I'll share with you the options on how you can correct the payroll for your employees, @asap-service3032.

If these are manual paychecks, let's first delete them. Then, change the pay type from vacation to holiday pay in the Pay section. Let me guide you how.

- Go to Workers from the left menu.

- Choose Employees.

- Select the employee's name.

- Click the Edit (Pencil) icon beside Pay.

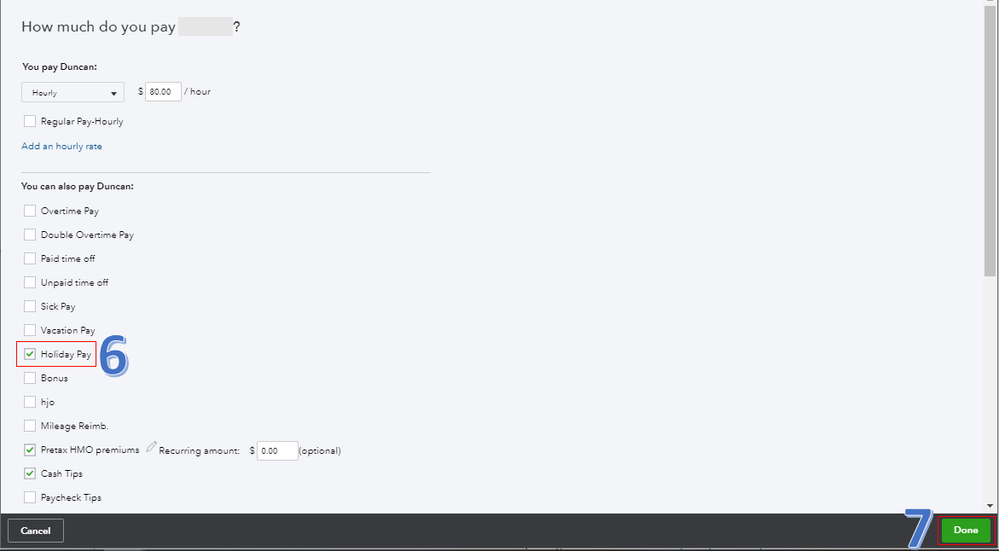

- In the How much do you pay [employee's name]? section, click the Edit (Pencil) icon beside Additional pay types.

- Check the Holiday Pay box.

- Click Done.

- Repeat the process for other employees.

The screenshot below shows you the last two steps. For detailed instructions, go through this article: Add or Change Pay Types.

Once done, you can now enter the Holiday Pay Hours as you recreate the paychecks (see the screenshot below).

If these are unprocessed direct deposit (DD) paychecks, you'll have the option to select Edit on the screen. Then, make any necessary changes. After that, save them before 4:55 PM PT, two days before the pay date.

However, if these are processed DD paychecks, you'll need the assistance of our Customer Care Team. They have the specialized tools to change the pay types to correct the employees' payroll. This ensures your payroll and W-2's information are accurate.

You can always visit this website: Change An Employee Paycheck. This link provides you the information about what can be or can't be edited on an employee's paycheck.

There are several tasks to perform and important dates to consider when you start and complete the year-end payroll process. To help prepare yourself, check out this article: Year-end Checklist.

I'm here anytime you have other concerns. Have a great day, @asap-service3032.