Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I hope you're doing fine today, ttanassept.

I see how important to get your Q2 2020 form 941 in QuickBooks. Please know that we are still working with your state to make this updated form available in QuickBooks Online soonest.

The Q2 2020 form 941 is currently included as one of the blocked forms, which means it's unavailable. Rest assured, making this form available is our top priority. The team is working and doing the best to release it as soon as possible.

For now, you may want to check the latest update of the Federal and State Forms in the Online product. This form might be available in a few days. In the 2nd week of July, try to check it again.

Let me include these resources where you can get additional details about filing the quarterly forms:

Drop me a line if you have other questions or clarification about payroll forms. I'm always here to provide the information you'll need to know. Take care!

@ttanassept I’m having the same issue. I try to file Q2 Form 941, and it says “form not available, check back later”. This didn’t happen with Q1 this year, nor has it happened in past years. Similarly, I was able to successfully file my Louisiana form.

I cannot download or view Q2 form 941 either as of today.

I am in Florida and having the same exact issue. I read a response that QB is working on the issue so I will make a note on my calendar and check back next week!

I am in NH and still can not process Quarterly 941

Hi there, @Dbelair.

I'll provide information about the availability of the form. Then, how you can respond and file Q2 Form 941 on time.

Currently, the Q2 2020 941 included as one of the blocked forms, which means it's unavailable. That's the reason you received the message. Rest assured, making it available is our top priority. Our team is working and doing the best to release it as soon as possible.

To know more about the updates of the 941 Quarterly form in QuickBooks, reference this short article: Forms unavailable (blocked) - Federal and State Forms. It includes FAQs about its availability as well as other state forms.

In case you want to submit the form now, I suggest going to the IRS website. From there, you can manually file the Q2 Form 941. Before doing so, ensure printing a copy of your 941 forms as your guide when filling the form. Here's how:

Once done, you can copy the details there and then enter it according to their part in the forms. Then, manually file it to the IRS.

I've added a link that explains the equivalent of each line in the report: How QuickBooks Populates The 941.

Feel free to place a comment below if you have more questions in mind. I'll keep my notifications open. More power to your business!

I am still experiencing this issue. California forms processed fine, just the 941 that is still not working. Is there a known issue and time frame when we can expect this form to be available?

@ttanassept @LoriLH @Dbelair @CPAC2015

There are extensive changes to the Q2 941 due to the CARES Act. It is taking the programmers a little longer to update the online system to comply with the new regulations than we all would like.

There is nothing you are doing wrong - we just need to wait for it to be developed, tested, and released for use in QBO.

Try again in a few days. Or check the link here to see if it is available.

@Jovychris_A Items 1-6 in your reply don't work when we can't even VIEW the 2020 Q2 Form 941.

At this time, when I click "Quarterly Forms", then "941", I see "This form will be available soon. Please check back later".

Therefore, performing items 1-6 in your reply is impossible when I can't even view the form at this time.

We are now 7 days in July. When will 2020 Q2 Form 941 be available to e-file? Sure, I can manually paper file and send snail-mail, but that's not what I'm paying QBO for. I'm paying QBO to e-file.

Hi there, LAC1.

I see how important to get your Q2 2020 form 941 in QuickBooks Online. The Q2 2020 form 941 is one of our top priorities.

For now, we're unable to give the exact time and date when 2020 Q2 Form 941 will be available to e-file. That being said, manually filing them is the best way to file the form.

Rest assured, we are working with your state to make this updated form available in QBO as soon as possible. We'll also do our very best to ensure that we can provide your Form 941 for Q2 2020 timely. To get updates once it's available in the program, I'd recommend bookmarking this article: Forms Unavailable In QBO (Federal And State Forms).

Please check this article on how QuickBooks populates each line on form 941 and an equivalent report from your payroll software: How QuickBooks Populates The 941.

If you have other questions, don't hesitate to post here. We are all here to back you up. Keep safe.

QuickBooks Desktop Payroll already has the 2Q 2020 developed. It is not ok that QBO Payroll does not have this functionality yet.

Couldn't agree more...is Intuit going to reimburse my clients for the extra time it will take me to download, pull reports, complete, and mail a paper form (plus postage)? Not likely, so I will have to bear the cost of paper prep (which will take at least 15 minutes per client, depending on number of employees) as opposed to what I am already paying QBO to do in two clicks (15 seconds). I know we're all scrambling due to the CARES Act and its ramifications but this isn't the first time QBO has let me down.

The form needs to be "unblocked" no later than July 22nd so that all we QBO Pros have time to manually prepare and mail forms to be postmarked by July 31st. Hoping that's the timeline the programmers are working under and not a "complete" date of July 31st...

