Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThese IRS forms are always confusing!

There's a freelance web developer in Tunisia who I hire sometimes. I also sometimes hire an assistant who lives in Hungary. They are not US citizens nor legal aliens. My questions are:

1. Do I still need to get them to fill out and sign form W-8BEN?

2. Judging by the information they ask in form W-8BEN, it looks like there's a treaty between both these countries and the US for tax collection purposes. Does this mean that once they fill out the form, I have to withhold 30% from their payment? Or do they (the freelancers) have to start filing/paying income taxes to the US?

3. The form asks for the Beneficial Owner's Social Security number, an ITIN, and a Foreign Tax ID number. What if a freelancer I hire happens to have a SS number but does NOT live in the US and all work performed was done OUTSIDE of the US?.

Sorry for all the questions. I'm sure others have similar situations.

Thanks!

Hi Project Guru,

Thank you for joining the thread.

The best thing to do is seek advice from the IRS on how to handle taxes for your foreign freelancer. We're unable to support set up for this scenario because we are only limited to US taxes.

If you need payment reports or transaction details, you can pull up the Transaction List by Vendor report and filter the transactions of that particular vendor.

You can always go back to this thread if you have other questions in mind.

Curious how I need to categorize an W-8BEN contractors pay in my transactions. I want them to be categorized correctly for my accountant at the end of the year.

> At this time, QuickBooks doesn't have the option to e-file 1099s with non-US addresses so it has to be done manually.

Why not? This seems pretty common (we're experiencing it too). It seems worth allowing especially when these are being emailed, not sent internationally.

Hi there, grgg.

I can see the importance of having the option to e-file 1099s with non-US. However, this isn't available in QuickBooks Online (QBO). As mentioned by my colleague above, sending feedback is the best way to relay your suggestions. This also, helps us improve your experience and the features of the program.

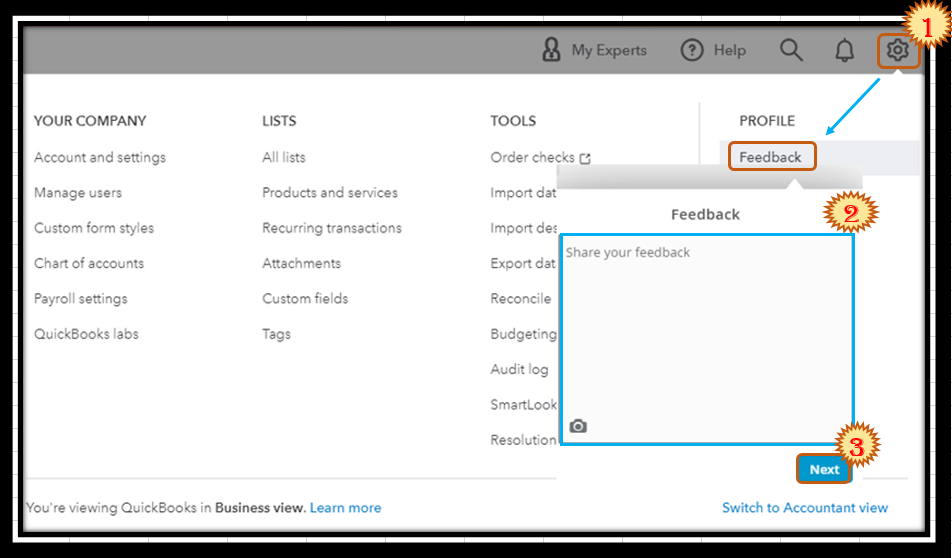

Here's how to submit feedback:

You can also track feature requests through the Customer Feedback for QuickBooks Online website.

To further guide you in managing your contractors and answering the most commonly asked 1099 questions in QBO, I'd recommend checking out these articles:

This thread is always open for further questions, so drop by again if you have other concerns regarding your 1099. Have a good one.

I am trying to add a US citizen who lives outside of the US as a contractor. This questions was posed in 2020, have any updates been made to allow the contractor to be added without having to go to the IRS directly?

Hey there, Gabewest.

The availability to add a person who lives outside the United States is currently unavailable. The best thing to do is to file it manually with the IRS. Doing this also ensures that you'll be filing the accurate form.

In case you want to learn more about 1099, you can refer to this material: Get answers to your 1099 questions.

Please keep me posted if you have further information or concerns related to QuickBooks. We'll be around to help.

Great information! Thank you!

Thank you for following up on this thread, @Queenly.

We are pleased to hear that our colleague provided you with essential information regarding your employee details. Helping you with your business activities in QuickBooks is our highest priority.

I am also attaching these resources that may be useful in the future:

You can use them to manage your 1099 forms.

If you have any additional concerns about tax forms, feel free to repost them in the Community. We are here to help 24/7.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here