Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowOur business is based in Florida but we have an office in Georgia. As of 1/1/2020 one of our employees became a resident of Florida, he had been a resident of Georgia. We neglected to reflect this change in his paycheck. He is paid once a month on the first. So from 1/1 to 5/1/2020 we have withheld $656.45 that we should not have. In addition we deposited with the GA Department of Revenue our first quarter withholding which was $393.87 more than it should have been.

As I seen it I need to:

Pay the employee the $656.45 that was withheld in error.

File an amended 1st quarter return to the GA Department of Revenue

How do I do this in Quickbooks? I am using Quickbooks Desktop 2020 Professional Services edition on a PC with Windows 10 Pro 64 bit. I also use the payroll subscription service.

Send an amended return to the GA Department of Revenue for the 1st quarter.

Solved! Go to Solution.

I appreciate you getting back to us, @uwphotonut.

QuickBooks depends on the information entered. Let's first check the employee's information and update it. This way, the calculation of taxes will be accurate moving forward.

Here's how:

I'm adding this article for more details: Update employee info.

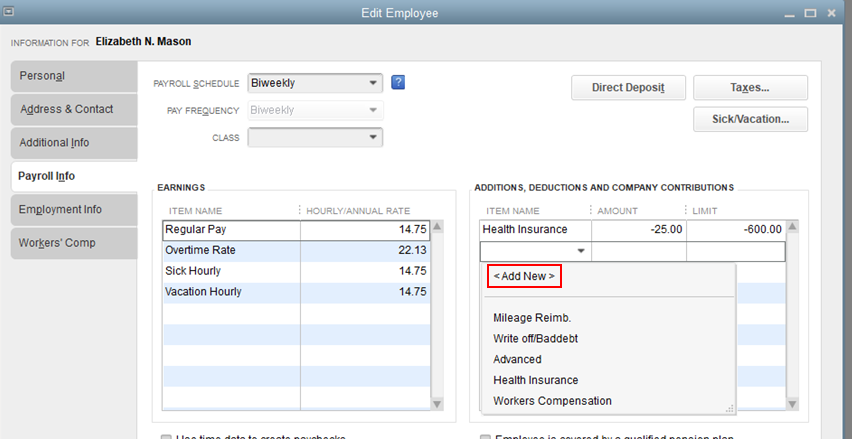

Once done, you'll have to create an additional item for non-taxable to refund the $656.45 back to your employee.

After adding the item, you have the option to apply the $656.45 on the next payout of your employee. You just need to select the item and enter the amount to add it to his/her paycheck.

For more information about processing payroll in QuickBooks Desktop, feel free to check out this article: Create paychecks to pay your employees.

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response. Have a great day and stay safe.

Thank you for posting, @uwphotonut.

There are reciprocal agreements between states that would require an employer to only pay income tax to one of the two states. I'd suggest you consult your state agency to determine what income taxes you may be subject to.

Check this fix an error on my filed form or request and amendment article. Our Customer Support will help in reviewing the issue with you and start the amendment process.

To ensure compliance with state payroll tax regulations, go to the Payroll Tax Compliance page and select your state.

Please reach out if there's anything else I can do to help. I'm always here to assist. Have a great rest of the day!

I have already jumped through those hoops. What I need to know is HOW to fix the error in Quickbooks. Where do I make the correcting entries and so forth and in what order so that Quickbooks will properly reflect the changes made.

I appreciate you getting back to us, @uwphotonut.

