Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowWe are moving the payroll from an accountant to Quickbooks Pro Plus desktop payroll. We are doing this effective July 1.

One employee worked in CT for Jan 1 through June 30. Starting July 1 he began working in Maine. I input the first 2 quarters of payroll for CT. Then I added the new work location in Maine and ran the payroll for July, which went fine.

However, as I am trying to complete the payroll setup, I am finding quickbooks has applied the Q1 payroll of $11,000 to both ME and CT. Q2 is applied to CT only, July is applied to ME only, but Q1 has generated ME and CT unemployment and has applied that $11,000 in payroll to both states.

I went in and manually removed the payroll from ME. However, it keeps going back on and creating an error. Please see the attached image. Can you help me correct this?

Hi there, CA8C.

Thank you for providing additional information and a screenshot of the problem. I'd like to share an idea of why state tax setups haven't changed.

We can review the employee's information to make sure we enter the work location correctly and set up payroll in a new state again.

Here's how:

To give more information on how to set up an employee moves to a new state, here's an article: Set up payroll taxes in a new state.

Create payroll liability adjustment to correct the state unemployment taxes for both states. Take some time to view this article: Adjust payroll liabilities in QuickBooks Desktop. It shows the steps on how to correct employees’ year-to-date (YTD) or quarter-to-date (QTD) payroll info.

Let me know if you have other payroll questions for me. I'm still here to help you further. Wishing you all the best!

I received this private message as soon as I posted this thread:

"Hey, Contact QuickBooks Helpline team directly at toll-free Number +[removed] "

I assume that is a complete scam, correct?

Your data security is our top priority, @CA8C. That's why I'm here to share further details about recognizing official Intuit correspondence and websites to keep your account safe.

Phishing, spam, spoof, or hoax messages are a huge issue today. Suspicious messages can sometimes be a scheme to get you to share your personal information.

Please note that customer support scams work by convincing you there’s a problem with your computer, then offering to fix it. Intuit won’t reach out to you to fix a problem with your computer. These fraudsters are really after your money or files. Our security tips can help you avoid fake customer support scams.

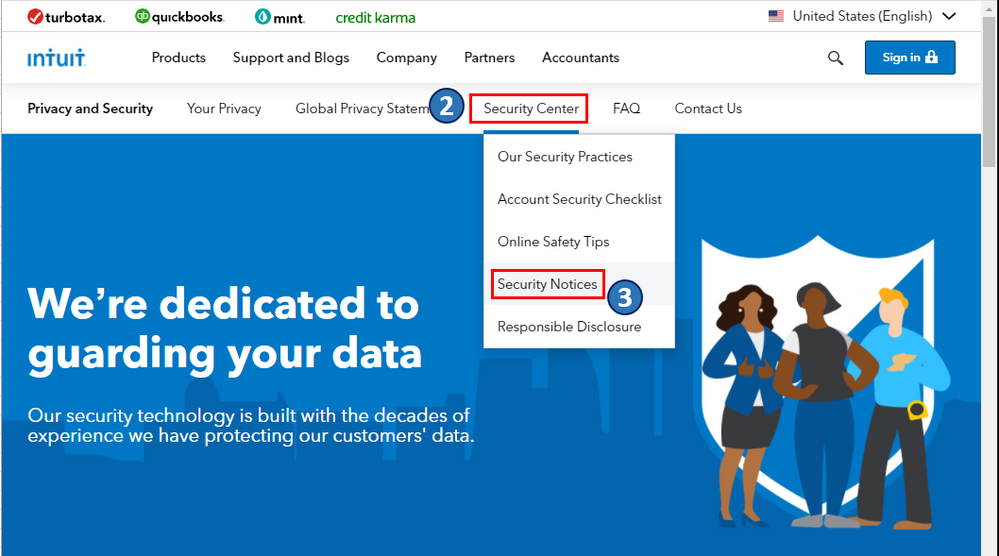

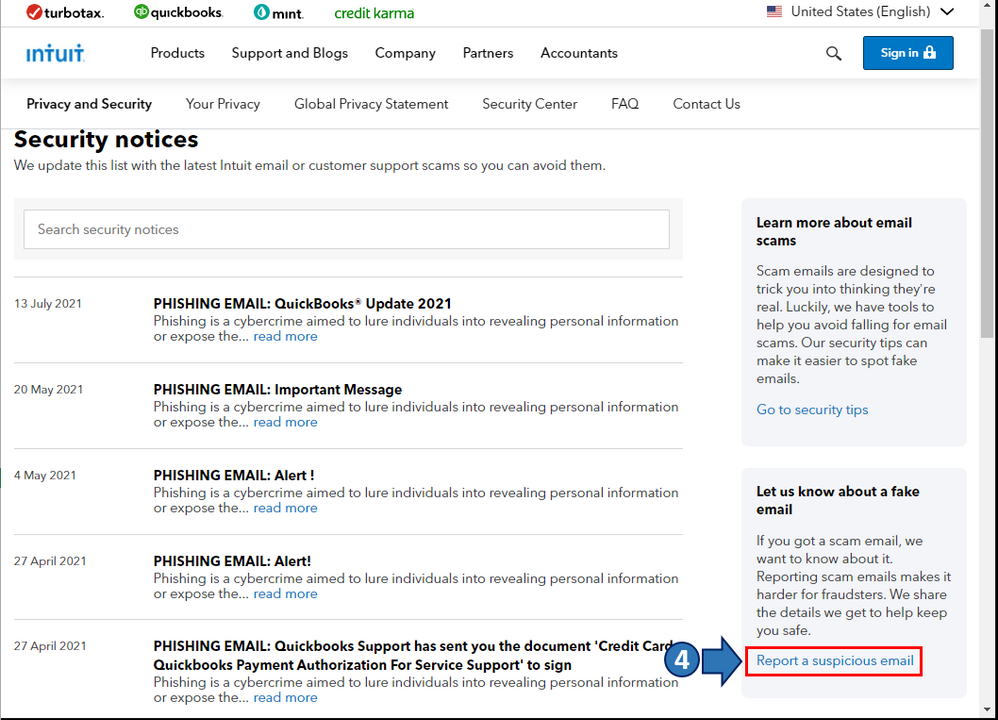

When you suspect that you have received a phishing message/email targeting the Intuit brand, you can do the following to report it:

Once you notify us about suspicious emails, it helps keep everyone protected. To learn more about this, I'd recommend checking out this article: Identify suspicious activity, phishing scams, and potential fraud.

Also, I'm adding this article to know how dedicated we are to guarding your data: How We Keep Your Data Safe. It includes topics about multi-factor authentication, data encryption, and advancing our security, to name a few.

Keep me posted on how it goes. If you have other payroll concerns or data privacy inquiries, just drop a comment below, and I'll gladly help. Take care, and wishing you continues success.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here