Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy Massachusetts UI rate is 0% as a sole proprietor with only wages being paid to me/owner. QB will not accept 0%. How do I override?

Hi @ATobin,

I know the importance of following the changes to the rate to keep the SUI tax liability accurate. I can share some information about updating the SUI rate in QuickBooks Online.

The process of updating the payroll information will depend on your payroll service. Users using Enhanced Payroll should be able to change the amount to zero.

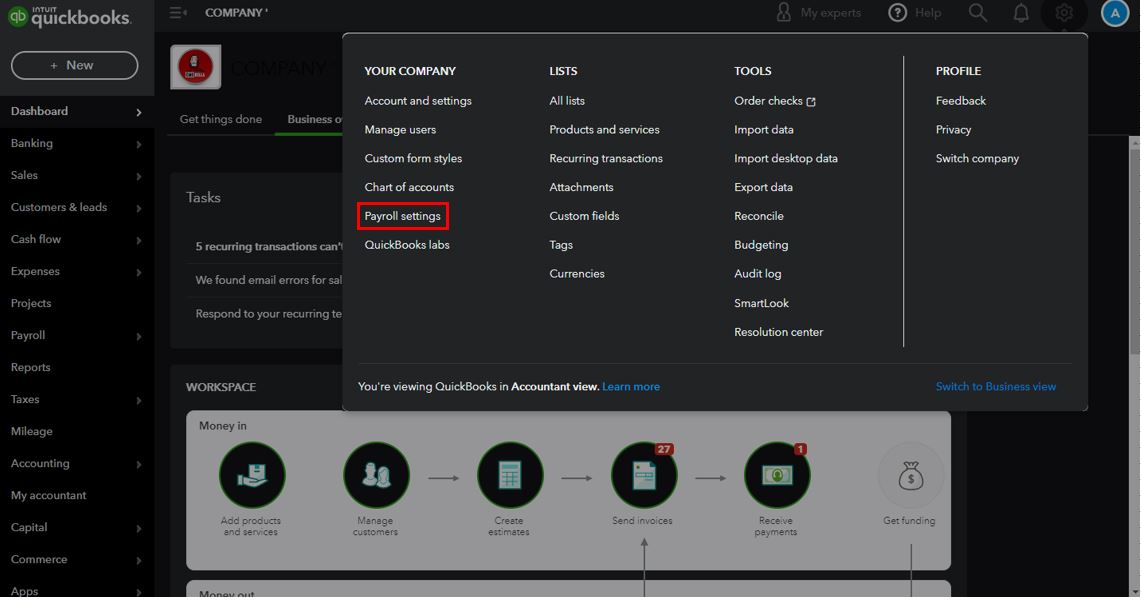

Here's how:

If you can't change it or are using a different version (Full Service, Core, Premium, Elite), I recommend contacting our Payroll Support Team for further assistance. They can edit the SUI rate on your behalf in a secure environment.

Also, did you know you can authorize Intuit to act as your payroll agent in Massachusetts (MA) if you have full-service payroll? Check out this link for more information: Authorize Intuit as your Massachusetts unemployment Third Party Agent.

Post a comment anytime you have follow-up questions about managing payroll or changing tax rates in QuickBooks. We'll be happy to lend a hand. Have a great day.

MA is still requiring a minimum of .56% even when I go in through settings. I will try to call payroll support.

Thank you!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here