I am having the same problem. I hope this issue gets fixed quickly, because of the shelter-in-place, this form needs to be printed, delivered for signature, then sent back to process and mail in; this is about a two week process, so it is essential to get these forms ASAP.

Exactly! The form in desktop was available before the 1st. It's July 8th and still no form. This is causing a lot of delays with our QBO clients. And QBO requires that you e-file at least two days before the deadline so that already shortens the time we have. This is ridiculous! Intuit has had ample time to get this form ready for filing.

Good news, everyone!

I'm here to inform you that the 941 form for the second quarter is now available in QuickBooks Online (QBO).

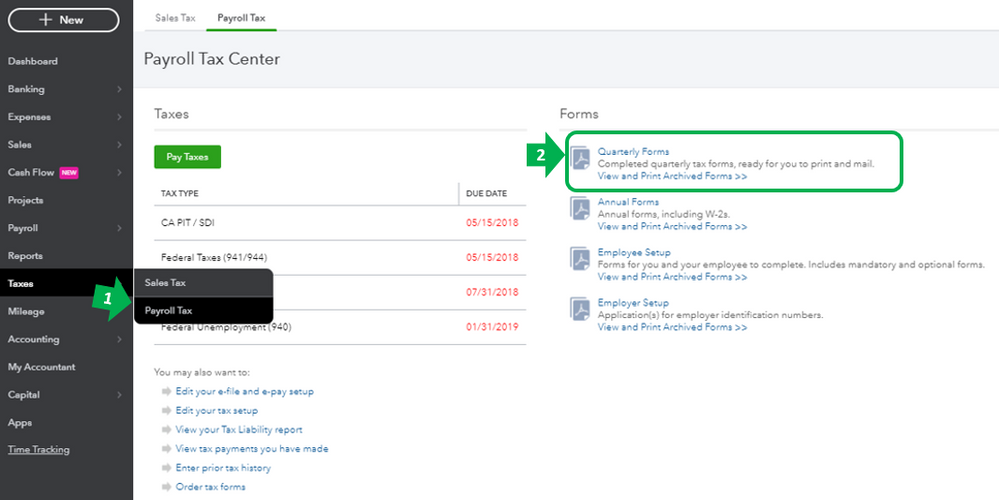

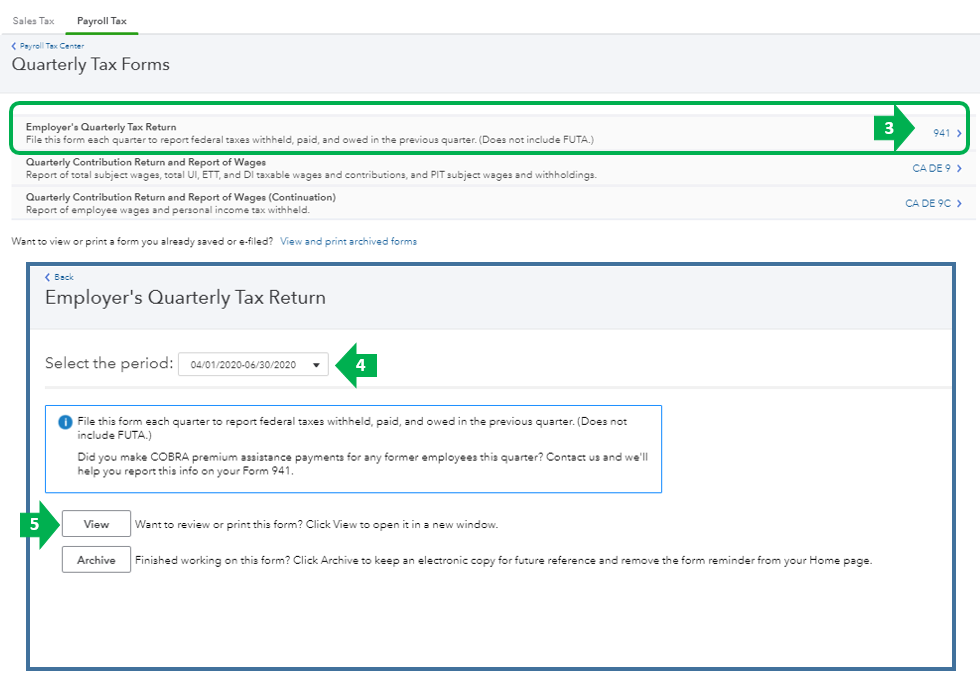

You can access the form by following these steps below:

For your reference on how to prepare and file quarterly forms in QBO, feel free to check out these articles:

I appreciate your patience until the form becomes available. Visit us again if you need help with anything QuickBooks. I'd be more than happy to assist. Have a nice day everyone!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here