Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowUnder the Pay Liabilities section, I have a series of old "overdue" liabilities that are still queued up. I would like to clear this, because I have paid these liabilities outside of QuickBooks on the appropriate websites. Can someone help explain how I can get rid of these?

Thanks for visiting the Community, @dsteffhill!

I'll outline a couple of handy details to help you get rid of those overdue payroll liabilities.

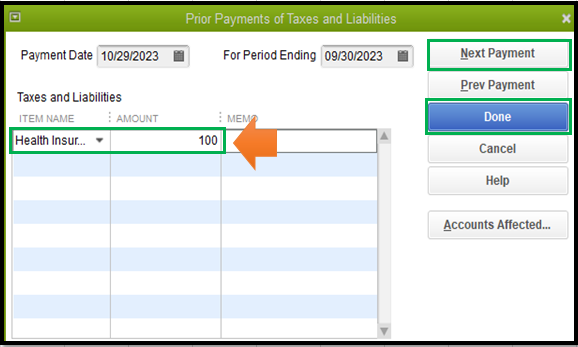

There are two ways on how to go about this. First, you can enter those payments you've made using the Enter Prior Payments option.

Here's how to do it:

Another way to achieve this is to enter the payment through the Pay Scheduled Liabilities. Please head to this link for more details: Pay a scheduled liability in QuickBooks Desktop.

I'll be adding this article for more insights about payroll liabilities in QuickBooks: Scheduled liabilities show as overdue or in red.

Also, the Payroll Liability Balances report is a great source you can use to view your unpaid liabilities. You can run this by going to the Reports menu under the Employees & Payroll section.

Do you have more clarifications or need payroll tips? Drop me a comment below and I'd be glad to help you out.

Yes, to clear them, record the payments you made as liability payments in QuickBooks, not as standard bank checks.

For those payments already record in QuickBooks incorrectly, replace the check that's there with a liability check for the same amount and date for the taxes paid.

I am having the same issue with old liabilities that have been paid but were not connected to the liabilities due. I'd like to get rid of them since they are just sitting there but have been paid. When I tried to follow your instructions, it seems like it is going to debit my bank account for these liabilities. They have already been paid so I don't want my bank account to show a double payment. Also, I don't want it to be in my books that I paid these liabilities twice. Quickbooks does not make things easy when trying to clean up old mistakes that people have on their books. How do I get rid of these liabilities?

Thanks for joining in this conversation, @littlegreekgirl. I appreciate you for following the steps shared by my peer.

Since that doesn't resolve the issue, we can run the Verify Data/Rebuild Data processes to correct any data damage on the company file. Always create a backup to avoid any accidental data loss before performing these steps below:

Then, follow the steps above except select verify instead of rebuild. Check out this article for reference: Fix data damage on your QuickBooks Desktop company file.

Here are a couple of articles you may find helpful to you in the future in case you'll need to remove scheduled liability. Read through:

Let me know if you have additional questions. We're always delighted to be your guide.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here