Congratulations on making your first post here, @Laurie72. It's my pleasure to help you process an EFT against payroll liabilities.

Follow the steps below for scheduled payment:

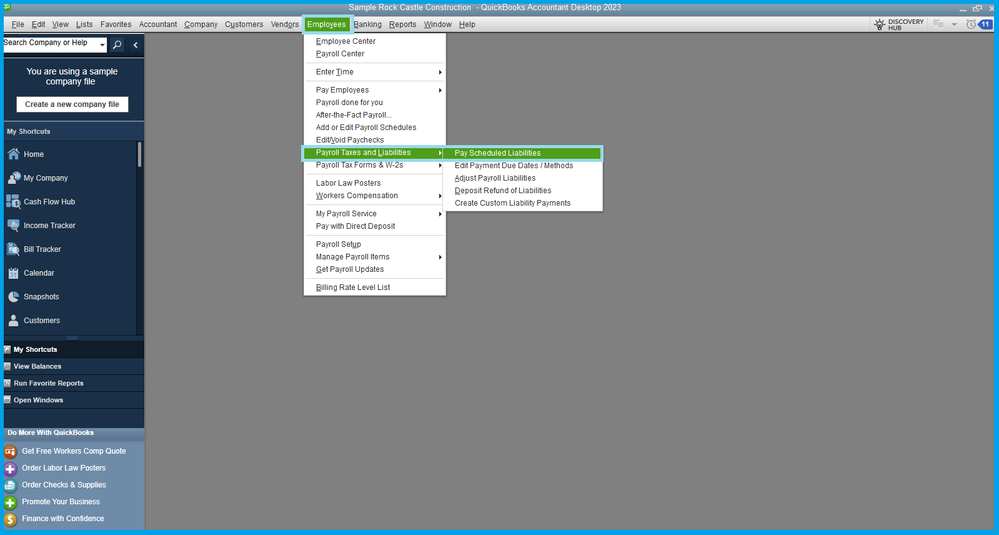

- Go to Employees, select Payroll Taxes & Liabilities, then click Pay Scheduled Liability.

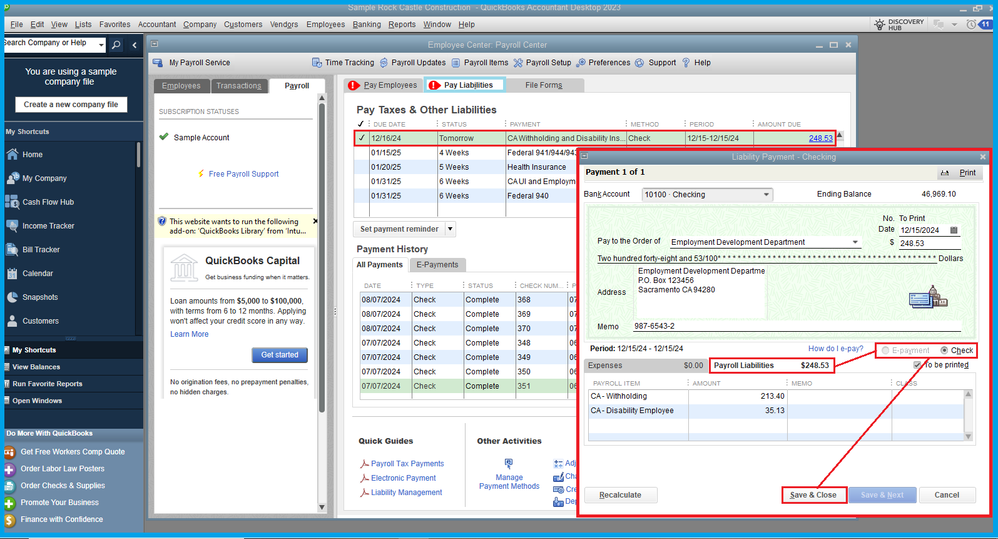

- In the Pay Taxes & Other Liabilities window, choose the tax or other liability from the list. Then tap View/Pay.

- Review the dates and the amounts due.

- Press Check/E-pay to proceed.

However, if it's an unscheduled or custom payment, check out this article for the procedure: Pay your non-tax liabilities in QuickBooks Desktop Payroll. This includes links you can use to pay taxes or file federal forms.

If you have any other questions about payroll liabilities, please let me know by adding a comment below. I'm more than happy to help. Have a great day!