Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I do not have a payroll subscription. I use payroll setup to enter the amounts into. I could not get into payroll setup today. I get error 11052 20000. I had an update two days ago that had an error in messages of #404 and in Doctor of #15270. I followed the instructions and re-downloaded the update and payroll updates. That didn't help.

I ran the doctor program. It found no problems.

I opened a previous version of my company and it has the same problem, will not open payroll setup.

I opened utilities and did the rebuild and verify of my company. It also found no issues.

I restored a backup and it also does the same thing. What should I do next?

Hello there, SherryG.

Thank you for posting in the Community. I'm here to help fix the error to run manual payroll successfully.

Can you share what amounts you're trying to enter in the Payroll Setup section? If you can also let us know what QuickBooks version you're currently using in the system, it would be a great help. You can add more details by posting a comment down below.

If you use the manual payroll feature, you should have no option to get payroll updates. Since you're able to see that option, we'll need to make sure there's no service key entered in the system.

Here's how:

Once done, let's proceed with repairing your QuickBooks Desktop to fix any program-related errors. You can follow the outlined steps in the article below:

Lastly, let's activate manual payroll through the Help tab to ensure it'll run without any problem.

Please follow these steps:

After following the steps above, run the payroll setup and check if the error isn't showing up.

If you have any questions, please know that I'm just a post away. I'm on a lookout for your response in this thread.

Thanks for responding quickly. I am using 2016 Pro with enhanced payroll on Windows 10. We run payroll on another program and computer. I input the totals and taxes manually into Quickbooks so that everything is together weekly.

I did everything you said and I am still getting the error [removed]. Next?

Hello there, @SherryG.

Thank you for getting back into this thread and providing extra details. I can make sure you'll be routed to the best support for your manual payroll issue.

I appreciate you trying the resolutions provided by my colleague. Since you're still getting the same error message, I recommend contacting our phone agents. They have more tools, such as screen sharing, that will be useful in investigating the cause of this.

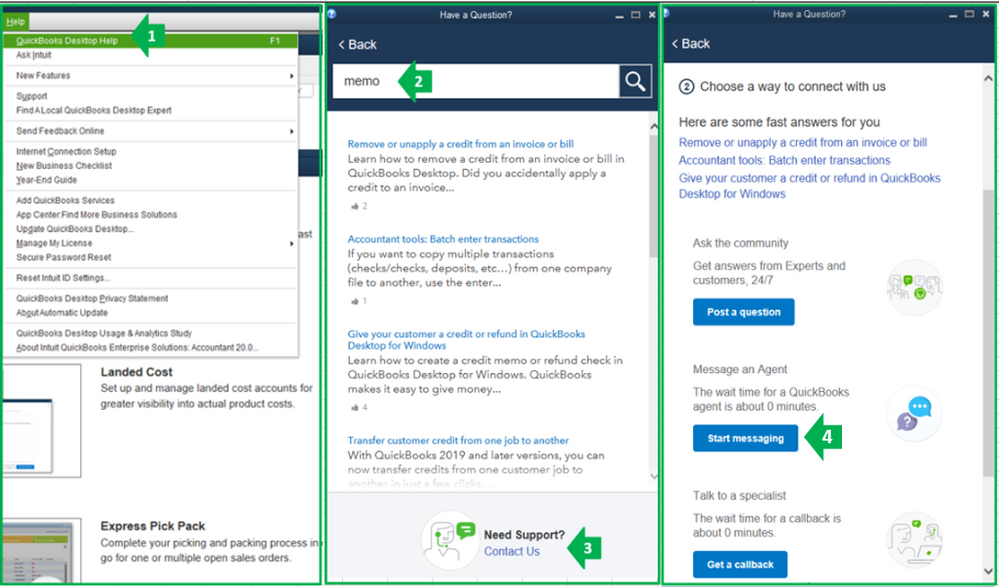

To get their contact number and schedule, you can follow these steps:

And of course, I’m here to help you if you have other concerns about payroll. Please also keep me posted on how the call goes. I'd like to make sure this is taken care of. Have a great rest of your day.

Well I spent about 3 hours on the phone yesterday and still haven't resolved the problem. I was going to be connected to IT department, but it was a 20 minute hold, which we waited for and still didn't get through. Maria was very nice, helpful and patient, but no success. I was told that because I don't have a payroll subscription that was all that she could do. I have been using payroll setup every week to input check totals, that we run on an older Peachtree program. It keeps everything together and if I wanted to change to Quick Books for payroll everything would already be there. plus the reports are nicer. I have not tried to call IT yet, because I know it will probably be awhile also. I am highly suspicious that the last update I had on the 14th is what locked me out. We will see what happens

Hi, SherryG.

Thank you for providing such detailed information. Allow me to point you in the right direction.

I'd like to check this for you and get it taken care of myself. However, I won't be able to check your account without asking for sensitive information. I don't want your account information displayed here for security reasons since Community platform is a public forum.

I know you've already called in. However, I still suggest getting in touch with our QuickBooks Desktop Customer Care to have this re-investigated. Agents have the necessary tools, like screen-sharing to get you back up and running.

Our most-up-to-date contact details can be found here:

Also, you may find this article helpful: https://quickbooks.intuit.com/community/Employees-and-payroll-taxes/Set-up-QuickBooks-Payroll-withou...

Please get back to me if you continue to get the same results so I can look further into this. Have a nice day!

I received an rejection for my GA G-7. It said it was rejected because I filed the wrong form with the GA Dept of Revenue. The error code is: 2000.

Please help

Let's get this error 2000 fixed, Richard138.

Since you have received an email notification about the reason why your GA G7 is rejected, you'll want to manually submit an amended form outside of the QuickBooks Desktop program.

You can refer to the amounts that are shown in the original form. Then, download the amended version directly from the state website.

Feel free to visit our year-end guide to make sure that you're good to go before the end of the filing season: Year-end Checklist For QuickBooks Desktop Payroll.

Furthermore, you can check out this article to ensure compliance with your state's payroll tax regulations: Georgia Payroll Tax Compliance. It contains details on tax forms, withholdings, unemployment and other tax, e-file and pay information, general state and agency information, and employer registration.

If you need assistance in doing this, you can reach out to our QuickBooks Care Support. Here are the steps to get in touch with them:

Please take note our operating hours for chat support depends on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

The Community is always open if you have other questions. I'll be around to help. Wishing you a great day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here