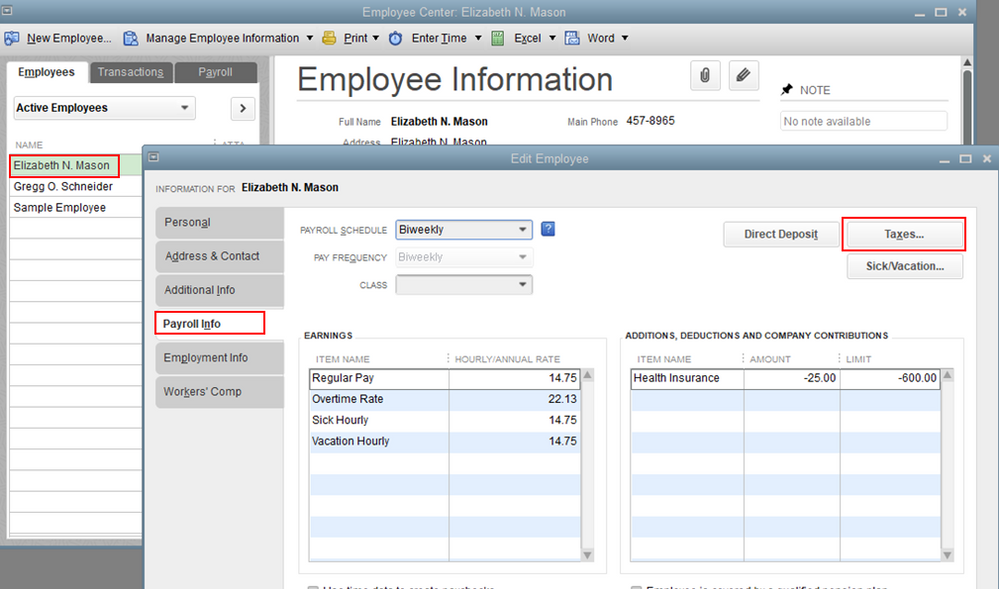

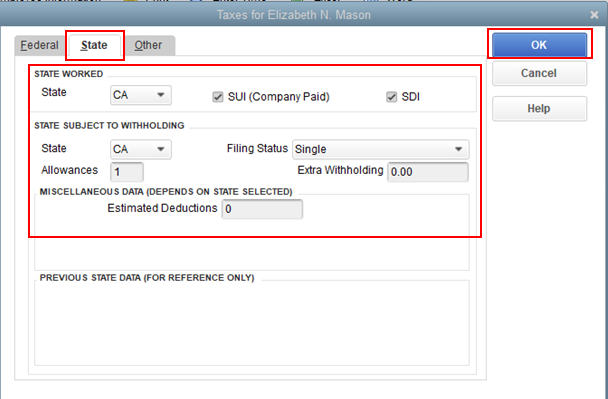

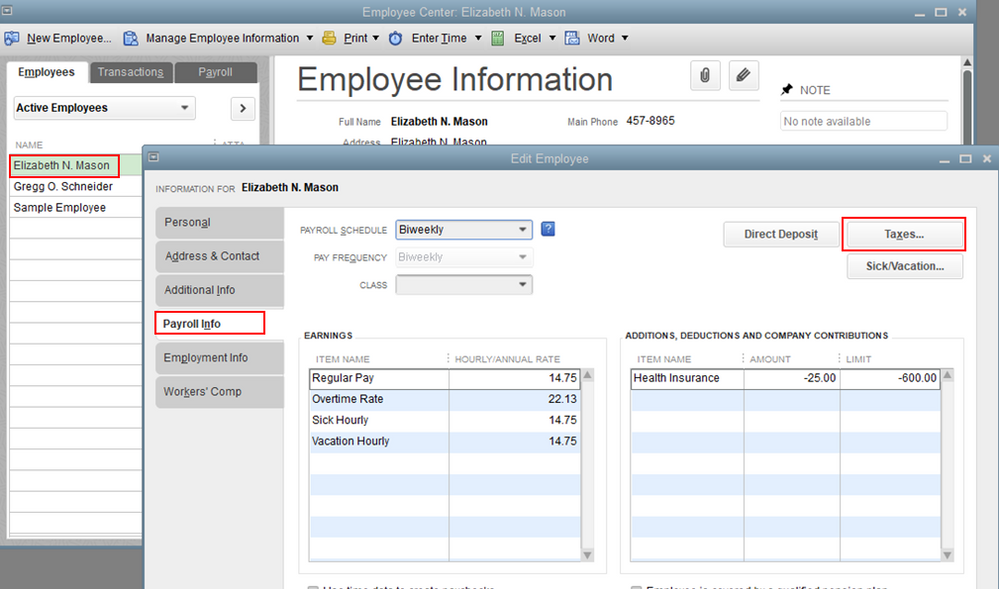

QuickBooks depends on the information entered. Let's first check the employee's information and update it. This way, the calculation of taxes will be accurate moving forward.

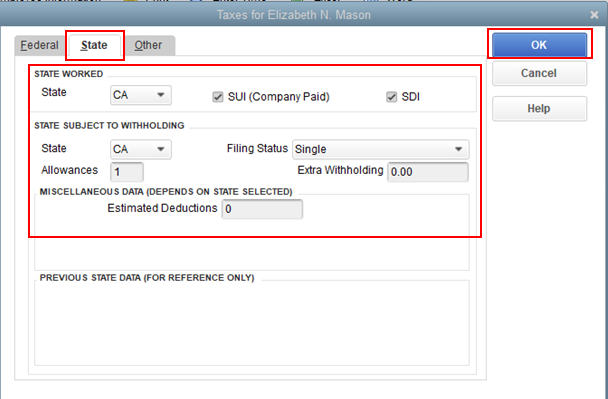

Here's how:

I'm adding this article for more details: Update employee info.

