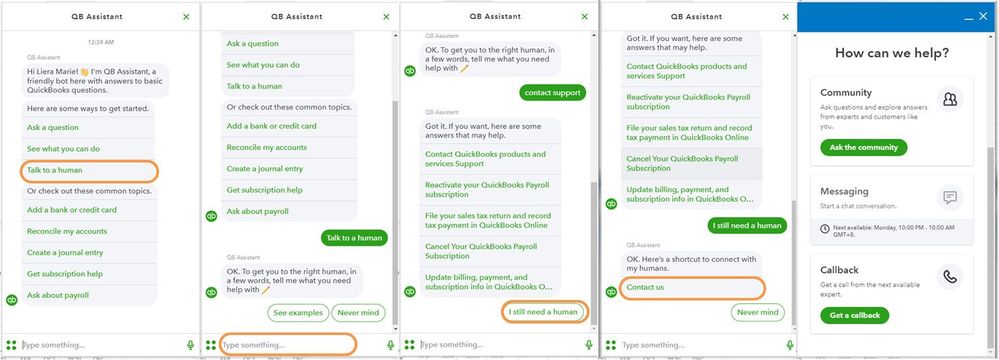

- Click the (?) Help icon in the upper right-hand corner of the Dashboard.

- Select Talk to a Human.

- Enter a short description of your concern and press Enter.

- Click I still need a human.

- Select Contact Us to connect with our live support.

- Choose Get a callback.

I also suggest updating your worker's DD account information to ensure you'll send your next payroll to the correct account. Updating their information will not affect any paychecks created before the process.

Here's how:

- Navigate to the Employees menu.

- Click Employee List.

- Double-click the name of the employee you want to edit.

- Select the Payroll Info tab.

- Choose Direct Deposit.

- Update the Routing No. and Account No. fields.

- Hit OK twice.

Finally, I encourage checking out the following resources that explain the different payroll statuses and how to fix direct deposit issues:

Please update me on how these steps guide you with the process of correcting your payroll. I want to make sure that this matter is resolved for you. If you need further help, let me know in the comment section. I'll be happy to assist.

Get answers fast!

Log in and ask our experts your toughest QuickBooks questions today.

Related Q&A

Featured

Ready to pay your team? Watch our Quickbooks 101 video below to get

started...

Join us fromMarch 17th-21st, to spring into action with Quickbooks this

sea...

QuickBooks Solopreneur was built with our brave, determined, and busy

self-...