Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI appreciate you for joining this thread, sherwood. I'll share some insight on how to fix the issue so you can send your direct deposit data to QuickBooks Desktop (QBDT) payroll.

To sort this out, I recommend updating your tax table to the latest release so you'll always have the latest features and fixes if you haven't already. But beforehand, please make sure that your QBDT is up-to-date. In case you don't have the latest payroll update, you can follow these steps to update it:

Then, please also check if you have the correct payroll service key and if the status is active. Here's how:

If you have an active payroll service key and the issue continues, you can run the Verify and Rebuild Data tools if you haven't done it. We can perform this to verify and resolve the most commonly known data issues within your company file.

However, if the issue persists, I suggest contacting our Payroll Support Team since the Community is a public forum, and we'll need to collect some personal information to pull up your account. They'll be able to pull up your account securely and perform a screen-sharing session to investigate this behavior further and pinpoint its root cause.

Please don't hesitate to reply to this thread if you have other QuickBooks-related concerns. I'm just around to help. Keep safe!

I have been trying to transmit payroll and get an error message - "problem The PIN has been entered incorrectly too many times.

I have waited the 15 minutes to transmit again and continue to receive the same error message.

Thank you,

Frank Cesario

THANK YOU SO MUCH! This was a HUGE help! One of our employees decided to split their net direct deposit into two separate bank accounts. I went in to that particular paycheck and removed the amount going into the secondary bank account so the full deposit was going into the original primary account (I did not remove the bank account in the employee's file, just edited the paycheck so that line item was zero and it automatically updated the other bank account to reflect 100% of the net pay). I attempted to resubmit the payroll and it went through without problems.

I did not change the employee's set up. I will attempt this again next payroll to determine whether I get another error message when trying to split the deposit. If so, we will know that Quickbooks does not seem to be able to split the deposit. If all goes well, maybe it's just the initial submission for the new secondary account needs to be zero?

You are an angel!! This solution worked for me - there were two new employees since last payroll. I followed these steps for both of them and THANK YOU!!!

The client is out of town with limited cell service... I thought I was seriously screwed.

We have Quickbooks Enterprise, I went on help and chose contact us option for them to call me back, I did not have to do anything - they fixed this issue on their end.

Error message

we’re sorry. we’ve encountered a Payroll Service connection error and could not send your payroll information.

We want to ensure you're able to send payroll information, Buck13.

Upon reviewing our records, I've found that there's an open investigation regarding your concern. Our software engineers are working diligently to identify the root cause of the problem. We assure you that we are taking all necessary steps to get this rectified as soon as possible.

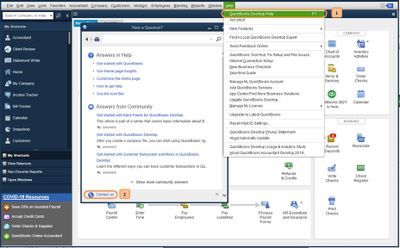

For now, I recommend contacting our support team. This way, you'll be added to the list of affected users and receive status updates through email or SMS. For a faster transaction, provide this investigation number to our representative: INV-93674. Here's how:

For more details about our support availability, refer to this article: Contact Support.

Your patience and understanding are greatly appreciated as we work to address the issue. We look forward to providing you with the best possible experience in the future, Buck13. If there's anything else that I can do for you, just tag my name in the comment section. Take care!

I am receiving a code 9000 when sending my payroll for Direct Deposit. I had the same issue last week and it was an error on your end. It was fixed and my payroll was sent and everyone got paid, however it is showing in Quickbooks that last week payroll was not sent nor was it deducted from our QB Checkbook. This week payroll will not go through again. I have updated Quickbooks, I am in Single user mode, my internet connection is good. Please advise.

I completely understand how crucial it is to have accurate payroll data, especially when it comes to running and reporting, andrea. I'm here to ensure this gets resolved.

First, I recommend running QuickBooks as an administrator. Doing so allows the program to access system resources that may otherwise be restricted:

Next, update QuickBooks to the latest release. Doing so ensures you have up-to-date features and fixes.

Then, download and install the latest tax table to stay compliant with paycheck calculations:

After that, check your system time and date settings. If your system date and time are wrong, update them.

If the issue persists, set your Windows firewall and security settings for QuickBooks Desktop.

Once done, verify if the paychecks show. Then, run payroll for this week.

Lastly, QuickBooks Desktop offers various payroll and employee reports to help you manage and keep track of business and employee expenses. You can customize the data to get the information you want to see.

If any other concerns arise or if you have additional questions about managing payroll, please don't hesitate to add a reply below. I'm here to ensure that you receive the help you need and to be your advocate throughout this process.

This solution from @Bstandridge worked for me:

"When we added a new employee/changed an employees banking information, I did this and we did not have any issues.

If someone wants to adjust bank account information, submit payroll to qb with everyones name but at 0.00 amount. This should let QB update everything. Then try to submit a normal payroll.

They said that updates the information on both sides and does not cause a fuss. Hopefully this works for people."

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here