I've got the details you need about completing your 2017 and 2018 taxes in QuickBooks Self-Employed (QBSE), @onlyterence2013.

Right now, the option to directly file your 2017 and 2018 taxes using the software is unavailable. However, I'd suggest running the yearly reports since your info is in the system. These reports will serve as your reference when manually filing them to the IRS. I'll guide you how.

- Log into your QBSE account.

- Go to Reports from the left menu.

- Set the date range of each report for 2017.

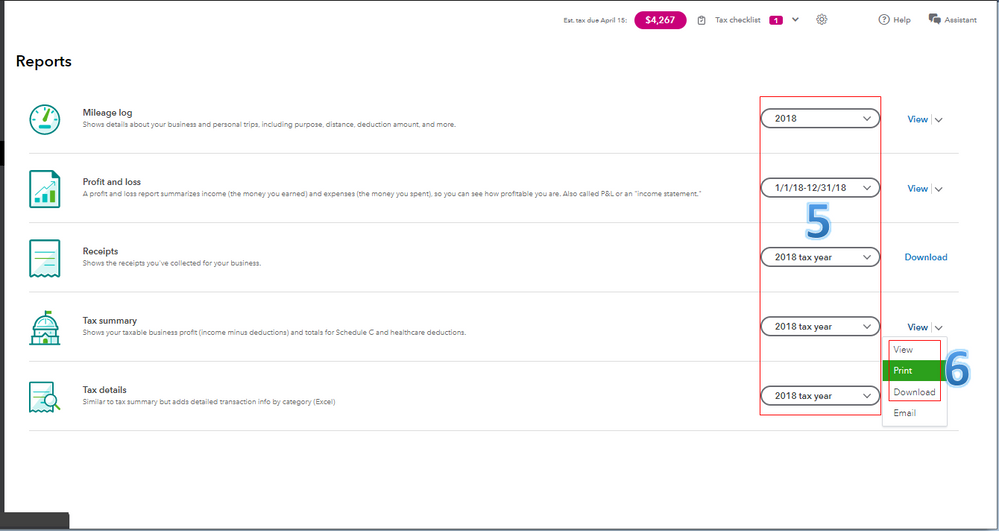

- Click either View, Print, or Download.

- Change the period of each report for 2018.

- Hit either View, Print, or Download again.

The screenshot below shows you the last two steps. For more information, see the How do I run my year-end reports? section through this article: Manage Taxes and Forms.

Once done, you'll have to manually file your annual return to the IRS for each year. To learn more about this process, I recommend visiting their article: Self-Employed Individuals Tax Center. Just go to the How Do I File My Annual Return? section.

Additionally, I'd want to make sure you'll get ready for your 2019 taxes. We combine all the important tasks for self-employed, like you, to make the tax preparation easier for you. With this, please check out this article: Annual Taxes Guide. It has in-depth information about completing the Tax Checklist, creating a file of your tax documents, and running year-end reports.

I'm just a comment away if you need further assistance. Enjoy the rest of your day, @onlyterence2013.