Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWelcome to the Community, esgodfrey.

Thanks for being part of the QuickBooks family. Let me share some insights into how the retirement plan is reported in your W-2 form.

When setting up a retirement plan, the amount is reported in Box 12 in the W-2 form. The code differs depending on the type added in QBO. For additional information, click the Health Insurance link in the following article: Add or change pay types.

If you wish to report the retirement plan to Box 13, I suggest consulting an account or tax adviser. They can recommend the specific pay type to use in tracking the payroll item in QBO. Additionally, these resources provide an overview of setting up a retirement plan and how it’s tracked in the W-2.

Feel free to click the Reply button if you have any clarifications or other QuickBooks concerns. I’ll be around to answer them for you. Have a great rest of the day.

Greetings, esgodfrey.

I’m back to check if the information I shared answered your questions? I’m here to ensure your retirement plan is properly reported on the W-2.

If you have still need help with QuickBooks, feel free to leave a comment. I’m always ready to lend a helping hand. Enjoy the rest of the day.

My accountant told me that since there was a change in the tax structure last year I need to have box 13 checked (Statutory Employee) or I can not deduct my office Expenses. My boss said that your company told him that you were not able to do that. I did not believe him so I am asking to see how he enters my information in your system so that it can be checked.

I need help in determining if retirement box should be checked. I wonder if it should be set up for this. I am at a school and staff has IMRF but teachers have TRS. SHould they be checked and if so how do I so this in the setup

Look no further, @best program.

In Form W-2, the Retirement plan box (Box 13) tells whether an employee is an active participant in your company’s plan. If an employee was an “active participant” for any part of the year you should check the retirement plan box. Please refer to the info below:

Check it here for additional details: Form W-2 Codes for Retirement Plans.

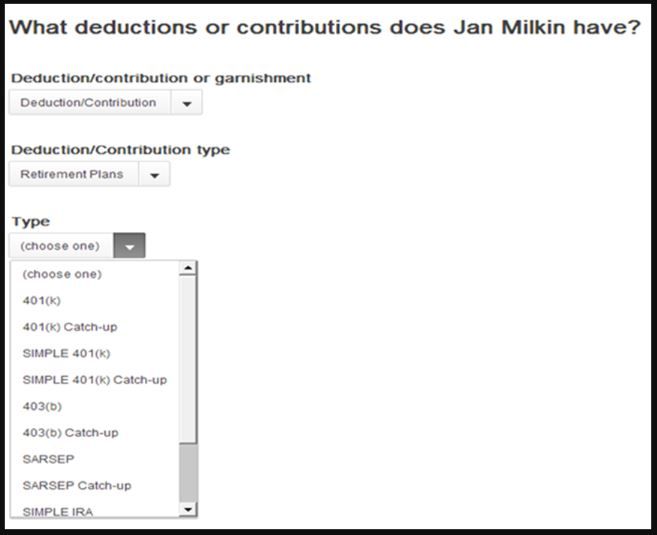

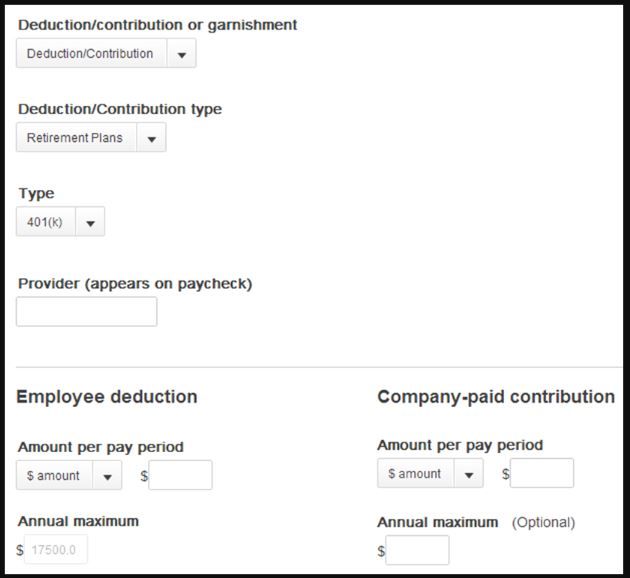

Then, follow these easy steps to set up a retirement plan deduction in QuickBooks:

Once done, here's how to add retirement plan deduction to an employee:

Here's the article that will provide more info about the process: Retirement plan deductions/contributions.

Also, it's best to consult your tax adviser so we can ensure you have accurate information in tracking your payroll item in QuickBooks.

I also encourage you to visit our QBO Help page, so you can browse articles or even questions of other QuickBooks users that were answered by QuickBooks experts. This will help you earn more knowledge that can help you with your accounting tasks.

Don't hesitate to post again here if you have further questions about setting up retirement plans in QuickBooks. I'll be around to help and provide answers to achieve your goal. Have a blissful new year and take care.

Is it possible to add a one time retirement payment to a W2? I know I did it last year but I can't figure out how to do it this year. The owners each put $19,500 towards retirement and the CPA wants me to add it to their W2. I was able to mark the Retirement Box but cannot put the dollar amount in.

Thank you,

Kathie

I’ll share some information when creating a retirement payment, @Katford.

Retirement payment or deduction has a limit and will depend on the type of retirement plan. You can use this article for detailed information about the deduction limit: Retirement plan deductions.

I also suggest contacting our Payroll support for further assistance. That way, you’ll be provided with the best solution.

Feel free to click the Reply button if you have any clarifications or other QuickBooks concerns. I’ll be around to answer them for you. Have a great rest of the day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here