Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'm here to help set up local withholding for your employee, mikelafrance.

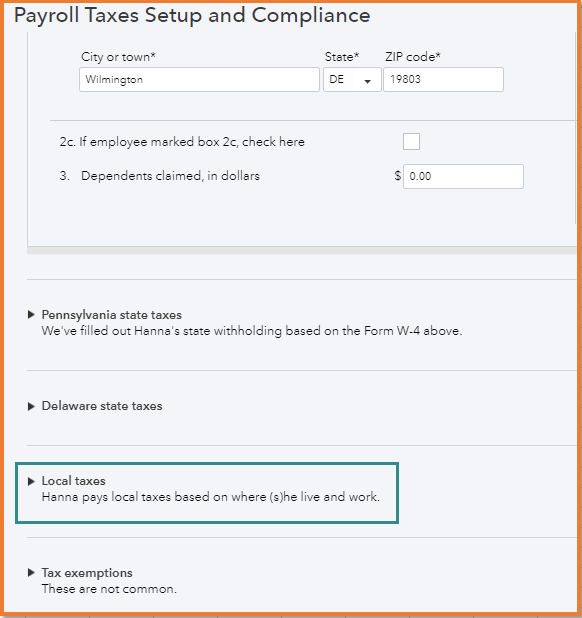

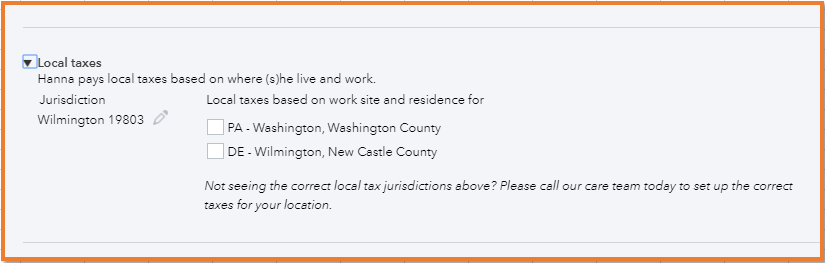

Payroll taxes are based on your employees' residence location as well as their work location.

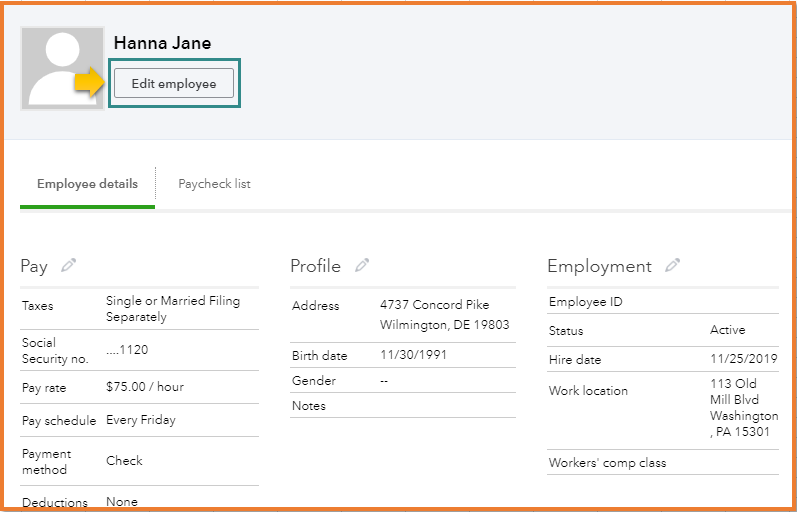

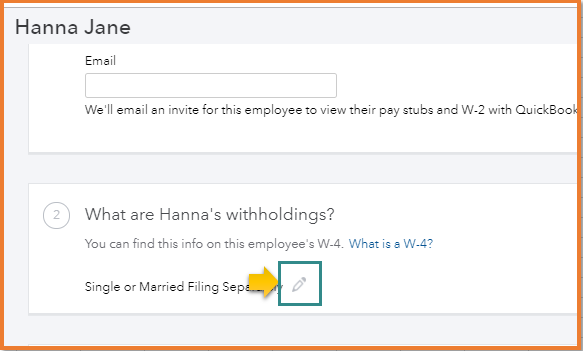

After adding the employee's information, you can mark local taxes for the employee who resides in DE and works at PA through the employee's profile.

And, the following steps outlined below will show you how to accomplish this:

Please take note that local taxes showing up in QuickBooks are derived from the reciprocity agreements of your tax agencies. You can refer to the About multistate employment payroll situations for more details.

Stay in touch with me if you need anything else. I'm always right here to help.

Thanks for your response but QB Online does not give me the options you are showing.

W-4Employee's Withholding Allowance Certificate | 2020 |

1a. First name* M.I. Last name* | 1b. Social Security number* |

Filing status (choose one) Single Married Do not withhold (exempt) Do not withhold (exempt) | Allowances | Additional amount $ |

|

Thanks for getting back to this thread, @Bev66.

Sometimes local internet cache files stored in the system can cause unexpected behavior in the product. This can be the reason why you're unable to see.

The best thing that we can do is to perform some basic troubleshooting steps by following these procedures:

First, let's use a private window to access your account. This doesn't save your site data and visited pages. Here's how:

If you're able to view the setup in the Employee's window, then let's clear the cache in your web browser or try using a different supported browser. This might be a temporary issue with QuickBooks and the current browser that you use.

Let me also provide you a link to check if your browser is compatible with QuickBooks: Fixit.intuit.com.

Additionally, there are several payroll reports you run in QuickBooks Online Payroll. You can use them to view useful information about your business and employees.

If there's anything else that I can help you with, please let me know in the comment section down below. I'll be around to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here