Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi,

The basic problem that I started with was that my P60 for 2019/2020 is incorrect. There is one months pay missing. A QuickBooks representative suggested that when I moved to the new [standard] payroll system I may have forgotten to advance the payroll for the last month in the old system. So, as per instructions I deleted the M11 and M12 payrolls in the new system to try and get back to advance the payroll for M10. However, now I have delete these payrolls I am totally stuck - the system seems totally unaware of anything existing before M11. The representative I was dealing with has not replied to my emails for the past 4 days now and I will need to run my first payroll for 2020 on Tuesday next week.

I really need to get this fixed ASAP! Some help would be appreciated.

Hello there, ChangedDaily.

If you've already paid employees during the current calendar year, it's important that the information is entered in your account before you run your first payroll. This will ensure accurate year-to-date (YTD) totals on paychecks. To present the payroll before M11 you'll have to enter the YTD in order for the P60 will include all payroll of the employee from M1-M12.

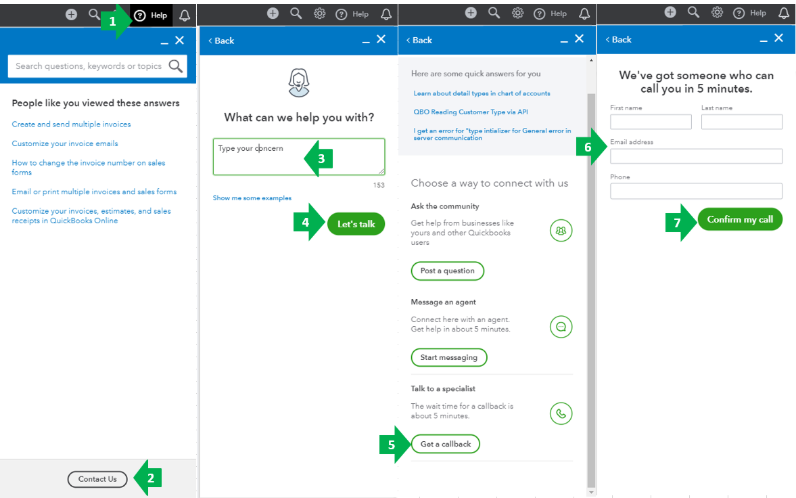

I also suggest getting in touch with us again so we can correct and walk you through the steps:

If you have further questions you can just leave a reply below. Take care always!

Hi,

Thanks for the reply. When you say "calendar year" in the first sentence are you referring to the accounting year/tax year or do you really mean calendar year? I don't think this can be the issue, the P60 was only short by one month's pay, not 10. I looked at the payslips and the YTD was correct for M10 the last month before I migrated to the new payroll system. However, the YTD is the same in M11, suggesting that M10 had indeed not been included in the figures.

I have contacted the help desk again last night and we started running the payroll again but the deductions were wrong for M11. The representative has assured me that someone will get back to me today to fix the problem

Patrick

I know how important it is to fix the incorrect P60s for 2019/2020 promptly, @ChangedDaily. I'm here to share the details about this issue, and how to take care of it.

My peer refers to the tax year when he said "calendar year" above. You're on the right track in contacting our support team last night. Please know that they'll get back to you as soon as possible to resolve this. Also, you'll receive email updates about your case's status.

Once resolved, you can manually download the P60s in the program. This way, you'll be able to send them to your employees. Just go to the Documents tab in your employee's profile. View the screenshot below for your visual reference.

Moreover, I recommend visiting this website: Payroll Year End 2019/2020 for QuickBooks Online Standard Payroll. It has in-depth information to help you prepare as you move to the new tax year, 2020/2021.

I'm here anytime you have other concerns. Take care always. Stay healthy, @ChangedDaily.

Hi,

I have not heard anything today to help me resolve this issue.

It has been 3 weeks now for what I would have thought to be a very simple issue for QB to help me fix.

It is now quite worrying that I will end up in an even bigger mess with payroll to run on Tuesday.

This is not the impression we want to leave with, @ChangedDaily.

It would be best for you to contact our Technical Support team again. This way, you’re able to get updates personally about the issue.

You can present the case number to our experts who will assist you. They can review and check the progress of the issue and provide other solutions if needed. To make sure you’ll be assisted immediately, please check out our support hours.

Allow me to share this help article that tackles more information about QuickBooks Payroll.

Please let me know how this goes. I'll be right here. Take care.

Hi,

Despite this being 'escalated' and speaking to numerous support personnel my P60 is still incorrect and my payroll is now also out of sync.

I need to run my Payroll and file with HMRC TODAY.

I should be working to meet my customer deadlines but again I find myself chasing up QB and worrying about how on earth I am going to deal with my payroll.

I'm now thinking I would be better off with a spreadsheet and the free HMRC payroll tools.

Thanks for sharing this with us, ChangedDaily.

I want to ensure you are routed to the right support that can help you get through this issue with incorrect P60 and out of sync payroll.

I know that you've already contacted our support team several times and I appreciate your patience. However, this situation requires thorough handling from our QuickBooks Care Team. They have the special tools that can help investigate and resolve your payroll issue.

Below are the instructions on how you can reach them:

Let me know if you have other questions. I'm always happy to assist you further. Have a great day ahead.

I've totally given up on QB helping me with this. I had to run my payroll on Tuesday 28th and the problem was not sorted.

Instead I have installed the HMRC free tools which are very easy to use and I successfully ran my first payroll on Wednesday.

All I need to know now is how to cancel my subscription to QB payroll?

I wish I could make it better, @ChangedDaily.

You can cancel your payroll subscription from the Billing & Subscription section of your Accounts and Settings. I'm here to help you accomplish this.

In addition, here's an article you can read to learn more about how you can cancel your payroll subscription: Cancel and reactivate your Online Payroll account.

Lastly, I've got you this helpful article for ideas about you can manage your company data: Help Articles for QuickBooks Online.

If you have any other questions, let me know in the comments. I'll be here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here