Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I need to set up an item as an addition that will also be included as wages when calculating the employees IRA deduction. Right now, QB had me set up a salary item with the rate of 1.00 as a work around. This is really not what the client is used to seeing. They want the insurance reimbursement to automatically show up on every paycheck like it has been (they just added the IRA in February). Anybody have a solution?

Good morning, @texaslonghorns.

Welcome to the Community. I'm here to get you on the right track.

There are two ways that you can set up a payroll item for retirement benefits.

For more details on how to set up the item in QuickBooks, I recommend checking out: Set up a payroll item for retirement benefits (401(K), Simple IRA, etc.).

Once you have the payroll item added, you'll need to add it to the employee record. Here's how:

If you have further questions, feel free to reach back out. I'm always happy to get you back to business. Take care and have a great week ahead!

I followed this process. The item I added is an allowance that needs to be added to taxable income and also used in our Simple IRA calculations. It is calculating correctly as far as the amount. But it is not being added to total wages for purposed of calculating IRA deductions and company match.

Thanks for giving us a follow-up, CindyW2.

I appreciate your effort in following the process of setting up IRA payroll set up. Since the amount is not adding to the total wages, I suggest contacting Payroll Support. This way they can review your Payroll set-up to make sure calculations are accurate.

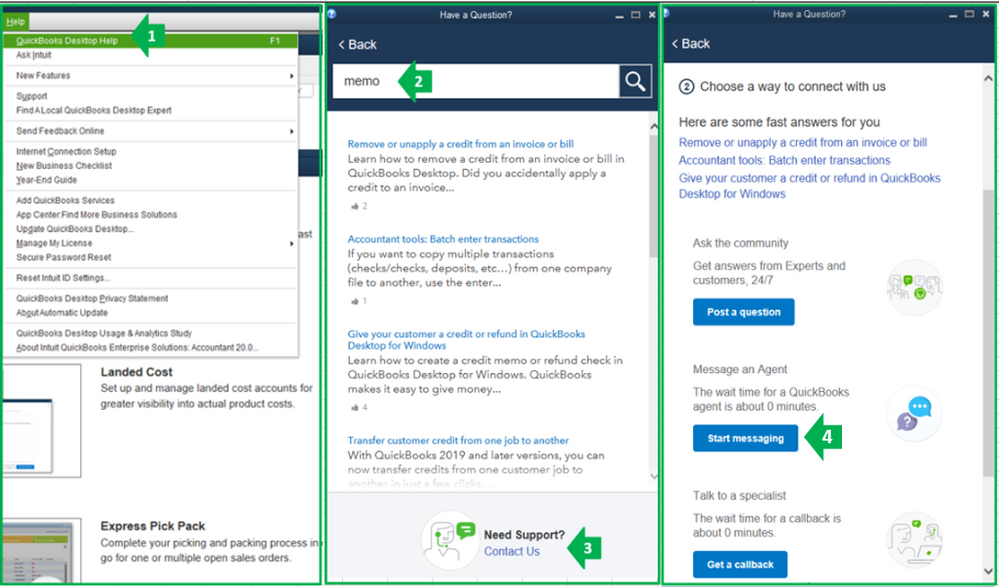

Here are the steps to contact support:

Our operating hours for chat support depend on the version of QuickBooks that you're using. Please see this article for more details: Support hours and types.

You might also want to visit our help page to browse articles that can guide you with your QuickBooks tasks. To get started head to our QBDT help articles at this link.

Keep me posted on other payroll questions and I'll be around to further help. Have a good day.

I am wondering if there was a solution to this request. We have added a "benefit allowance" to the employee's paycheck and the 401(k) contribution is not counting the allowance even though it's set up as compensation. Hoping there was an answer to your question as mine looks to be the same situation.

I appreciate you joining this thread concerning setting up compensation in QuickBooks Desktop (QBDT), @lmbart. Let me route you to the correct line of support that can assist you with payroll setup.

Since the amount is not counted as compensation even though it is set up as one, I suggest contacting Payroll Support. This way, they can review your payroll setup to make sure the calculations are accurate. Here's how:

On the other hand, you can refer to this article for their support hours and schedules to contact them at your convenience. This article also includes their contact number at the bottom of the page: Contact Payroll Support.

Keep me posted on any other payroll inquiries you may have, and I'll be available to offer further assistance. Have a good one!

Hello! Have you looked into the order of the payroll items in the employee's setup - Payroll Info tab? I believe this had caused issues for us in the past as we had the retirement plan payroll item listed after the Health insurance deduction, therefore, the retirement plan amount was calculating after deducting the health from the gross wages. By placing the retirement plan payroll item before the health deduction item, the amount was calculating correcting off of gross wages (before the health deduction). Hope this gives you some direction and it solves your particular issue!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here