Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowLet's ensure you're able to enter the lump sum contribution in QuickBooks Online (QBO), DPARENT.

To record the contribution, we can create a journal entry within QBO. However, this entry will not be reflected in the W2 form. To address this issue, I recommend reaching out to our Customer Support Team. They can securely access your account and assist in entering the contribution correctly.

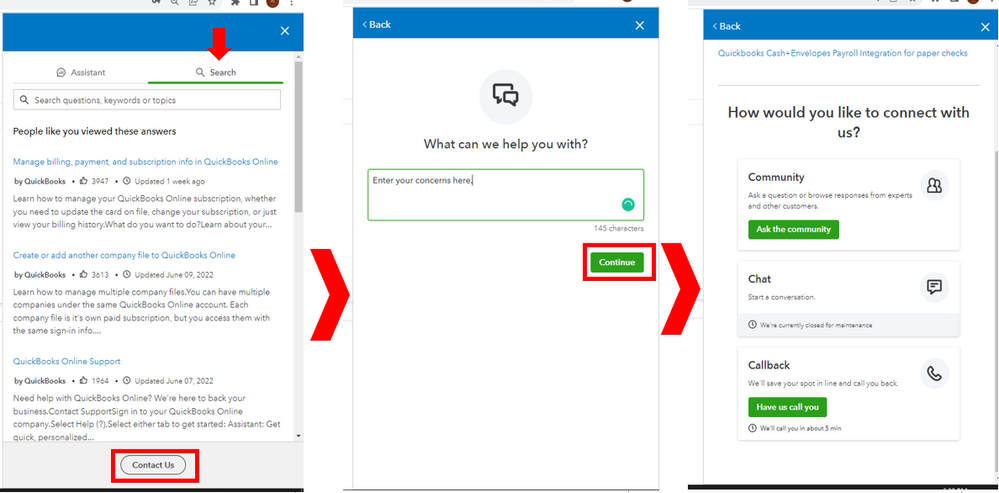

Here's how:

I'm adding this article to learn more about adding a payroll deduction or contribution in QBO: Add or edit a deduction or contribution.

Please know that I'm just a reply away if you need any further assistance processing payroll. Have a good one!

If I add a 401K Deduction onto Quickbooks Payroll does Quickbooks take that money out and send it to my 401K provider or Do i manually send it in to them ? Also I am opening up a SOLO 401K which Quickbooks apparently doesn't support but I am assuming I can just clasify the deduction as a 401K contribution. Is this correct ?

Let me shed some light on this, DPARENT.

QuickBooks Online (QBO) does not automatically transfer your funds to your 401K provider. You'll have to initiate the transfer manually.

Furthermore, yes, you do have the option to select the nearest 401K plan. I would also recommend consulting with your accountant for assistance during this procedure.

I'm adding these articles that you can read to learn more about 401k and how to efficiently run your payroll:

If you have any other payroll questions, let me know by adding a comment below. I'm more than happy to help. Keep safe!

It was interesting because even though they won’t transfer the money I needed to have enough money in the account to process the payroll.

Will quickbooks do a journal entry on the deduction even though they aren’t taking it out. How do I account for the deduction in Quickbooks online ?

So every week, when payroll is run and employee contributions are set aside for the employee(myself), I have to manually transfer those funds to the 401k account? Is this normal, or is this just something that Quickbooks doesn't offer a service for(transferring automatically)?

For employer contributions, is the same true? A manual transfer is needed?

Thanks

Greetings, ERP2019! We are delighted to have you join this discussion and seek clarification regarding the 401k account. We'd be pleased to provide the information you need and help you clear things up.

When it comes to retirement planning, various savings options are available. One of the most popular retirement savings options is the 401(k) plan.

If you've set up a retirement plan in QuickBooks Online, any contributions made by employees or employers will be automatically recorded in their assigned accounts. The specific account where these contributions go will depend on the type of account you choose to track them.

To set up a retirement plan deduction or a company-match contribution item in QuickBooks, ensure that you select the 401k account. Afterward, update the payroll accounting preferences to designate the account where the contributions should be recorded.

However, if you're referring to the auto-pay feature, please note that the Online Payroll system does not create the check to pay non-tax liabilities such as Health Insurance premiums, 401(k) contributions, and Child Support. Here are the steps to follow: You will need to create these payments from the Check screen. Here's how:

For more detailed instructions, read this article: Create a payroll liability check.

Moreover, I've also included these resources that you can refer to in handling other payroll-related activities:

The Community is always available to help you if you have further questions about managing contributions or need assistance with other QuickBooks challenges. We're rooting for the success of your business venture, ERP2019. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here