Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello there, @dajja.

Paying your employees for overtime doesn't re-calculate the hourly cost rate. Also, it won't reflect as an expense on the job. However, you can consider creating an expense transaction for the overtime.

Please know that when you set an hourly cost rate, it calculates the total cost of your employee that works for your business.

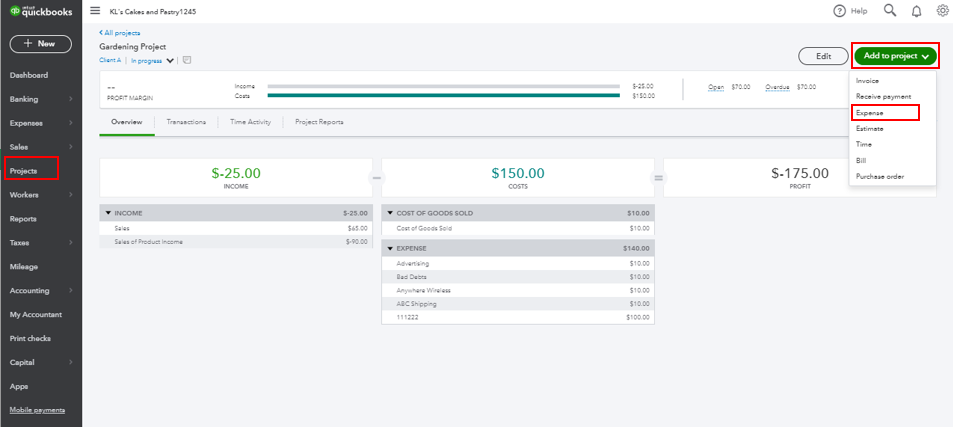

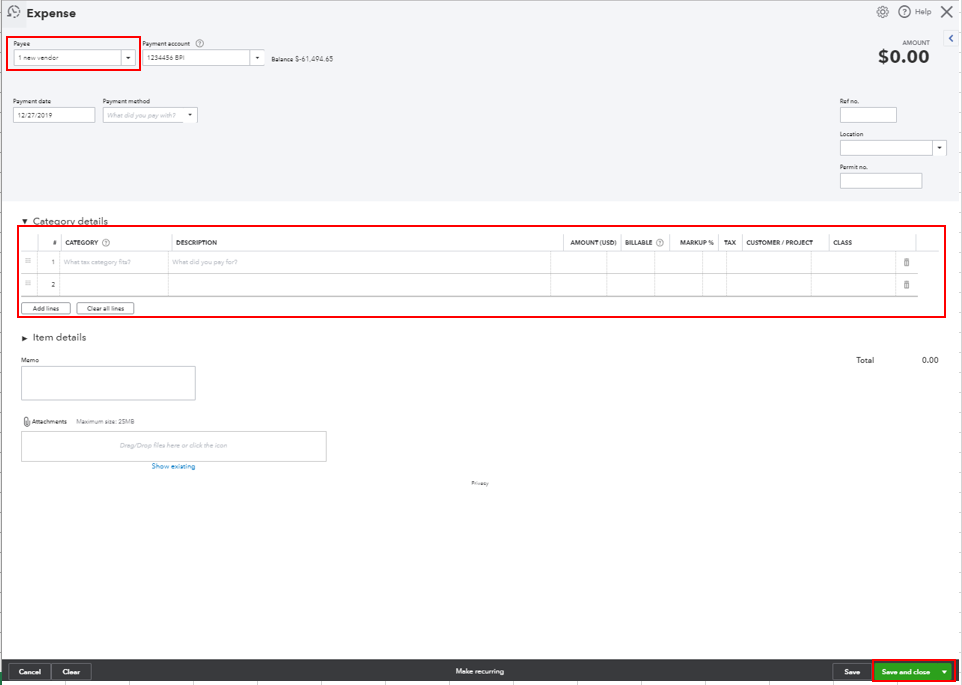

Here's how to create an expense for your employees' overtime cost:

To learn more about hourly cost rate, you can check out these articles for more details:

Just hit the Reply button if you have any other questions. I'm always happy to help. Thanks for dropping by.

Thanks Mark_R

It looks that in QBO most of the things need to be accomplished with workarounds, extra steps and additional work, sometime I think QBO has nothing to do with Intuit. QB Desktop (also made by Intuit) is being here for a while and Intuit has managed to do a great accounting software there, I understand desktop and cloud base are complete different animals, but "accounting" is not. QBO is a new product on development stage, they don't need to ask us for a feed back to know what we need or want, just look at your own desktop product, most of the things are there.

Mark, can you picture a service company with 10 techs, working 2 to 5 jobs per day each, and at the end of the week search who make overtime and on what job to create an expense for each of them? I am sure we can create a report for that and then enter the expenses, but it sounds like an additional work. I am not comparing QBO to QBD, I know it took a long time for QBD to be what it is now (I use it since 2003), and big new features were not added every year, but the accounting basic were there since the first time I use it. Bottom line QBO was release before having the basics for a solid business accounting software, it take money to develop a product and that's the phase QBO is now and we are paying for that, hope it be solid good before I retired.

I am so frustrated! We use QBO (Corporate mandate), TSheets, projects and only had one issue. When OT came over to QBO from TSheets, the projects didn't recognize the pay rate but recognized the hours that were separate on the TSheets reports. In a 3 way conference call with QBO and TSheets reps, the QBO one told me it was because we didn't do the QBO online payroll. Talked to the boss & explained what I was told and hence we opted for online payroll to get it to calculate properly. WOW, what a mess. 1) Our job costing overview no longer includes the labor hours as applied to the job. 2) The labor has moved to an area that doesn't reflect on ANY report for costing and will only show IF YOU PROCESS IN HOUSE PAYROLL WITH QBO PAYROLL, but wait, it will ONLY show every time you process payroll...Weekly, bi-weekly, semi-monthly...etc. We outsource payroll so it will NEVER reflect right. 3) The rates seen by QBO for OT are still wrong. QBO tells me it's TSheets, TSheets tells me it's QBO. 4) There is no way to undo the move and get the time to go back to job costing the way it was. 5) All the advice I've received from QBO is work arounds which cause double work. My advice is just don't.

Is there a resolution for this now or does it still have to be manually inputted as an expense? Seems very shortsighted when it should be able to register the "Overtime" and adjust it's calculations...

Hi, C4ctuss99. QuickBooks Online does not automatically recalculate hourly cost rates to include overtime pay in job costing. I’ll share insights on how you can account for this manually within your workflows.

When you set an Hourly Cost Rate for an employee in the Projects module, QuickBooks uses this fixed rate as a fixed value that does not account for overtime pay. To reflect overtime costs, you’ll need to adjust the relevant entries manually.

Here’s how:

You can also consider toggling your project view to Payroll Expenses to view actual payroll costs. I've included a screenshot for your reference:

I’ll ensure this conversation remains open for any future updates and discussions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here