Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowHi @linkaxel , filling W-2c form is unavailable in QBO, so you could request the official form from IRS. If the changes are already on your account,

I suggest pulling up the Form W-2 to guide you with entering information for W-2c.

Here's how:

For more detail : Correct or amend w2 forms

You'll have to enter the correct SS# in the employee's profile. Then, reprint the 2019 W2 form containing the right details, @linkaxel. I'm here to guide you how.

In QuickBooks Online (QBO), it's necessary to update first your employee's SS# so the system will display the appropriate information into the new W2 form. Here's how:

Once done, print the W2 form and give it to your employee. With this, he/she can use the corrected one in filing for unemployment to the agency.

After that, manually file an amended form to correct the employee's tax information to the SSA. You can use the W-2c form, then make sure to indicate the employee's correct SS#. You can refer to this article for the complete instructions in preparing the W-2c form: General Instructions for Forms W-2 and W-3.

To check the accuracy of your employee's SS#, you can pull up a payroll report. For this, I'd recommend opening the Employee Details report. It contains employee data such as employment info, pay info, and payroll details to name a few. Just go to the Payroll section in the Reports menu to select it.

I'm also adding these articles to answer the most commonly asked questions about correcting and amending W2 forms:

Please let me know if you have other concerns. I"m just around to help. Take care always.

The 2020 W2 has two SS#'s one correct and one incorrect how can I rectify this and file a new

W2 for 2020

Thanks for posting here, @Hotdogsman,

I can help you do your W-2 corrections. Please note that the amendment process may differ for every QuickBooks Online Payroll versions.

If you're using QuickBooks Online Payroll Enhanced, you must create and file a W-2C form with the Social Security Administration manually. This form is currently unavailable for this payroll service which is why you need to do it outside the program. See the General Instructions for Forms W-2c and W-3c section in General Instructions for Forms W-2 and W-3.

For QuickBooks Online Payroll Core, QuickBooks Online Payroll Premium, QuickBooks Online Payroll Elite and QuickBooks Online Payroll Full Service subscribers, we will be the one to fix it. Our experts will file a W-2C form with the SSA, and mail the W-2c to your employee. You’ll also receive a copy of the amended form.

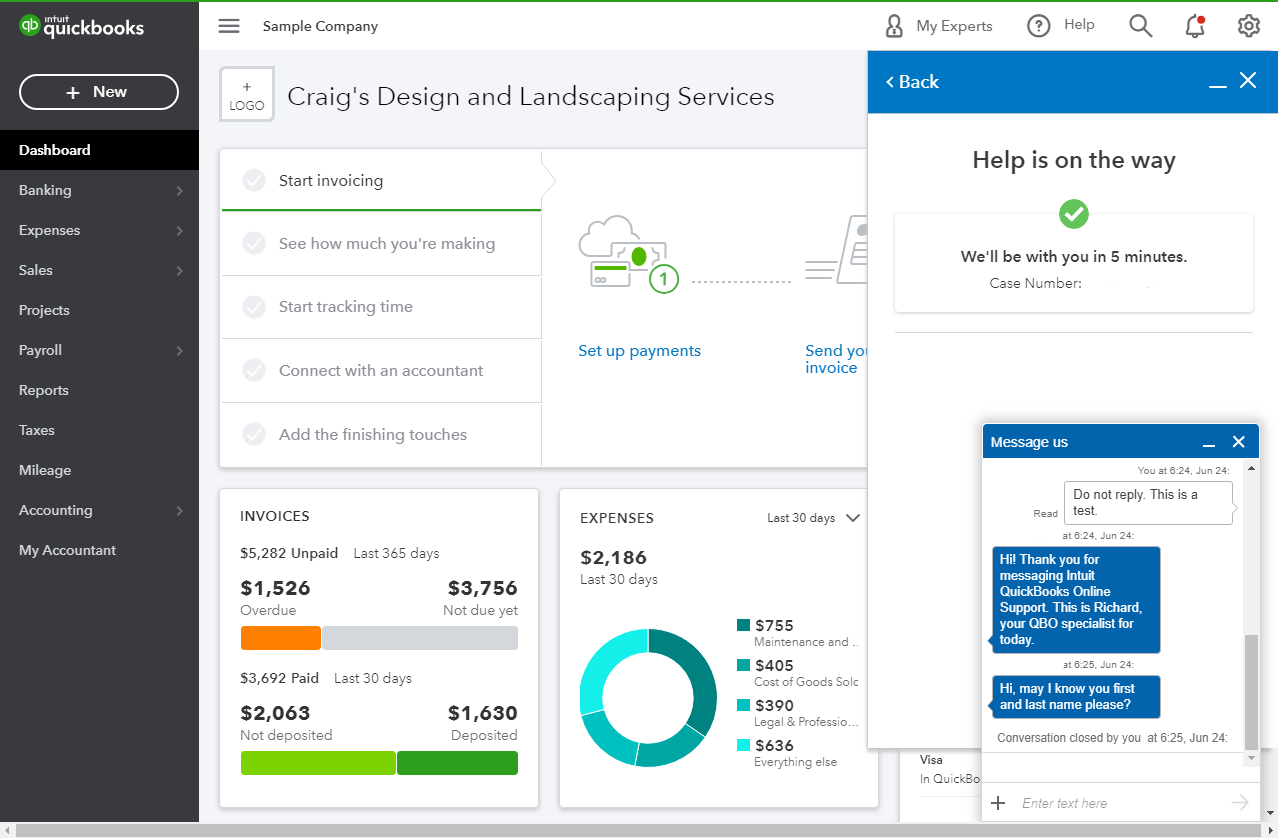

To request a correction, please contact our Support Team. Here are the steps to do that:

When you're connected, provide all the information about your concern or request a viewing session with out representative.

The expert you talk to will let you know approximately when you and your employee should expect to receive the W-2C.

To check which subscription you have with us, go to the Account and Settings page. Follow the steps below:

Let me know if there's anything else I can help you. I'll be right here to assist you with your payroll forms and take care of other concerns in QuickBooks. Have a nice day!

I need to get a call back regarding correction of a W2 form

[removed] my cell number

Thanks for joining the thread, haferehm. I love to help you with your issue about W-2.

For me to provide you with the resolution, may I know what specific assistance you need? I can answer some general questions or concerns you may have about QuickBooks. Simply click the Reply button below, and I’ll do everything in my power to assist.

However, if you really need to speak with our Customer Care Team, we've updated a better way of contacting them without publishing our phone number. You can do this by requesting a callback or messaging an agent.

Check out this link for ways on how to connect with us: Contact Payroll Support. Ensure to review their support hours, so you'll know when agents are available.

In the meantime, to know more about correcting the W-2 form, see the below articles:

I want to make sure this is taken care of for you. Please get back to me about how this goes. I'll be right here to continue helping. Have a great day.

I corrected the one employee's SS# but I don't know how to electronically send in the one employee's corrected SS#.

Thanks for chiming in on this thread, @Melitta. I can certainly share some information on how you can electronically send your W2 forms through QuickBooks Online (QBO).

If you haven't filed your W2 form yet, then you can just file your W-2 forms as you normally would.

If you have already filed your W2 forms, you can manually file an amended form to correct the employee's tax information with the SSA. You can use the W-2c form, but ensure to indicate the employee's correct SS#.

You can refer to this article for the complete instructions for preparing the W-2c form: General Instructions for Forms W-2 and W-3.

I'm also adding these articles to answer the most commonly asked questions about correcting and amending W2 forms:

Don't hesitate to visit and drop a post again if you have other concerns about your payroll forms or other questions about QuickBooks. The Community has your back. Take care always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here