Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHey Quickbooks -- the state of Maine Department of Labor announced a change in the CSSF Assessment Rate for 2024, increasing to 0.13% from 0.07%. As you know, we are unable to manually change this in our payroll setup, so please make this change in Quickbooks Payroll as soon as possible. Thank you!!!

Hello Scott,

Thank you for dropping by here in the Community. I'm here to share information about the Maine CSSF rate in QuickBooks Desktop.

QuickBooks provides payroll updates to QuickBooks Desktop Payroll subscribers. These updates include current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and pay options.

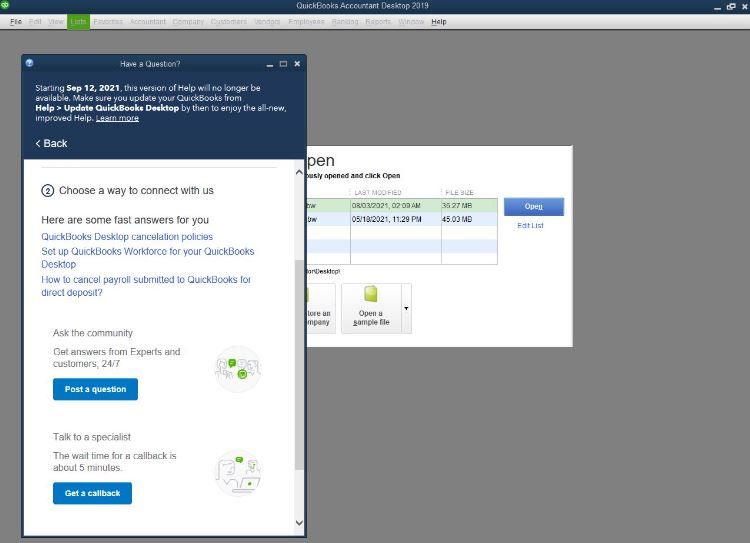

I recommend running the payroll update to ensure you have the latest release for the tax table. Here's how:

After performing the update, please review the rate to check if there are changes to the amount. If the problem persists, contact our Payroll Support Team for further assistance. Our Customer Support Team for Basic and Enhanced is available from 6 AM - 6 PM PT (Monday - Friday). For Assisted Payroll, any time, any day.

See the steps to get a hold of a specialist:

Also, if you have QuickBooks Payroll and received a tax notice of discrepancy, it is crucial to take care of it promptly to avoid additional tax penalties, interest, or notices. I've included a link you can visit to learn what to do if you receive an IRS or state tax notice of discrepancy: Send in your payroll tax notice.

Drop me a comment below if you have any other questions about payroll tax or updating tax rates. We'll be happy to help you some more.

I am having the same problem, have run the update as you suggested, and no change occurred to the CSSF rate or the UPAF rate. These absolutely need to be updated ASAP!

I am having the same issue here. Tried everything. No help.

We appreciate both of you for letting us know about the outcome of the troubleshooting steps you did to resolve the Maine CSSF rate in QuickBooks Desktop (QBDT) Payroll, Marty, and PSW5. We encourage you to contact the next available support option to further investigate this matter.

To do this, here's how:

Additionally, QuickBooks offers a selection of reports that can help you manage your payroll and keep track of employee expenses. To guide you in customizing them to get the information you need, you can check out this article: Run payroll and employee reports.

Please let us know in the comments if you have other payroll concerns or questions about state taxes in QBDT Payroll. We'll get back to you right away to assist you further.

I'm having the same trouble with my payroll as well. I've tried updating a few different times and the rates for the CSSF and UPAF stay the same. I finally submitted my payroll before the 5pm deadline tonight and figure I'll have to go back and figure out what the correct amount should be. It's a PITA for sure. Hope it gets updated ASAP!

Why hasn't this been fixed yet? My notice was mailed December 15. I need to do payroll today. This has happened in the past, also. I have installed all the updates.

This seems to happen every year... Perhaps they should make it so we can change it manually like the Unemployment.

We are having the same issue. I was able to change the 2024 Adjusted Unemployment Contribution Rate but after installing the payroll update, the CSSF has not changed. QB needs to fix this ASAP.

You're doing the right thing in installing the payroll update, EJPerry.

Thank you for letting me know about the issue with the payroll update. I appreciate your efforts in trying to install it. However, upon checking with my tools, there is an announcement regarding the inability to add the 2024 ME CSSF UI tagalong rate of .13%. With that said, I suggest contacting our customer support team so they can assist you with the issue. Also, the expert will add you to the list of affected users and will be sent a communication once the ability to add these rates becomes available in each product.

Feel free to read these articles related to state taxes in QBDT. They contain detailed insights about adding a new state to your payroll product and fixing incorrect state forms used on paychecks.

Additionally, I'm also sharing this recourse with you to guide you in ensuring the accuracy of your employee's payroll transactions: Learn how to create a payroll summary report to see what you've paid out

Please know I'm only a couple of clicks away if you have clarifications about Maine CSSF UI Tagalong Rate Change 2024 in QBDT. The Community is always open to answering your questions and concerns. Stay safe, and have a great day.

THE PAYROLL UPDATE DOES NOT CORRECT THIS ISSUE. THIS MUST BE DONE BY QUICKBOOKS PAYROLL, FOR WHOM WE PAY A LARGE FEE EVERY YEAR!

I don't know why they don't let us correct this manually!

So I tried contacting Quickbooks today, twice by chat where I ended up getting disconnected as they were trying to get me to the payroll experts, and once by phone where I was not able to make any headway. THIS TAX RATE NEEDS TO BE CHANGED BY QUICKBOOKS, and someone AT QUICKBOOKS needs to be in contact with the Maine Department of Labor to get this fixed. I've wasted enough time trying to get this fixed on behalf of every Quickbooks payroll user in Maine. I can just tell you that I'm switching over to manual payroll once my current subscription has expired!

I just got an email from Intuit with an update for the CSSF rate. I think we have you to thank for them getting it done as quickly as they did. Thank you!

Yes, the rate is finally updated!! You're welcome, as I was happy to push them!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here