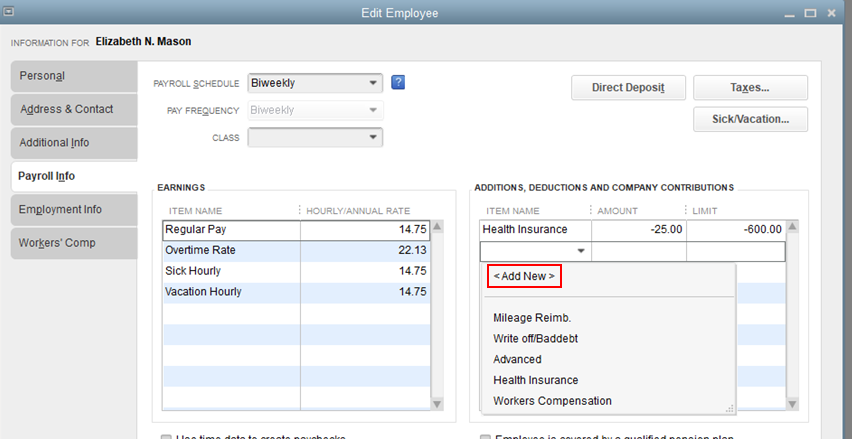

Once done, you'll have to create an additional item for non-taxable to refund the $656.45 back to your employee.

After adding the item, you have the option to apply the $656.45 on the next payout of your employee. You just need to select the item and enter the amount to add it to his/her paycheck.

For more information about processing payroll in QuickBooks Desktop, feel free to check out this article: Create paychecks to pay your employees.

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response. Have a great day and stay safe.

That was exactly what I needed. THANKS!!!!!

Hello there, @uwphotonut.

I'm happy to know that I was able to resolve your concern about the incorrect calculation of taxes in QuickBooks.

Please know that the Community team and I are always here to help with any QuickBooks concern you may have. Thanks for coming to the Community, wishing you continued success.

I followed you instructions (they were great) and then waited for my account number from the FL Dept of Revenue. I have edited the employees record so that GA withholding does not happen. The question is how do I now add the FL unemployment withholding? I have set up the account in Quicken, applied the tax rate but I can not find out how to add it to the employee.

I appreciate you for getting back to us and for performing the steps provided by my colleague, @uwphotonut.

QuickBooks Desktop Payroll will only handle one state withholding and one state unemployment. If your employees work in Florida, you'll have to enter FL in the State Worked. However, QBDT does not support if the employee is subject to both GA and FL unemployment.

When an employee works in more than one state. You can refer to the four tests to determine which state’s payroll taxes the employee services are subject to Localization, Base of Operations, Place of Direction and Control, and Residence of Employee.

For more information, about the four tests, please check this article: Localization of Work Provisions. It also provides detailed examples that have been taken from state manuals.

Also, I'd recommend consulting your accountant, as well as the applicable state tax agencies. They can advise what payroll taxes the employee(s) services may be subject to.

I've added this article for reference about Multi-State Employer Unemployment Insurance Requirements.

Please know that I'm just a post away if you have any other questions about QuickBooks. Have a good one.

The employee works in FL only as of the first of this year. How do I change the employees state tax from GA to FL.

Good morning, @uwphotonut.

Thanks for following up on this thread. I'd be happy to help show you how to change your employee state taxes.

Before going into detail, I want to ask if the employee was paid under an incorrect state? If so, you'll need to contact QuickBooks Desktop Payroll to make corrections to previous payrolls.

If you're just needing to set up an employee is a new state, here's how:

For more detailed instructions on how to set up an employee in a new state, please refer to this article: Change state taxes for an employee.

I look forward to speaking with you soon. Have a good rest of your day!

I did that but I STILL CAN'T ADD the FL unemployment insurance to the paycheck. How do I do that?

ok, once you do this to pay the employee back the taxes taken out in error, does that correct the W-2 when it's issued?

Thanks for following up with the Community, uwphotonut.

You can add unemployment insurance to an employee's paycheck by making some changes to their profile.

Here's how:

I've also included a detailed resource about working with unemployment insurance which may come in handy moving forward: Update your State Unemployment Insurance (SUI) rate

Please don't hesitate to send a reply if there's any additional questions. Have an awesome day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here